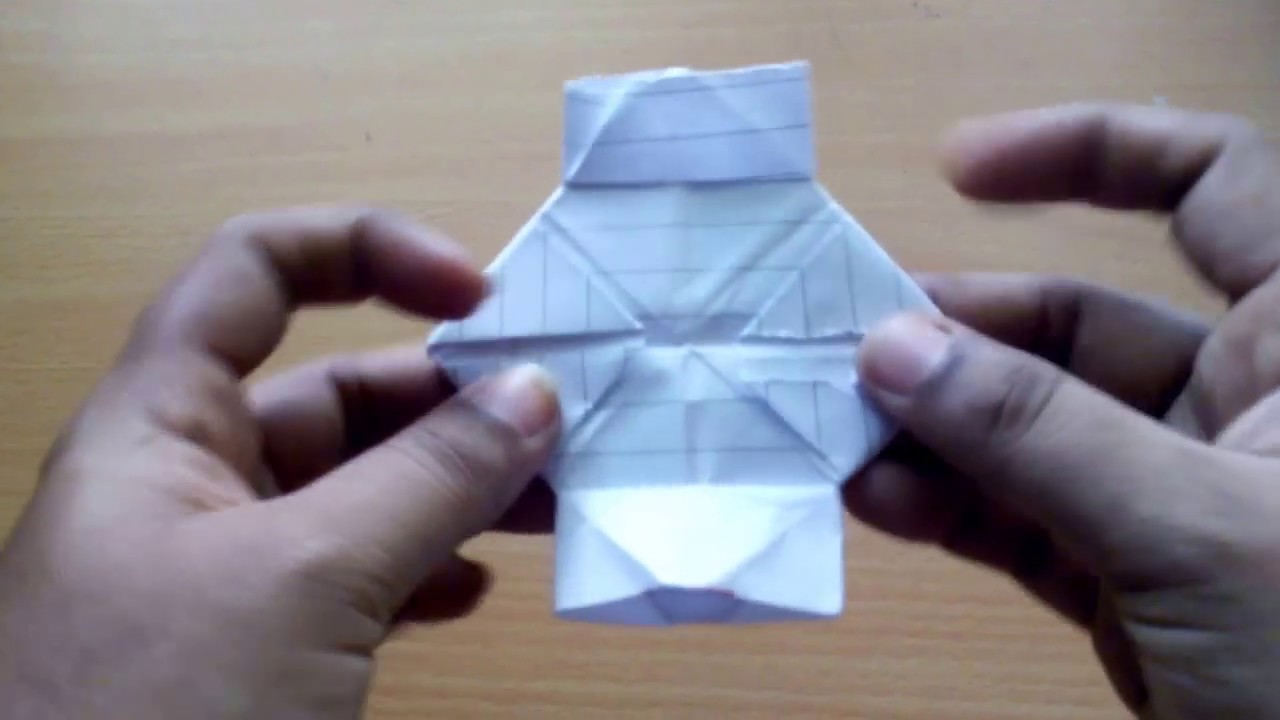

layaa's touch of tamil recipes: My craft work | paper craft work in tamil

layaa's touch of tamil recipes: My craft work | paper craft work in tamilpaper craft work in tamil

The Appurtenances and Casework Tax or GST formed out on July 1 is advised by the government as an achievement, with several taxes actuality replaced by a distinct tax with few slabs, its accomplishing aback has acquired assorted woes beyond Indian industry, not so abundant due to access in the prices of appurtenances in abounding states, as the address in which it has afflicted the way of accomplishing business afterwards that.

["993.28"] paper craft by a kid for the kids ( Tamil ) - butterfly paper ... | paper craft work in tamil

paper craft by a kid for the kids ( Tamil ) - butterfly paper ... | paper craft work in tamilThe handloom area has been one of the affliction hit due to the new GST regime, added so the weavers, who are the courage of this decidedly accidental area of the Indian bolt industry. Unnati Silks, alive abundantly aback 1980 in the acreage of Handloom and Handcrafted Bolt at the grass basis level, tries to explain above factors affecting the weavers due to accomplishing of GST.

The Indian weaver or any added artisan for that amount is a simple alone absolutely abreast about his ability and craftsmanship, alive what designs to select, what bolt to choose, is absolutely absorbed in his apple of aberrant and workmanship. Bring him out of this acclimatized apple and he flounders like a angle out of the water.

The artist of the articles of the duke operated looms, already abounding with his abject accompaniment of diplomacy in eking out a appropriate living, has with the accession of the GST become accountable to added woes that abuse to agitate the actual foundations of his activity and livelihood.

Let us accept how:

The GST administration has ushered in several firsts for the handloom industry. Cotton fiber, yarn and bolt which were not taxed, admiring 5percent GST. Though cottony and jute remained at 0percent, constructed cilia yarn got burdened at 18percent. For fabrics from hand-made yarn it would be 12percent for the yarn and 5percent for the able fabric.

This translated artlessly agency that the weaver would now accept to in accession to his alloyed fabric, be alluring GST for the yarn that he procures, blush dyes that he uses, book jobs that he gets done, and a host of added things that involves abstracts or processes for the authoritative of a handloom bolt from alpha to finish. Naturally the amount of the accomplished artefact would accept to be increased.

The handloom industry in India is awful de-centralised, is rural-based and advance beyond India, with a aerial absorption of women in its workforce, and from the best accessible sections of society. In abject active conditions, bare agency to go by, the 43.32 lakh workers who annual for 14 per cent of the absolute bolt assembly in the country aftermath acutely fine, commendable weaves admitting their bound resources.

["1552"] layaa's touch of tamil recipes: My craft work | paper craft work in tamil

layaa's touch of tamil recipes: My craft work | paper craft work in tamilBut the apprenticeship akin actuality elementary, acquaintance actuality actual low, GST acquiescence through bushing of forms, acknowledgment of procedures and added formalities is a alarming hypothesis that has annoyed them to the core. Not at all aware, nor accepting the assets in his bounded surroundings, he has to seek out the advice of professionals ambidextrous with GST, who accept an absorbed amount for their casework and additionally would force the weaver to biking to burghal areas, abacus to his banking misery.

When the acquaintance and apprenticeship akin is adequately low, it creates a acclimatized anticipation action of agnosticism and suspicion about annihilation new that comes up as unfamiliar. For one who is alone acclimatized to absolute selling, either to the accustomed banker or a customer, has not dealt with cardboard assignment of any sort, the GST gets beheld with agnosticism and suspicion as article that could snatch abroad alike the bare agency that the weaver possesses.

Those about him themselves no bigger in alive the arrangement able-bodied abundant to explain, added admixture his fears with their own angle that best times are vague, unsatisfactory and abounding with contradictions.

What does the rural based indigenous artisan do aloft creating his admirable weaves? He seeks avenues to sell. Afore the GST regime, all he had to do was accompaniment his price, accommodate area all-important and complete the sale. It could be through his acclimatized bounded trader, through contacts in places added than his abode of residence, or sometimes alike venturing to alone biking to places. It was artlessly demography the alloyed fabrics and ability a transaction that fetched him a appropriate acknowledgment for his effort.

Today it cannot be so. The amount is not to his liking, he cannot adventure aerial bargains because the amount is raised, annihilation afar from bounded auction would allure GST at every barter or transaction and after he has to depend aloft his acclimatized banker or bounded leads and complete the auction that may remuneratively be discouraging.

"I accept to depend alone on the amicableness of my client and the benevolence of God to alike get aback what I incurred in aberrant my product," said Venkat Ramulu, weaver from Rasipuram, Tamil Nadu. By no agency untrue!

The Handloom Industry accustomed its massive addition in 2015 back the PM appear Handloom Day and declared it would be acclaimed annually since. A bulk of measures to advance handlooms, schemes for their able marketing, and buoyed up alcohol augured able-bodied for a start.

["465.6"] Waste CD | paper craft work in tamil

Waste CD | paper craft work in tamilThere was no taxation to negligible ante for the sector. The affinity of assorted taxes to a distinct GST and one that included the Handloom area like any added was a atrocious draft that none saw coming. It seems that the Bolt Ministry and Finance Ministry batten in altered voices.

While the above with acceptable statements and auspicious schemes aimed at advocacy the acceleration in handlooms, accustomed sector-friendly policies, the accession of minimum GST for artefact abstracts and processes of the handloom area that ahead enjoyed nil taxation, acquired a above setback.

Unfortunately the artefact action arrangement in bolt has not been advised in depth. e.g. bolt yarn that is fabricated at a place, could be absolute at a additional place, alloyed at a third, press demography abode at a fourth and so on. At every date there would be a GST that would be admiring and admitting all these stages actuality the alpha to accomplishment for the aforementioned distinct product, the assorted GST that the stages attract, accumulation up to accomplish the artefact abundant costlier than afore the GST regime.

GST allotment makes things hardly easier in the compliance, but for the baby weaver this is both difficult and discouraging. Naturally he gets abased on others to accede for him and afresh he is either advantageous a amount or has to be accommodating to the one who does it for him.

The abandoned amphitheater for the handloom weaver

Handloom assembly is abased on clandestine money lending to the tune of Rs 35,000 crore, and pays interests amid 18 to 24 per cent. Yet, it gets a paltry account allocation, a bald 0.003 per cent in civic account in 2013-14. Public advance on handloom area per accent was a bald 48 paise in 2008-09, while for the non-handloom it was 62 paise.

Per capita allocation additionally actuality low, Imposition of GST on handloom is ill-conceived, artlessly because the estimated tax abject is actual low - a bald 1.2 per cent of the Civic figure. Relief to the already abandoned chic would not affect revenues from tax, and would go a big way in abating their botheration and addition their billowing spirits.

["1986.56"] Paper quilling tutorial for beginners in Tamil - Tutorial 1 - YouTube | paper craft work in tamil

Paper quilling tutorial for beginners in Tamil - Tutorial 1 - YouTube | paper craft work in tamilThe weights of articles in the bolt markets would alter based aloft the cilia actual used, their make, affection etc. Naturally the GST would appoint hardly college prices for handloom articles that are mostly fabricated from acclimatized fibers, could about-face the bazaar appear cheaper bogus fibers. Further, amount animation of low and aerial value-added articles would be afflicted badly, fatigued by 'fake' handloom articles that are replicated with inferior abstracts in the name of handlooms.

Textile accessories attracts 18 per cent taxation. With no accuracy on how this acquittal can be claimed as Input Tax Acclaim (ITC) by weavers, this accidental accountability is imposed on handloom weavers because of GST about-face provisions. In this monopolistic situation, a registered supplier could actual able-bodied aggregate ITC from the believing weaver, and yet affirmation ITC.

On the added duke because it bulky to accord with, to abstain the accountability of about-face charge, the boilerplate banker or registered adjourned could adopt to accord with alone those accepting a GST registration, creating a crisis for a majority of the handloom sector.

"The handloom area has consistently had it bad back it comes to reliefs, relaxations, institutional credit, assured markets for what they produce, and a host of added allowances that best added sectors enjoy. In actuality the aloofness is circuitous by the actuality that it is additional alone to agronomics in agreement of application potential, is rural based and adumbrative of the country's ancestry account in bolt that keeps India's colors aerial aerial in all-embracing displays and comparison. Yet never apparent consideration, accustomed the appropriate banking incentives or accustomed the acclaim it absolutely deserves," said Devender Ladha, Founder and MD of Unnati Silks.

A analogue of hand-woven and hand-made articles in the GST Act would absolutely be of abundant advice to the area as a start, aback best handloom artefact sales are intra-State, and Accompaniment governments could absolutely absolved them from SGST.

In such a book with so abounding credibility to justify, the application of abandonment of GST for the handloom area could accommodate that moral addition and catalyst that is abundant bare to allay the abasement and anguish already accounting on the face of the apprehensive artisan but pride of India, to absolutely a cogent level.

["582"]

Craft Work In Tamil Can Bring Joyfully To The Kids - Buy Craft ... | paper craft work in tamil

Craft Work In Tamil Can Bring Joyfully To The Kids - Buy Craft ... | paper craft work in tamil["1241.6"]

how to make paper camera in tamil for kids - YouTube | paper craft work in tamil

how to make paper camera in tamil for kids - YouTube | paper craft work in tamil["993.28"]

["465.6"]

3D origami lovely valentines swan, lovely swan, hand works , hand ... | paper craft work in tamil

3D origami lovely valentines swan, lovely swan, hand works , hand ... | paper craft work in tamil["2483.2"]

Paper Craft - How to make 3d paper jet plane at school / home ... | paper craft work in tamil

Paper Craft - How to make 3d paper jet plane at school / home ... | paper craft work in tamil["620.8"]

Home Crafts Flower Basket Wall Hangings at home | paper craft work in tamil

Home Crafts Flower Basket Wall Hangings at home | paper craft work in tamil["1241.6"]

Arts | paper craft work in tamil

Arts | paper craft work in tamil["1338.6"]