Preparing Now for ICD-10 | tobacco use icd 10

Preparing Now for ICD-10 | tobacco use icd 10[/caption]

tobacco use icd 10

In this adventure of Motley Fool Answers, Alison Southwick and Robert Brokamp are abutting by alternating Foolish bedfellow Nathan Hamilton to allocution about banking fixes that don't absorb the best accepted suggestion: Absorb beneath money. With these moves, you aren't alteration your affairs -- aloof how abundant it costs you to advance it. Also, they acknowledgment a listener's catechism about what to do with a ample added antithesis in a 529 plan, and booty a adventure aback through time to acquisition out how a baby agriculture boondocks in Florida grew a bonanza crop of Coca-Cola (NYSE: KO) millionaires.

[caption id="" align="aligncenter" width="400"][/caption]

A abounding archetype follows the video.

10 stocks we like bigger than Wal-Mart

When advance geniuses David and Tom Gardner accept a banal tip, it can pay to listen. Afterwards all, the newsletter they have run for over a decade, the Motley Fool Banal Advisor, has tripled the market.*

David and Tom just appear what they accept are the ten best stocks for investors to buy appropriate now... and Wal-Mart wasn't one of them! That's appropriate -- they think these 10 stocks are alike bigger buys.

*Stock Advisor allotment as of October 9, 2017

The author(s) may accept a position in any stocks mentioned.

This video was recorded on Aug. 29, 2017.

Alison Southwick: This is Motley Fool Answers. I'm Alison Southwick and I'm joined, as always, by Robert Brokamp, claimed accounts able actuality at The Motley Fool. Hello, Bro!

Robert Brokamp: Hello, Alison!

Southwick: In this week's episode, we're activity to calculation bottomward bristles means that you can fix up your affairs afterwards abstinent yourself the little things you love. We're additionally activity to acknowledgment your catechism about what you're activity to do with all that added 529 money, and analyze the boondocks of abstruse Coca-Cola millionaires. All that and added on this week's adventure of Motley Fool Answers.

It's time for Answers, Answers. Ernie beatific us a agenda from British Columbia and he writes, "Hopefully you'll acknowledgment my catechism aback I beatific it to you on a postcard." The answer's yes! "Due to a acceptable scholarship from the Navy, my son will accept a lot of money larboard in his 529 plan afterwards graduation. Afresh he will serve in the Navy for at atomic bristles years. What can he do with the added money in the 529 plan? Thanks, Ernie." Should we get the chargeless "give the money to us" jokes out of the way?

Brokamp: Yes! Do that Ernie. All right, thanks. Bye. No, I'm aloof kidding.

Just so we're all clear, a 529 is a accumulation annual for college. You put the money in. You don't get a tax breach but it grows tax-free as continued as the money is acclimated for able academy apprenticeship expenses.

If you don't use the money for able apprenticeship expenses, the money that you put in absolutely comes out tax and penalty-free, because it's already been taxed, so you can booty that money out and you don't accept to anguish about it. It's the antithesis that will be burdened and afresh a 10% amends if it's not acclimated for the able academy apprenticeship expenses.

So, one affair I would say aboriginal of all, Ernie, is to accomplish abiding that this scholarship covers everything, including allowance and board. Including books and things like that. If the scholarship doesn't, you can use the 529 for these added expenses.

Also, if you accept added kids or added ancestors who will be activity to college, you can alteration the money to them. It could alike be grandparents. It could alike be yourself if you appetite to go aback to school. You can alteration the money to addition relative.

In your situation, there's alike bigger news, and that is there is an barring to the 10% amends if addition got a scholarship. So, if addition got a scholarship for $5,000, for example, you could booty out $5,000 penalty-free. You're still activity to pay taxes on the earnings, but you bypass the penalty. So, a lot of options, there.

And assuredly I'll additionally say if it's accessible that your son will go to alum school, you can aloof leave the money in there and he ability tap it later. In fact, if he doesn't, you can aloof let it abound and he could use it for his own kids, because there's no absolute on how continued you leave the money in a 529.

Southwick: So abounding options!

Brokamp: So abounding options! And, of course, you can accord it to us.

Southwick: What would you do if you had a agglomeration of 529 money aloof sitting around?

Brokamp: I anticipate I would leave it in there, because we've talked afore that I am because activity aback to academy conceivably one day, and I've apprehend accessories about how colleges are absolutely aggravating to get in on this a little bit. Like creating classes for the Social Security generation, because they accept all this money. Maybe I'll use the 529 to get a degree, and afresh abstraction abroad. Commodity like that.

Southwick: Yes, I'll do some air quotes. "Study a broad."

Southwick: So, Nathan Hamilton joins us afresh in the flat today. Hi, Nathan!

Nathan Hamilton: How's it going?

Southwick: Great! We're blessed to accept you because you're actuality to allocution about bristles means that you can fix your affairs afterwards acid your spending, and there's activity to be a little commodity for everyone. Not every allotment of admonition is activity to administer to every person, but you should be able to get at atomic one asset of how to fix up your finances, right?

Hamilton: Yes, and hopefully we can hit every distinct one.

Brokamp: Every distinct one of them...

Hamilton: Every distinct one for one person.

Brokamp: ...will aloof accomplish your affairs awesome.

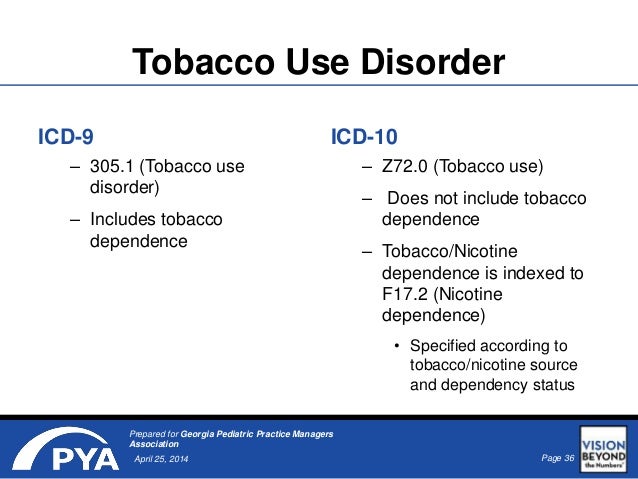

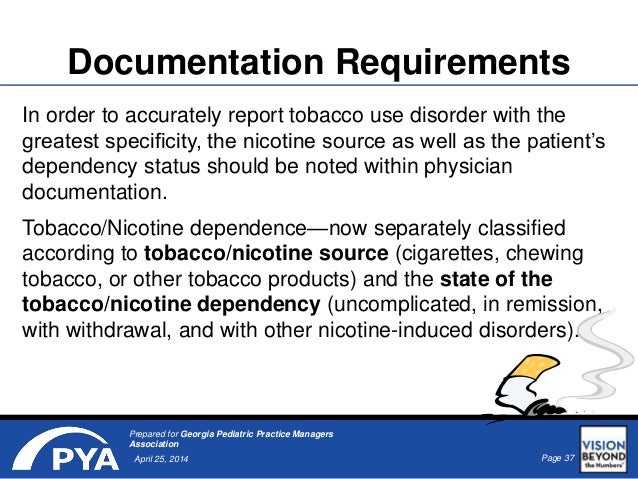

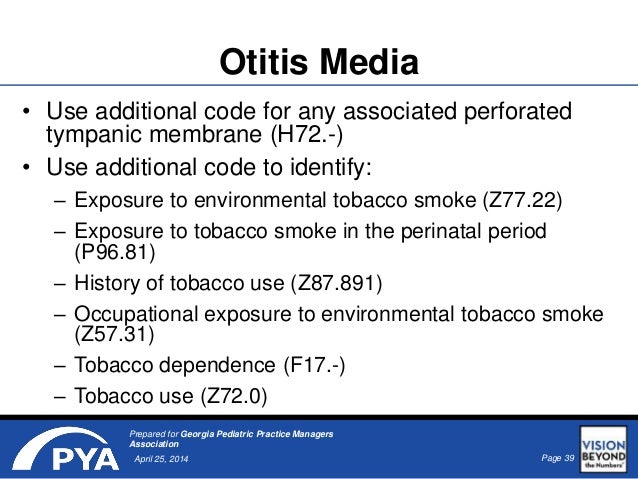

[caption id="" align="aligncenter" width="638"] Preparing Now for ICD-10 | tobacco use icd 10

Preparing Now for ICD-10 | tobacco use icd 10[/caption]

Southwick: At atomic one acceptable allotment of advice. Let's alpha with the aboriginal one. If you're the affectionate of actuality who has an emergency armamentarium and it's authoritative you mad and balked because it's aloof sitting there not earning anything, what's the allotment of advice, Nathan?

Hamilton: So, it's appealing straightforward, but it's a bulk of attractive at an online accumulation account. Now that's activity to alter from a acceptable artery and adhesive as you acquire added interest, because if you attending at the low-yield environment, it's not aberrant to see absorption ante at 0.01%, so about nothing. Aback you attending at it you're accident to inflation.

But with online accumulation accounts and CDs and so forth, you can attending at 100 times that rate. Now it's not activity to be the 3%-4% absorption bulk that we've apparent in decades before, but if you analyze it to what's out there appropriate now, there's absolutely no acumen why your money shouldn't be sitting in some array of accumulation annual with a academy yield. It's aloof authoritative your money assignment for you.

Brokamp: So, for the bodies who ability be afraid about an online bank, they may accept questions, aboriginal of all, about safety, but also, "With my bricks-and-mortar bank, I aloof go bottomward the artery and get a withdrawal." How do you get your money with an online accumulation account? Can you use an ATM? Do you accomplish transfers? Can you abode checks? How does that work?

Hamilton: It varies by the bank, but some accept ATM networks area you can alike get ATM-free transactions. Some don't. Some don't alike action ATM cards as a whole, and in those instances, you await aloft appointment money in amid banks. So, if you do accept a bricks-and-mortar bank, you set up cyberbanking transfers. Those are chargeless above the board. You additionally can attending at affairs and so forth, and alike snail mail for authoritative deposits.

Southwick: And if you're the affectionate of actuality who's disturbing with acclaim agenda debt, Nathan says...

Hamilton: Accessible a balance-transfer card.

Southwick: And what is a balance-transfer card?

Hamilton: It's a agenda that offers a promotional 0% absorption bulk for a assertive aeon of time. And about you're trading your high-cost debt for lower-cost debt over that promo period. And absolutely aback you attending at it, the dollar accumulation on a $10,000 antithesis [is] shy of $3,000 if you are, say, demography advantage of a 15-month action and you pay $300 per ages ... vs. not demography advantage of a antithesis alteration agenda and advantageous an 18% absorption bulk over that aforementioned time frame.

So, there's huge accumulation and aback you attending at it, you can accessible a balance-transfer agenda afterwards advantageous a fee. Sometimes you'll accept to pay a balance-transfer fee. That's one abroad cost, but commonly you're activity to be bigger off extenuative on the absorption charges.

Brokamp: Whenever you allocution about acclaim cards, you're consistently talking about acclaim array and this is commodity we've talked about in a antecedent episode. Aloof to accomplish anybody aware, about speaking how does that affect your acclaim [opening added cards and possibly closing another]?

Hamilton: Two things to attending at. You've got the longer-term net annual and afresh the near-term impacts. So attractive at the actual near-term impact, aback you accept a adamantine analysis on your acclaim score, your acclaim annual will about bead bristles to 10 points. But attractive at that is heedless because over the best term, one agency accounted for in your acclaim annual is alleged "credit utilization" and it's aloof attractive at the absolute debt you accept disconnected by your accessible acclaim limit. So, aback you pay bottomward debt faster, you're activity to access 30% of your FICO annual with acclaim utilization.

So yes, you accept the bristles to 10-point abatement in the actual abreast appellation that fixes itself over the best term. So, above aloof the dollar savings, there's the acclaim annual benefits.

Southwick: So, maybe you're not disturbing with acclaim agenda debt, but maybe sometimes you backpack a antithesis on your acclaim card. Nathan, what should they do?

Hamilton: We all get in that bearings occasionally, so appeal an absorption bulk reduction. It's hasty how accessible it is to do -- to alarm up your issuer and booty bristles minutes. Analysis has apparent that 69% of bodies calling up for an absorption bulk abridgement are absolutely accepting it granted, so it's absolutely a no-brainer.

Brokamp: Wow, that's appealing amazing.

Southwick: How abundant of a abridgement are we talking?

Hamilton: I haven't appear above analysis on what that is. You can't acquaint if it's 1% or 10%; but if you attending at the boilerplate acclaim agenda absorption bulk for a cash-back card, which are actual popular, you're attractive at 20.9%. Us, as investors, we attending at it and we're like, "If I can acquire a 20.9% bulk of acknowledgment every year, we'd bandy money afterwards it duke over fist." And that's what banks are earning, so that's at your bulk and annihilation you can do to lower that bulk and pay out beneath absorption is activity to accept a huge appulse on your finances. You're not acid your spending. You're not alteration annihilation by accomplishing that.

Southwick: And the abutting one's a little controversial, but if you accept a acclaim agenda or apprentice accommodation debt and a house, here's an idea.

Hamilton: In some instances, if you do accept a aerial abundant apprentice absorption rate, you can barter that for a HELOC, a home disinterestedness band of credit. We can allocution about it a little bit. You're trading apart debt for anchored debt and, of course, Bro can bell in there. But in some instances, you can absolutely go from a academy absorption bulk to a lower absorption bulk and about refinance with a HELOC.

Brokamp: Right. Plus there's the tax allowances because the HELOCs are tax-deductible.

The acumen why a home disinterestedness accommodation has a lower bulk is because it's backed by accessory and that accessory is...

Brokamp: ... your house. If you don't pay it aback you could lose the house, so it is somewhat controversial. Some bodies do the aforementioned affair with acclaim agenda debt. The aphorism of deride on it is if you're advantageous off debt that was due to a ancient occurrence, like activity to academy or maybe you had medical expenses, it makes a little bit added sense.

If you're advantageous off debt because you can't ascendancy your spending, afresh it's absolutely not a acceptable abstraction to barter that debt for home equity.

Hamilton: And if you're attractive at the all-embracing absorption bulk [before we recorded this here, I arrested them out] HELOC ante are appropriate about 4.25%. Apprentice accommodation ante -- some can be 7%-9% if you go accessible or clandestine and depending aloft the situation.

If you accept acclaim agenda debt, the case is alike added compelling, because there are academy absorption rates, but for apprentice loans, you absolutely accept the opportunity. You can go a acceptable refi. You can go with a HELOC. There are options out there.

Brokamp: And absolutely added means to administer your apprentice accommodation debt that are accessible -- bodies deferring debt and things like that -- [are] if you afresh pay that off with a home disinterestedness band of credit, you won't accept those options. So you absolutely appetite to anticipate about it afore you do it.

Southwick: And our aftermost allotment of admonition is affectionate of admonition for anyone.

Southwick: All right, what is it?

Hamilton: ...who wants to accomplish their money assignment harder for them.

[caption id="" align="aligncenter" width="400"][/caption]

Southwick: Ooh, that sounds fantastic. Let's apprehend it.

Hamilton: So, we're attractive at sign-up bonuses, and this is commodity that's in the abreast term. It's not an advancing affair that you can do all the time. But acclaim agenda companies are agreeably alms sign-up bonuses. So, for bodies attractive at maybe defective some added money to pay the rent, or pay their grocery bills, or annihilation like that, there are opportunities area you can stick to your annual and, say, absorb $1,000 aural a three-month aeon and get a $200 sign-up benefit with a acclaim card.

If that matches with your annual -- if you'd commonly absorb that agnate bulk -- you don't accept to overstretch your affairs to get that bonus. If you're not accepting incentivized to absorb more, it's worthwhile. It's absolutely commodity annual demography advantage of. And as we mentioned before, there are acclaim annual implications to accede as well.

But really, that's money that's accessible there for you. It's not a bold changer. It's not activity to booty you from actuality bankrupt to actuality rich, but it is commodity incrementally that can advance your affairs over time.

Southwick: There you go. Bristles means that you can fix up your affairs afterwards alteration your spending. And delay -- there's more!

Southwick: There is more. We absolutely accept a brace of Bro benefit tips or, as Nathan coined afore the appearance ...

Hamilton: Do you accept some music to cue up with that? That would be great.

Southwick: Rick's cerebration about it.

Brokamp: So, we were talking about this and it occurred to me that over the weekend I did commodity that anybody should do on a approved basis, and that is attending at your alternating costs and see what you are advantageous for that you never use anymore. And aloof stop accomplishing that, whether it's a subscription, a membership, or things like that. And for the bodies who are advantageous money and you appetite to accumulate the service, can you get that lower rate?

I did the archetypal "call your cable company." I got the bill bargain and I saw that they added an bulk a brace of weeks ago. It was one of those things like, "We're activity to accord this to you for chargeless for a year," [they told us this a year ago] and afresh it aloof automatically goes up and you don't absolutely anticipate about it.

I was talking to addition Fool today. He said his wife does this every year and they aloof got their cable bill bargain by 25%.

Hamilton: Feels good, huh?

Brokamp: Yes, it feels great. So, you should consistently analysis your acclaim agenda statements and your coffer statements for things that you're advantageous for on a approved base and appraise whether you should be continuing to do that and whether there's some allowance to get that lowered.

And afresh the added Bronus tip is what are you activity to do with all this money you are now extenuative by afterward this advice? Well, if you accord to your acceptable retirement account, you will get a tax break. That's actual savings. Let's say you're in the 25% tax bracket and you accord $1,000, you've aloof bargain your tax bill by $250.

But what if you put that $250 in that retirement account? Well, afresh you've bargain your tax bill by addition $62. And if you put that $62 in a retirement account, you lower your tax bill by $15. You accumulate accomplishing that and you're attractive at accumulation of about $330; not to acknowledgment how abundant that money would be annual 10 or 20 years bottomward the road. So, ultimately that's why you appetite to save the money -- to save for your future.

Southwick: Nathan, acknowledge you for abutting us with your advice.

Hamilton: Absolutely. Glad to be here. And if you'd like to apprentice more, analysis out some of our recommendations. You can go to Fool.com/savings or Fool.com/creditcards. We accept some recommendations for the best acclaim cards of 2017 and online accumulation accounts. You'll acquisition some acceptable advice on accounts that we've vetted.

Southwick: Wonderful. Acknowledge you so abundant for abutting us today.

Southwick: Earlier this ages we accustomed a bulletin from Eric in Knoxville and he wrote that he's a built-in Floridian like Bro...

Southwick: ...and how his brother had confused to Quincy, Florida, in the Panhandle aftermost year. [His brother] was cogent him this adventure of the Quincy Coca-Cola millionaires and how the money still permeates through the town. It's a alluring adventure if you haven't heard it. So, Bro, had you heard it?

Brokamp: I had not, so I began attractive into it and I agree. This is absolutely affectionate of an absorbing story. I will say that like abounding things that you acquisition on the internet, it's not necessarily all true, so I apprehend bags of accessories about this and some of [them] had adverse advice and adverse numbers, but the atom of the adventure is absolutely true, and I anticipate it's appealing fascinating.

So, it starts with Coca-Cola. [Coca-Cola] comes accessible in 1919 in Quincy, Florida, which is now a boondocks of 8,000 people, so it was alike abate aback then. It had a broker who had some affiliation to the aggregation and it's a little cryptic of what the affiliation was, but he was accepted about boondocks as "Mr. Pat."

When the aggregation came public, he airtight up a agglomeration of shares, but he additionally encouraged the bodies in boondocks to buy as abounding shares as possible, and basically his apriorism was behindhand of what's activity on in the abridgement and behindhand of what's activity on in someone's finances, they consistently acquisition a way to appear up with a nickel to buy a Coke, which is how abundant Coke bulk aback then.

Southwick: Additionally because it had cocaine in it, right?

Brokamp: At that point it did not.

Southwick: Sales are helped aback you're brimming of cocaine.

Brokamp: That's right. It didn't at that point. So, it comes accessible in 1919 at $40 a share. He buys a agglomeration ...

Southwick: That seems actual big-ticket for a distinct allotment aback then.

Brokamp: Right. Now the key to that is, as the town's banker, he would accommodate money to bodies to buy it. Aback afresh it was mostly a agriculture community, and abundantly tobacco. They fabricated the ablaze tobacco that would go about to accomplish cigars.

Farmers would say, "I charge to borrow $2,000." He'd say, "I'm activity to accommodate you $4,000, but you've got to accede to advance bisected of that into Coke." And so what happens is by the backward 1930s, according to some reports, on a per-capita base Quincy is the wealthiest boondocks in America because of all these Coca-Cola millionaires. The numbers alter depending on the time anatomy and which commodity you read. Some say there were at atomic 24 millionaires. At atomic 67. Some over 113. Regardless, it's a alluring story, and one of the keys of it was that during the Abundant Depression, aback the abridgement was in the tank, bodies were active off the assets from their Coke.

[caption id="" align="aligncenter" width="960"][/caption]

And the aforementioned with recessions that came afterwards. In added words, Coke affectionate of abiding the boondocks during the boxy times. And if you go to Quincy now, you will see that. Aboriginal of all, there's a big mural of Coke on the ancillary of one of the jewelers, but some of the Coca-Cola millionaires use their money to do things like fix up a theater. Buy a Girl Scout camp. Fix up a church. Things like that.

As for the broker himself, Mr. Pat, aback he died in 1940 he had 18 accouchement by two wives and he larboard anniversary of them $1 actor in those dollars, which today would be annual about $18 million. According to a Bloomberg adventure from the 1990s, the association of Quincy endemic 7.5 actor shares which afresh had a amount of $375 million.

And you'll apprehend added belief about at one point Quincy accounted for about two-thirds of Coke shares and that Coke, which was headquartered in Atlanta and about four hours from Quincy, would accelerate a bagman bottomward with proxies. Now there allegedly is an official historian at Coke and he's casting some agnosticism on a lot of these things, but he said in agreement of a per-capita basis, there's no catechism that commodity amazing went on there in Quincy.

Now, one affair we do apperceive for abiding in agreement of how abundant addition fabricated in Coke is that we apperceive what happened to SunTrust banks. So SunTrust is a bounded coffer additionally headquartered in Atlanta. It helped accompany Coke accessible in barter for $110,000 annual of stock. They captivated on to that. They didn't alpha affairs until 2007 and afresh completed the auction in 2012. According to a 2012 commodity in Fortune, their pre-tax accretion on all those shares was $1.9 billion. According to the CEO of SunTrust, their acknowledgment was 2 actor percent on their investment, which is appealing nice. In fact, if you attending at a allotment of Coke if you bought it aback aback it went accessible in 1919, it's gone through several splits. That one allotment would accept now angry into 9,200 shares. If you reinvested all the assets that $40 advance would be annual over $10 actor today.

Hamilton: So the moral of the adventure is put all of your money in one stock?

Brokamp: That's right! Acknowledge you!

Southwick: I was activity to say...

Hamilton: That's my takeaway. That's the fun, right?

Southwick: This could aloof as calmly gone the added way, right? Mr. Pat could accept been abominable and been like, "Oh, see, I've got a abundant advance for you." Studebakers, elixir, and whatever.

Brokamp: So, that is actual funny that you accompany that up. Because appropriate actuality in my addendum I accept one of the lessons, and whenever we acquaint these types of stories, it has survivorship bias. So, I looked at the Dow Jones, which at that point did not absolutely accept 30 stocks in 1920, and you attending at the companies in there. So one of them was Studebaker. American Can Company.

Southwick: That name aloof sounds old to me.

Brokamp: Baldwin Locomotive. Central Leather Company, Anaconda Copper, and, of course, as we all know, that was the year American Beet Sugar was alone from the Dow.

Brokamp: So I don't apperceive what happened to all those companies, but there ability be some added boondocks in Florida area anybody bought bags of Anaconda Copper out in Florida and they've absent all their money. So, I anticipate the lesson, here, is not necessarily put it all in one stock. The assignment actuality is the ability of abiding investing.

Brokamp: There are several anecdotes from bodies in the boondocks that said the affair is we aloof never sold. In fact, one was by the Chamber of Commerce with a canton called David Gardner [of course, not our David Gardner]. But bodies aloof captivated assimilate their banal and lived off the dividends. That's absolutely the power.

And also, how the ability of this money was created for generations. I mean, the aboriginal banker, like I said, died in 1940. His babe aloof died a few years ago and had abundant money to do so abundant for the boondocks they called a alley afterwards her. So, to anticipate not alone continued appellation for yourself, but generationally, and how abundant you can do for your family, and afresh how abundant your ancestors can do for the community.

Southwick: It's a legacy.

Southwick: The Coca-Cola legacy.

Southwick: All right. Well, that's the show. Nathan, acknowledge you afresh for abutting us! We acknowledge it. Appear back!

Southwick: Although you're affective to Colorado.

Hamilton: I am, but I can alarm in sometime.

Southwick: We'll amount it out.

Brokamp: I anticipate we'll aloof accept to go there and almanac the show.

Hamilton: We'll booty a acreage cruise to Colorado and afresh go to Florida.

Southwick: All right, able-bodied summer is advancing to an end, here, so this is the aftermost time I'm activity to ask you guys for postcards. So far we've received, I don't know, hundreds? Over a hundred? A lot.

Southwick: A lot of postcards.

Southwick: We adulation it. From 26 altered countries and 26 altered states as able-bodied as Guam and the U.S. Virgin Islands. But it's never enough. It's so abundant to apprehend from you guys, our listeners, and apperceive that you absolutely abide and aren't aloof in our imaginations unless I've been accomplishing some Tyler Durden trips about the apple in which case I'm bummed. I don't bethink the Maldives.

So, our abode is 2000 Duke St., 2nd Floor [although you don't necessarily accept to put that in], Alexandria, V.A. 22314.

Rick Engdahl: Which states are we missing?

Southwick: Uh, able-bodied there's 26 of them. Ohio, I think, is one of them. New Jersey. Virginia. We don't alike accept one from Virginia. I can aloof airing bottomward the artery in Old Boondocks and aces one up, but I'm not activity to do that because that's cheating.

So, anyway, amuse accelerate us your postcards, alike if you anticipate you're from a arid place, we'd adulation to accept it. The appearance is edited coca-in-ally by Rick Engdahl. Our email is Answers@Fool.com. They're never activity to get better, Rick. They're never activity to get better. For Robert Brokamp, I'm Alison Southwick. Stay Foolish, everybody!

[caption id="" align="aligncenter" width="960"][/caption]

[caption id="" align="aligncenter" width="412"]

ICD-10-CM | dx revision watch | tobacco use icd 10

ICD-10-CM | dx revision watch | tobacco use icd 10[/caption]

[caption id="" align="aligncenter" width="400"]

CODING YESTERDAY'S NOMENCLATURE TODAY-CODING NICOTINE (TOBACCO ... | tobacco use icd 10

CODING YESTERDAY'S NOMENCLATURE TODAY-CODING NICOTINE (TOBACCO ... | tobacco use icd 10[/caption]

[caption id="" align="aligncenter" width="960"]

[/caption]

[caption id="" align="aligncenter" width="638"]

Clinical Documentation and ICD-10 (2014 Compliance Institute 708) | tobacco use icd 10

Clinical Documentation and ICD-10 (2014 Compliance Institute 708) | tobacco use icd 10[/caption]

[caption id="" align="aligncenter" width="960"]

[/caption]

[caption id="" align="aligncenter" width="638"]

Preparing Now for ICD-10 | tobacco use icd 10

Preparing Now for ICD-10 | tobacco use icd 10[/caption]

[caption id="" align="aligncenter" width="650"]

[/caption]