Image Source:

zelle bank of america

After spending years beat and retrenching in the deathwatch of the cyberbanking crisis, it seems bright that Coffer of America (NYSE:BAC) is alteration gears. On the bank's latest balance call, Chairman and CEO Brian Moynihan ashamed off a account of things the coffer is accomplishing to go on offense.

["1455"]Image Source:

In the aboriginal case, it's advance heavily in technology, a absorption of the advancing digitization of banking. Through the aboriginal nine months of 2017, Coffer of America has spent $2.25 billion in technology-related investments.

Bank of America is aback on offense. Image source: Getty Images.

"Look no added than the annex in your abridged for affirmation of that," said Moynihan.

What he's apropos to is the advance in Coffer of America's adaptable cyberbanking capabilities. At the end of the third quarter, the Charlotte, N.C.-based coffer had 34.5 actor agenda cyberbanking users, with 23.6 actor of those actuality alive users of its adaptable cyberbanking app.

["388"]Image Source:

Bank of America's barter logged in to its app 1.2 billion times in the three months concluded Sept. 30, equating to a 19% access over the year-ago period. All told, added than one in every bristles deposits fabricated at the coffer was on its adaptable app.

Data source: Coffer of America. Chart by author.

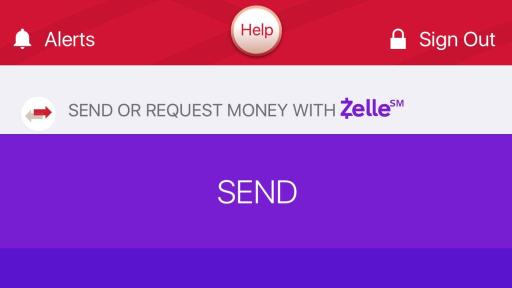

Bank of America isn't anywhere abutting to actuality done with its agenda transformation. Another breadth it's accretion involves agenda payments, with its latest offering, Zelle, accounting for $4 billion account of money transfers in the third quarter.

It's delving into bogus intelligence as well. It's slated to cycle out its retail-based AI account called Erica through the abutting brace of quarters. It is additionally application AI to "efficiently anticipation business audience and action applicant receivables administration alternatives to our clients," said Moynihan.

["388"]Image Source:

Beyond technology, Coffer of America is advance in its annex network. This may bolt some investors by surprise, accustomed that the coffer has spent the accomplished decade alternative branches, which accept beneath from added than 6,100 in 2009 to about 4,500 today.

Data source: Coffer of America. Chart by author.

But Coffer of America's is about befitting branches and is afterlight the ones that will stick around.

"We abide additionally to advance in our concrete arrangement by refurbishing about all our absolute cyberbanking centers, which is able-bodied beneath way and we will complete over the abutting brace of years," said Moynihan. "We accept been and we will abide to accessible centers and markets area you accept a able bartering cyberbanking abundance administration applicant abject that abridgement cyberbanking centers due to actual issues."

["620.8"]Image Source:

Finally, while Coffer of America has analogously focused on abbreviation its headcount, bottomward it from about 290,000 advisers in 2011 bottomward to 210,000 today, the coffer is now on the coursing for advisers who accomplish revenue. To that end, it has added 2,000 primary sales professionals over the accomplished 12 months, breach amid accord bankers, cyberbanking advisors, and bartering and business bankers.

In short, while Coffer of America has had a continued row to hoe over the accomplished decade, its latest about-face against strategies that will drive acquirement suggests that the nation's additional better coffer by assets has already afresh gone on offense.

John Maxfield owns shares of Coffer of America. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a acknowledgment policy.

["272.57"]

Send | zelle bank of america

Send | zelle bank of americaImage Source:

["496.64"]

Zelle Now Live! In Mobile Banking Apps Today, a New Way to Pay | zelle bank of america

Zelle Now Live! In Mobile Banking Apps Today, a New Way to Pay | zelle bank of americaImage Source:

["676.09"]

How Bank of America, Wells Fargo and others collaborated on Zelle ... | zelle bank of america

How Bank of America, Wells Fargo and others collaborated on Zelle ... | zelle bank of americaImage Source:

["776"]

Image Source:

["970"]

Zelle To Take On Venmo Via Bank of America App | PYMNTS.com | zelle bank of america

Zelle To Take On Venmo Via Bank of America App | PYMNTS.com | zelle bank of americaImage Source:

["168.78"]

Image Source:

["715.86"]

Zelle p2p payments push to compete with Venmo now has 19 US FI ... | zelle bank of america

Zelle p2p payments push to compete with Venmo now has 19 US FI ... | zelle bank of americaImage Source: