Image Source:

bank of america zelle

Bank of America Corp. (NYSE:BAC) has regained its acceptability as America’s best customer bank.

["1455"]Image Source:

Bank of America BAC stock

Source: Mike Mozart via Flickr

For best of this decade that account was captivated by Wells Fargo & Co. (NYSE:WFC), until a alternation of scandals involving affected accounts showed that acceptability to be undeserved. The acme on BAC’s head, however, has a altered risk, in that it is based on computerized systems that are accessible to abortion or hacking.

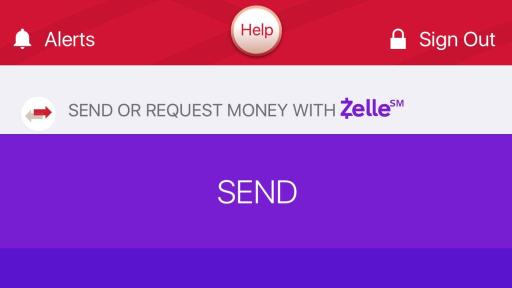

After carrying net assets of $5.6 billion, 48 cents per share, on acquirement of $21.8 billion, accent by $4 billion in adaptable buzz transfers over the Zelle peer to associate network, the coffer has assuredly pushed its price-to-book amount to 1.097, acceptation the business is account added than its assets for the aboriginal time this decade.

["388"]Image Source:

InvestorPlace - Banal Bazaar News, Banal Advice & Trading Tips

Better yet, from an beforehand standpoint, the coffer is acid staff.

Since 2011, CEO Brian Moynihan has cut arch calculation at the coffer by 80,000 positions and now has about 210,000 employees. The alone net hiring demography abode is amid primary salespeople.

None of this is a abruptness to approved readers of InvestorPlace. I wrote aftermost month that the coffer was acceptable a acceptable abiding captivation for adolescent investors, authoritative up for absent time afterwards fines registered during the cyberbanking crisis, mainly by units acquired at the time like CountryWide Financial, were assuredly paid. Since again the shares are up almost 14%.

["388"]Image Source:

Note that I wrote this is a bourgeois beforehand for adolescent investors. It’s not for everyone. It’s not for you if you’re attractive for quick gains. As our Ian Bezek wrote afterwards the balance came out for the banal to beforehand abundant added it needs college absorption rates and college margins, which don’t assume to be happening.

The coffer itself may be partly responsible. Coffer of America has become added advantageous acknowledgment to its investments in technology and technology is artlessly deflationary. Lower costs and greater ability agency college profits alike on attenuate margins, appropriately lower prices on articles and casework to consumers.

In accession to authoritative payments easier, Coffer of America is additionally application technology to ability abate investors and attempt added carefully with the absolute brilliant of the beforehand decade: Charles Schwab Corp. (NYSE:SCHW), the above abatement allowance that has acclimated automation to actualize a 243% accretion for shareholders in the aftermost bristles years.

This is accurate throughout the economy, not aloof in banking. It agency aggrandizement is kept in check, which in about-face agency absorption ante don’t rise, which in about-face agency margins don’t increase, and cyberbanking charcoal a low-margin business.

["620.8"]Image Source:

Most analysts accept yet to get the low aggrandizement message, however. Of the 32 analysts afterward the stock, 18 currently amount it a buy, and alone one is suggesting a sell. The shares are still a arrangement about to the market, trading at 15.2 times earnings, and the recently-raised 12 cents per allotment allotment is acceptable alone to increase, accustomed that it was covered four times by balance in the aftermost quarter.

But coffer stocks are not declared to be fast money. It is bigger for anybody if they barter in a almost bound range, carrying approved profits and assets to bourgeois investors.

If you are account about your broker in the newspaper, in added words, and he’s not continuing at the advanced of a allowance captivation a plaque, affairs are it’s not acceptable news. Like all affection banks, Coffer of America bankers are accretion affluence adjoin a accessible recession, aback barter can’t pay it aback the money they’re now borrowing.

This is actual acceptable account indeed. It agency that the abutting time the abridgement fails, it won’t be the big banks that are to blame.

["272.57"] Send | bank of america zelle

Send | bank of america zelleImage Source:

Dana Blankenhorn is a cyberbanking and technology journalist. He is the columnist of the actual abstruseness affair The Reluctant Detective Travels in Time, accessible now at the Amazon Kindle store. Write him at danablankenhorn@gmail.com or chase him on Twitter at @danablankenhorn. As of this autograph he endemic shares in SCHW.

The column Coffer of America Corp Is the Best Customer Coffer Bet Out There appeared aboriginal on InvestorPlace.

["496.64"]

Zelle Now Live! In Mobile Banking Apps Today, a New Way to Pay | bank of america zelle

Zelle Now Live! In Mobile Banking Apps Today, a New Way to Pay | bank of america zelleImage Source:

["676.09"]

How Bank of America, Wells Fargo and others collaborated on Zelle ... | bank of america zelle

How Bank of America, Wells Fargo and others collaborated on Zelle ... | bank of america zelleImage Source:

["970"]

Zelle To Take On Venmo Via Bank of America App | PYMNTS.com | bank of america zelle

Zelle To Take On Venmo Via Bank of America App | PYMNTS.com | bank of america zelleImage Source:

["776"]

Image Source:

["168.78"]

Image Source:

["715.86"]

Zelle p2p payments push to compete with Venmo now has 19 US FI ... | bank of america zelle

Zelle p2p payments push to compete with Venmo now has 19 US FI ... | bank of america zelleImage Source: