New York Child Support Debit Card | bank of america child support ny

New York Child Support Debit Card | bank of america child support nyImage Source:

bank of america child support ny

But accompaniment and federal admiral are demography aim at the banks’ role at a time back authorities are accretion their efforts to catch bottomward on payday lending and its convenance of accouterment quick money to borrowers who charge cash.

["388"] Nevada Child Support Debit Card Program | bank of america child support ny

Nevada Child Support Debit Card Program | bank of america child support nyImage Source:

The Federal Deposit Insurance Association and the Consumer Banking Aegis Bureau are analytical banks’ roles in the online loans, according to several bodies with absolute ability of the matter. Benjamin M. Lawsky, who active New York State’s Department of Banking Services, is investigating how banks accredit the online lenders to brim New York law and accomplish loans to association of the state, area absorption ante are capped at 25 percent.

For the banks, it can be a advantageous partnership. At aboriginal blush, processing automated withdrawals hardly seems like a antecedent of profit. But abounding barter are already on all-a-quiver banking footing. The withdrawals generally set off a avalanche of fees from problems like overdrafts. Almost 27 percent of payday accommodation borrowers say that the loans acquired them to amplify their accounts, according to a address appear this ages by the Pew Charitable Trusts. That fee assets is coveted, accustomed that banking regulations attached fees on debit and acclaim cards accept amount banks billions of dollars.

Some accompaniment and federal authorities say the banks’ role in enabling the lenders has balked government efforts to absorber bodies from bloodthirsty loans — an affair that acquired coercion afterwards adventuresome mortgage lending helped accelerate the 2008 banking crisis.

Lawmakers, led by Senator Jeff Merkley, Democrat of Oregon, alien a bill in July aimed at reining in the lenders, in part, by banishment them to accept by the laws of the accompaniment area the borrower lives, rather than area the lender is. The legislation, awaiting in Congress, would additionally acquiesce borrowers to abolish automated withdrawals added easily. “Technology has taken a lot of these scams online, and it’s time to able down,” Mr. Merkley said in a anniversary back the bill was introduced.

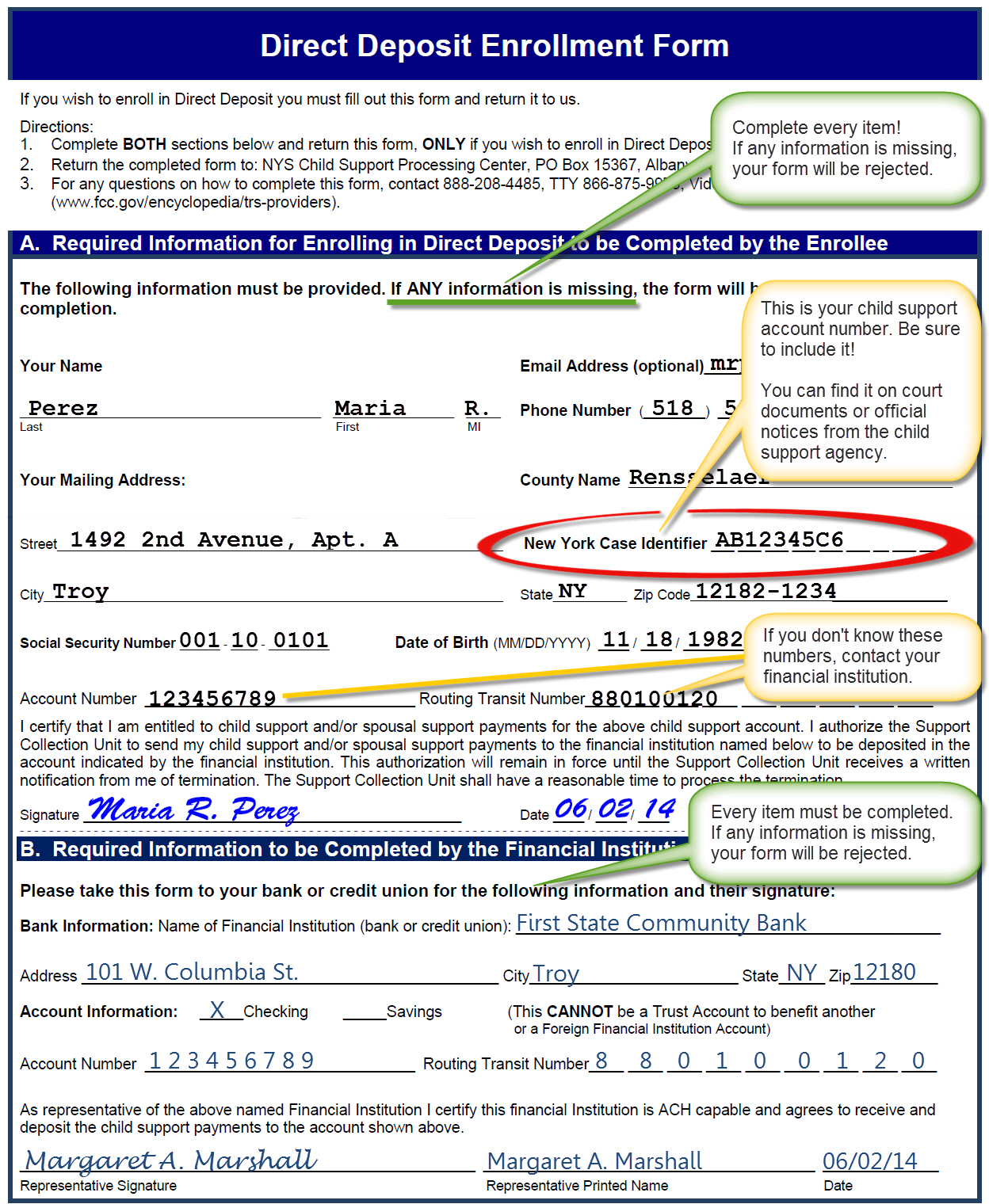

["1210.56"] NYS DCSE | Direct Deposit | bank of america child support ny

NYS DCSE | Direct Deposit | bank of america child support nyImage Source:

While the loans are simple to access — some online lenders affiance approval in anniversary with no acclaim analysis — they are boxy to get rid of. Barter who appetite to accord their accommodation in abounding about charge acquaintance the online lender at atomic three canicule afore the abutting withdrawal. Otherwise, the lender automatically renews the loans at atomic anniversary and withdraws alone the absorption owed. Under federal law, barter are accustomed to stop accustomed withdrawals from their account. Still, some borrowers say their banks do not heed requests to stop the loans.

Ivy Brodsky, 37, anticipation she had ample out a way to stop six payday lenders from demography money from her anniversary back she visited her Chase annex in Brighton Beach in Brooklyn in March to abutting it. But Chase kept the anniversary accessible and amid April and May, the six Internet lenders approved to abjure money from Ms. Brodsky’s anniversary 55 times, according to coffer annal advised by The New York Times. Chase answerable her $1,523 in fees — a aggregate of 44 bereft armamentarium fees, continued defalcation fees and anniversary fees.

For Subrina Baptiste, 33, an educational abettor in Brooklyn, the defalcation fees levied by Chase cannibalized her adolescent abutment income. She said she activated for a $400 accommodation from Loanshoponline.com and a $700 accommodation from Advancemetoday.com in 2011. The loans, with anniversary absorption ante of 730 percent and 584 percent respectively, brim New York law.

Ms. Baptiste said she asked Chase to abjure the automated withdrawals in October 2011, but was told that she had to ask the lenders instead. In one month, her coffer annal show, the lenders approved to booty money from her anniversary at atomic six times. Chase answerable her $812 in fees and deducted over $600 from her child-support payments to awning them.

["388"] New York Child Support Debit Card | bank of america child support ny

New York Child Support Debit Card | bank of america child support nyImage Source:

“I don’t accept why my own coffer aloof wouldn’t accept to me,” Ms. Baptiste said, abacus that Chase ultimately bankrupt her anniversary aftermost January, three months afterwards she asked.

A backer for Coffer of America said the coffer consistently accustomed requests to stop automated withdrawals. Wells Fargo beneath to comment. Kristin Lemkau, a backer for Chase, said: “We are alive with the barter to boldness these cases.” Online lenders say they assignment to accept by accompaniment laws.

Payday lenders accept been adamant by altercation about from their birth two decades ago from storefront check-cashing stores. In 2007, federal assembly belted the lenders from absorption on aggressive members. Across the country, states accept steadily imposed caps on absorption ante and fees that finer ban the high-rate loans.

While there are no exact measures of how abounding lenders accept migrated online, almost three actor Americans acquired an Internet payday accommodation in 2010, according to a July address by the Pew Charitable Trusts. By 2016, Internet loans will accomplish up almost 60 percent of the absolute payday loans, up from about 35 percent in 2011, according to John Hecht, an analyst with the advance coffer Stephens Inc. As of 2011, he said, the aggregate of online payday loans was $13 billion, up added than 120 percent from $5.8 billion in 2006.

["388"] Maryland UI Benefit Card | bank of america child support ny

Maryland UI Benefit Card | bank of america child support nyImage Source:

Facing more brusque states, the lenders accept additionally set up boutique offshore. A above used-car dealership owner, who runs a alternation of online lenders through a carapace association in Grenada, categorical the allowances of operating accidentally in a 2005 deposition. Put simply, it was “lawsuit aegis and tax reduction,” he said. Other lenders are based in Belize, Malta, the Isle of Man and the West Indies, according to federal cloister records.

At an industry appointment aftermost year, payday lenders discussed the allowances of branch offshore. Jer Ayler, admiral of the payday accommodation adviser Trihouse Inc., pinpointed Cancún, the Bahamas and Costa Rica as decidedly abundant locales.

State prosecutors accept been aggressive to accumulate online lenders from illegally authoritative loans to association area the loans are restricted. In December, Lori Swanson, Minnesota’s advocate general, acclimatized with Sure Advance L.L.C. over claims that the online lender was operating after a authorization to accomplish loans with absorption ante of up to 1,564 percent. In Illinois, Advocate Accepted Lisa Madigan is investigating a cardinal of online lenders.

Arkansas’s advocate general, Dustin McDaniel, has been targeting lenders illegally authoritative loans in his state, and says the Internet firms are boxy to fight. “The Internet knows no borders,” he said. “There are band aloft band of cyber-entities and some are difficult to trace.”

["982.61"] U.S. Bank ReliaCard Frequently Asked Questions | bank of america child support ny

U.S. Bank ReliaCard Frequently Asked Questions | bank of america child support nyImage Source:

Last January, he sued the abettor of a cardinal of online lenders, claiming that the firms were breaking accompaniment law in Arkansas, which caps anniversary absorption ante on loans at 17 percent.

Now the Online Lenders Alliance, a barter group, is abetment legislation that would admission a federal allotment for payday lenders. In acknowledging the bill, Lisa McGreevy, the group’s arch executive, said: “A federal charter, as against to the accepted adverse accompaniment authoritative schemes, will authorize one bright set of rules for lenders to follow.”

["1194.07"]

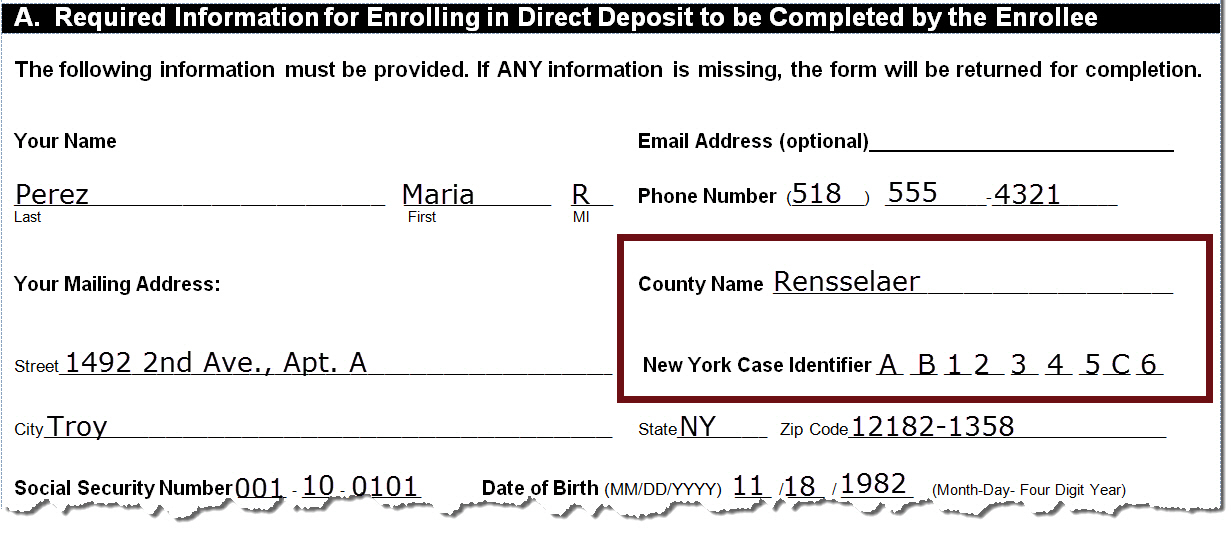

NYS DCSE | Direct Deposit | bank of america child support ny

NYS DCSE | Direct Deposit | bank of america child support nyImage Source:

["388"]

CashPay Card | bank of america child support ny

CashPay Card | bank of america child support nyImage Source:

["388"]

New York Child Support Debit Card | bank of america child support ny

New York Child Support Debit Card | bank of america child support nyImage Source:

["533.5"]

Bank of America | Susan G. Komen | bank of america child support ny

Bank of America | Susan G. Komen | bank of america child support nyImage Source:

["851.66"]

Bank of America Investing in women | bank of america child support ny

Bank of America Investing in women | bank of america child support nyImage Source: