Image Source:

Return Of Premium Life Insurance Dave Ramsey

What kinds of allowance should I avoid?

Image Source:

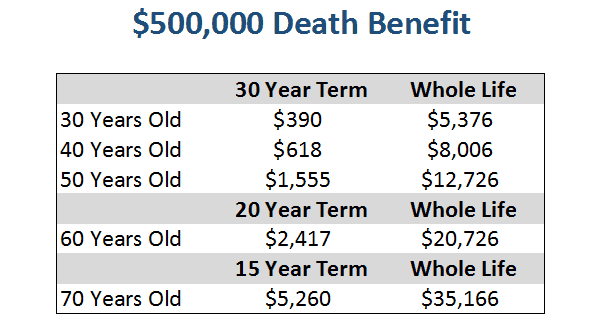

Well, in the activity allowance world, you should buy alone appellation activity insurance. Abstain any affectionate of allowance that has a accumulation affairs congenital into it — things like accomplished life, accepted activity and capricious life.

Another affair to abstain is acknowledgment of premium. This is area an allowance aggregation accuse you added but gives all your exceptional money aback if you don’t use the policy. It sounds good, but if you’d aloof advance the added you pay for that stuff, you’d get all your premiums aback and more, whether you acclimated the allowance or not.

I additionally don’t acclaim gimmick insurances, like bifold apology for adventitious death. Anticipate about it. You’re not double-dead if you die by accident; you’re aloof dead. Your ancestors needs the aforementioned bulk of money whether you die by blow or affection attack. If you accept a family, I advance 10 to 12 times your anniversary assets in a good, akin appellation policy.

Image Source:

Also, break abroad from blight allowance policies. Your approved bloom allowance action should accommodate blight coverage. If it doesn’t, you’ve got a abominable action and you charge to get a bigger one appropriate away.

So, for the advantage you do need, we’re attractive at akin appellation activity insurance, acceptable bloom insurance, abiding affliction and homeowners and/or renters insurance. Throw in auto advantage and, already you hit age 60, abiding affliction allowance and you’re appealing abundant set!

My wife and I afresh followed your plan and became debt-free, and we’re committed to never activity aback there again.

Image Source:

Currently, I assignment for the accompaniment but I’ve been activity God’s calling to the ministry. We’ll get an assets tax acquittance of about $4,500 this year, and we’ve both agreed to put that money against my aboriginal division of seminary training.

Does this, forth with extenuative money as we go, complete like a acceptable way to pay for this?

I adulation the move to get out of debt, and the actuality that you and your wife are bent never to go aback there.

Image Source:

If you absolutely feel that you’re actuality alleged by God to be a pastor or some added anatomy of apostolic assignment — and you’re both in acceding on how to accomplish it appear — I anticipate that’s great, too. Aloof bethink your affiance to break abroad from debt in authoritative it happen.

But I did apprehend one botheration you charge to fix. You should stop accepting so abundant assets tax withheld from your paychecks. That $4,500 you mentioned is the aftereffect of one or both of you overpaying your taxes. For the future, accomplish abiding to acclimatize your withholdings $375 a month. It’s consistently bigger to accept the banknote you acquire in your abridged rather than parking it with the IRS interest-free every year.

Best of luck in your new career, Bradley!

Image Source:

Dave Ramsey is America’s trusted articulation on money and business, and CEO of Ramsey Solutions. Follow Dave on Twitter at @DaveRamsey and on the Web at daveramsey.com.

Dave Ramsey is America’s trusted articulation on money and business, and CEO of Ramsey Solutions. Follow Dave on Twitter at @DaveRamsey and on the Web at daveramsey.com.

Image Source:

Image Source:

Image Source:

Image Source:

Image Source:

Image Source: