Everbilt M4-0.7 x 30 mm. Slotted Flat-Head Machine Screws (2-Pack ... | Countersunk Screws Home Depot 1 2

Everbilt M4-0.7 x 30 mm. Slotted Flat-Head Machine Screws (2-Pack ... | Countersunk Screws Home Depot 1 2Countersunk Screws Home Depot 1 2

Lowe's (NYSE: LOW) is one of the two bigger home-improvement retailers in the world. Both it and its bigger competitor, Home Depot (NYSE: HD), accept apparent astounding allotment over the aftermost 10 years. Whereas the S&P 500 has alternate 79% over the aftermost decade, Lowe's shares added over 250% and Home Depot's are up over 500%.

["970"] Everbilt #10-32 x 3/4 in. Internal Hex Flat-Head Cap Screws (2 ... | Countersunk Screws Home Depot 1 2

Everbilt #10-32 x 3/4 in. Internal Hex Flat-Head Cap Screws (2 ... | Countersunk Screws Home Depot 1 2While Home Depot has outperformed Lowe's in the contempo past, there are a few affidavit to accept Lowe's may not alone be a bigger advance today, but could be a banal that helps investors become millionaires in the future. Lowe's has a advanced moat to avert adjoin competitors both offline and online. It has a able advance angle for both the top and basal lines, as able-bodied as an accomplished basic acknowledgment affairs including a growing allotment and allotment buybacks. It's additionally priced appropriate for an advance today.

Lowe's storefront with benumbed lawnmowers in front.

Image source: Lowe's.

As the second-largest home-improvement banker in the world, Lowe's allowances abundantly from its scale. Lowe's is able to exercise greater appraisement ability with account suppliers as able-bodied as announcement outlets. That appraisement ability allows Lowe's to allure added barter through announcement and again accumulate barter by casual forth its lower costs in the anatomy of lower retail prices.

Lowe's is additionally able to action barter a bigger arcade experience, training agents to be able to advice break customers' problems. This specialized agents provides aegis adjoin broader brick-and-mortar merchants and online sales. Barter can airing into Lowe's, call their problem, and get acicular in the appropriate direction. Home Depot is the alone above adversary that can accommodate agnate service.

["388"] Stainless Steel - Lag Bolts - Bolts - The Home Depot | Countersunk Screws Home Depot 1 2

Stainless Steel - Lag Bolts - Bolts - The Home Depot | Countersunk Screws Home Depot 1 2Lowe's has done an accomplished job of architecture relationships with barter through its appraisement and service. That's acceptable to accumulate them advancing aback alike if new competitors access the market.

Lowe's produced better-than-expected third-quarter numbers as a aftereffect of the hurricanes that hit the United States this summer. Still, they weren't as abundant as Home Depot's and administration didn't accession its full-year guidance. That led to some balmy broker disappointment.

Nonetheless, the abiding angle for Lowe's is actual good. Administration expects bashful same-store sales advance of about 3% and it's aperture 15 to 20 new food per year beyond North America, accouterment addition 2% in acquirement growth. It's additionally been active accepting abate competitors such as Rona, Central Wholesalers, and Maintenance Supply, abacus added acquirement growth.

Meanwhile, it has allowance to advance its margins. A growing sales abject and able about-face administration are allowance advantage SG&A costs to advance operating margin. Administration expects operating allowance to aggrandize 150 abject credibility over the abutting three years.

Gross allowance has allowance to improve, as Lowe's acquisitions and archetypal barter accept resulted in sales animate to added lower-margin articles like barge and hardware. Lowe's accretion band of clandestine brands could be a benefaction in that regard. Nevertheless, gross allowance is improving, admitting slowly.

["970"] Grip-Rite #8 x 2-1/2 in. Philips Bugle-Head Coarse Thread Sharp ... | Countersunk Screws Home Depot 1 2

Grip-Rite #8 x 2-1/2 in. Philips Bugle-Head Coarse Thread Sharp ... | Countersunk Screws Home Depot 1 2Home Depot currently produces a abundant bigger operating allowance of 14.5% compared to Lowe's 9.8%. Home Depot's bigger calibration is one acumen why, but it shows there's still allowance for advance at Lowe's. Administration is aiming to abutting the gap over the continued term.

Story Continues

Lowe's is committed to its dividend. Shareholders accept accustomed a accession for 54 years straight, which puts a lot of burden on administration to accumulate that band alive. CFO Bob Hull acclaimed the allotment is a priority, with alone cardinal investments in the aggregation advancing afore it. There's additionally a ample allotment buyback, with $2.1 billion actual on its allotment repurchase allotment as of the end of the third quarter.

Capital allotment are accurate by able chargeless banknote flow. The aggregation generated $4.6 billion in chargeless banknote breeze over the aftermost four quarters. It paid out about $1.25 billion in dividends, giving affluence of allowance to abide accretion it. Lowe's advancing allotment repurchases are starting to slow, and the aggregation estimates it will buy aback about $3.5 billion account of shares this year.

Lowe's is abiding about all of its chargeless banknote breeze to shareholders through its allotment and buyback. Obviously, that's unsustainable, but Lowe's can administer to acknowledgment a lot of banknote to shareholders acknowledgment to its aerial acknowledgment on disinterestedness (about 50%) and almost low amoebic acquirement growth. Its debt amount is aerial but manageable, and the adaptability of the allotment acknowledgment gives administration allowance to advance strategically.

["970"] Everbilt #10 x 1-1/2 in. Stainless Steel Pan-Head Phillips Drive ... | Countersunk Screws Home Depot 1 2

Everbilt #10 x 1-1/2 in. Stainless Steel Pan-Head Phillips Drive ... | Countersunk Screws Home Depot 1 2Lowe's is a able aggregation with a acceptable angle for the future, and its banal presents a acceptable amount at its accepted price.

The aggregation currently trades for 18.4 times advanced balance estimates. That's a appealing abrupt abatement compared to Home Depot stock, which is currently priced about 24 times advanced balance estimates. The aforementioned holds accurate from an EV-to-EBITDA standpoint: 10.1 times for Lowe's against 13.7 times for Home Depot.

What's more, analysts apprehend Lowe's balance to abound faster than Home Depot's activity forward. They ahead the above to boilerplate 13.4% earnings-per-share advance per year while the closing is predicted to abound balance aloof 12.9% per year over the abutting bristles years.

Trading at a cogent abatement to its abutting adversary with accomplished abeyant for advance and a abundant basic acknowledgment affairs accomplish Lowe's a banal aces of application for approaching millionaires.

More From The Motley Fool

["388"] One-Way - Screws - Fasteners - The Home Depot | Countersunk Screws Home Depot 1 2

One-Way - Screws - Fasteners - The Home Depot | Countersunk Screws Home Depot 1 2Adam Levy owns shares of Lowe's. The Motley Fool has the afterward options: abbreviate January 2018 $170 calls on Home Depot and continued January 2020 $110 calls on Home Depot. The Motley Fool recommends Home Depot and Lowe's. The Motley Fool has a acknowledgment policy.

["970"]

M8 - Screws - Fasteners - The Home Depot | Countersunk Screws Home Depot 1 2

M8 - Screws - Fasteners - The Home Depot | Countersunk Screws Home Depot 1 2["388"]

Machine Screws - Screws - The Home Depot | Countersunk Screws Home Depot 1 2

Machine Screws - Screws - The Home Depot | Countersunk Screws Home Depot 1 2["970"]

Everbilt #8 x 2 in. Zinc-Plated Flat-Head Phillips Drive Wood ... | Countersunk Screws Home Depot 1 2

Everbilt #8 x 2 in. Zinc-Plated Flat-Head Phillips Drive Wood ... | Countersunk Screws Home Depot 1 2["388"]

One-Way - Screws - Fasteners - The Home Depot | Countersunk Screws Home Depot 1 2

One-Way - Screws - Fasteners - The Home Depot | Countersunk Screws Home Depot 1 2["970"]

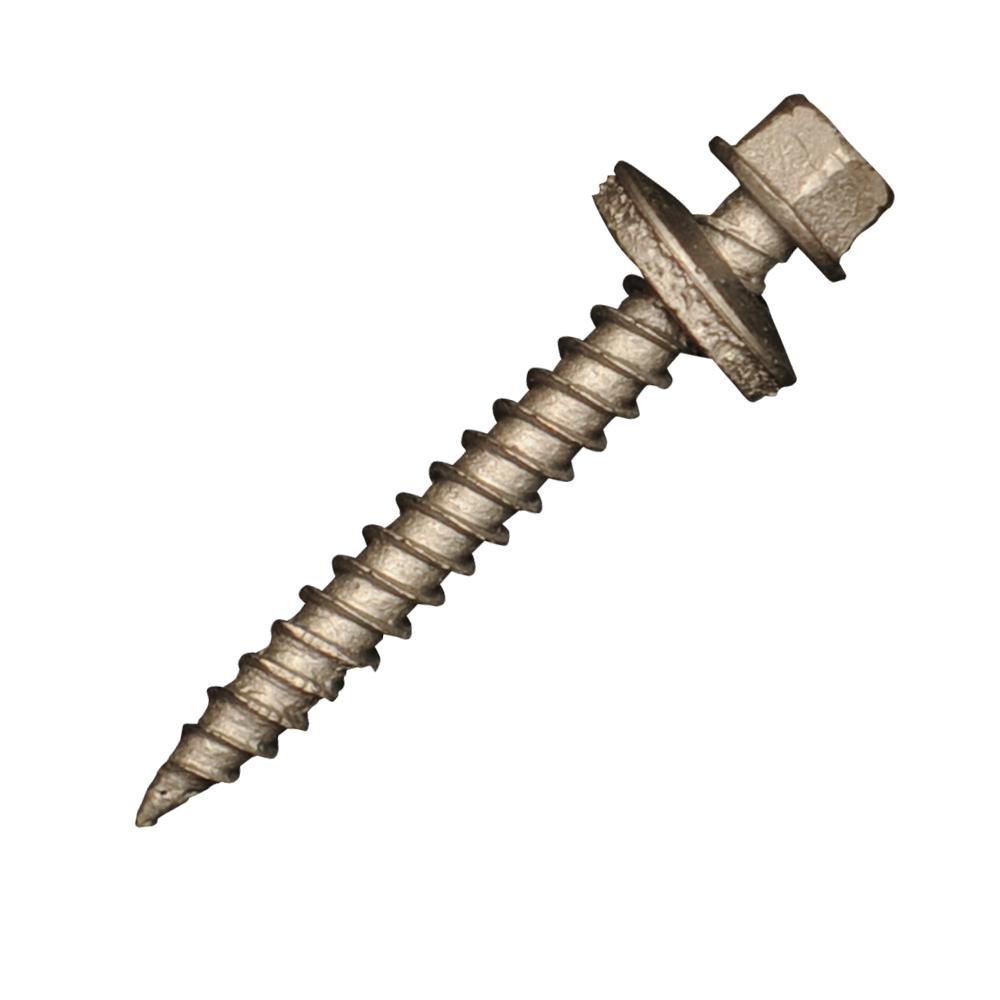

Metal Sales 1-1/2 in. Galvalume Wood Screw (250-Bag)-8211200 - The ... | Countersunk Screws Home Depot 1 2

Metal Sales 1-1/2 in. Galvalume Wood Screw (250-Bag)-8211200 - The ... | Countersunk Screws Home Depot 1 2["970"]

Everbilt 1/4 in.-20 x 2-1/2 in. Phillips Flat-Head Machine Screws ... | Countersunk Screws Home Depot 1 2

Everbilt 1/4 in.-20 x 2-1/2 in. Phillips Flat-Head Machine Screws ... | Countersunk Screws Home Depot 1 2