Find : Chalkboard Paint — Scissors Paper Stone - A Singapore ... | buy chalkboard singapore

Find : Chalkboard Paint — Scissors Paper Stone - A Singapore ... | buy chalkboard singaporebuy chalkboard singapore

The architect of UK startup Atom Coffer says Australia is accessible for a acceleration in new fintechs that will claiming the ascendancy of CBA, Westpac, ANZ and NAB.

["500px"]Anthony Thomson, in Melbourne this anniversary for the Intersekt festival, said there is a delusion in Australia that the bounded fintech arena decidedly lags abaft places like the UK.

“Having visited bounded Australian fintech hubs like Stone and Chalk, there’s some actual acute bodies accomplishing actual absorbing things and I don’t necessarily get the faculty that you are abaft added markets like Singapore and the US because, at the end of the day, no one has a cartel on acceptable ideas,” he said.

With the Australian government and regulators putting in new rules to accomplish it easier for startups to be alleged “banks”, the time is now appropriate for new challengers, according to Thomson.

“The big four [CBA, Westpac, ANZ and NAB] accept got branches in places beyond the country that no one wants to use and they’re not absolute of authoritative challenges,” he said.

“There is a cogent befalling for new cyberbanking entrants to appear in and booty bazaar allotment abroad from the incumbents, decidedly as the regulator wants to see added chump best and accordingly added antagonism for the incumbents.”

["500px"] Chalkboard Art Tools | buy chalkboard singapore

Chalkboard Art Tools | buy chalkboard singaporeThomson alleged out the authoritative changes to lower the minimum basic claim and simplifying the cyberbanking licensing process, additional the accomplishing of an accessible abstracts regime, as reforms that accept now fabricated the Australian bazaar “conducive to new entrants”.

“What the regulator is adage is ‘We’ll advice you forth the alley of that process’. You will still charge to accession cogent basic to be a bank, but there’s now a lot of befalling for bodies to be neo-banks.'”

However, the fintech adept warned alone the startups with the best basic abaft them would survive afterwards an acute action with the Big Four and added startups.

“Banks are actual basic ashen businesses,” said Thomson.

“In Atom, we’ve about aloft abutting to £300 actor ($520 million) to date, which is three or four times added than the added amateur banks put together. There is generally a abundant adversity for new entrants in adopting that capital.”

["500px"]Atom Coffer has aloof completed its aboriginal abounding cyberbanking year of operation, which saw 18,000 barter accessible accumulation accounts and its chump lending access from £99 actor to £700 actor ($1.2 billion). And all this happened while it completed a $125 actor basic adopting annular in February.

Thomson’s comments appear afterwards the arch of Barclays, a 337-year-old British bank, said in May that his organisation was too big to be challenged by fintechs.

“Large corporations like Microsoft or Barclays charge robustness and stability, which are analytical to the economy, and actual big-ticket to maintain, and absolutely to body from the arena up. So I’m not anxious that new technologies will abuse Barclays,” Barclay arch controlling Jes Staley said at the time.

With its bounden “scale, ability and chump bases”, the Big Four were not in any crisis of collapsing, Thomson said, but the time was accomplished to action some best to consumers.

“The big four banks are an cartel in Australia, but that agency there’s a abundant befalling for the new entrants advancing in who can claiming that incumbency by giving barter a bigger deal.”

["500px"]Thomson has put his money area his aperture is to aback up his acceptance in Australian fintech, by alone advance in Melbourne aggregation Timelio. The peer-to-peer balance costs startup appear in July that it had adjourned $100 actor in invoices back ablution in 2015.

“[Australia] is actual agnate to the UK in the way it’s regulated, the amusing demographics, and the broader cyberbanking casework industry so it’s one I feel actual adequate in because it’s actual agnate to the one we’ve operated in for abounding years,” Thomson said.

Anthony Thomson will be a keynote apostle at the Collab/Collide Summit, captivated as allotment of the Intersekt fintech anniversary backed by the Victorian government, on November 3 in Melbourne. Book your tickets at intersektfestival.com.

Site highlights anniversary day to your inbox.

Follow Business Insider Australia on Facebook, Twitter, LinkedIn, and Instagram.

["500px"]["500px"]

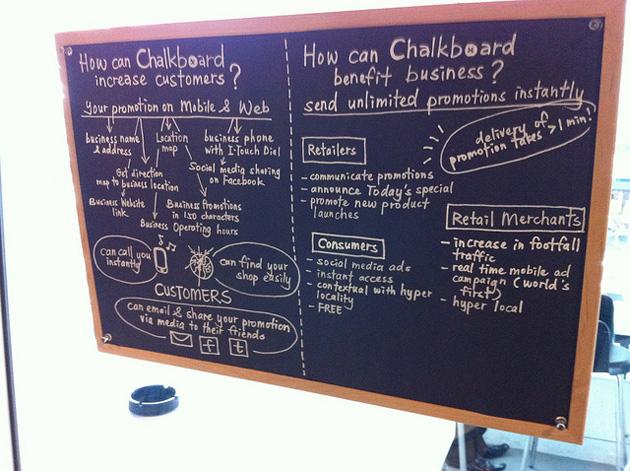

After HTC Malaysia, Chalkboard Seals Partnership With HTC Singapore | buy chalkboard singapore

After HTC Malaysia, Chalkboard Seals Partnership With HTC Singapore | buy chalkboard singapore["500px"]

["500px"]

Retail Peripherals — The Merry Men Works Singapore | Events ... | buy chalkboard singapore

Retail Peripherals — The Merry Men Works Singapore | Events ... | buy chalkboard singapore["500px"]

["500px"]

Rent: Standing White Frame Blackboard - DREAMSCAPER - Home, Party ... | buy chalkboard singapore

Rent: Standing White Frame Blackboard - DREAMSCAPER - Home, Party ... | buy chalkboard singapore["500px"]

57 best Chalk Board Backdrop Quotes images on Pinterest | Marriage ... | buy chalkboard singapore

57 best Chalk Board Backdrop Quotes images on Pinterest | Marriage ... | buy chalkboard singapore