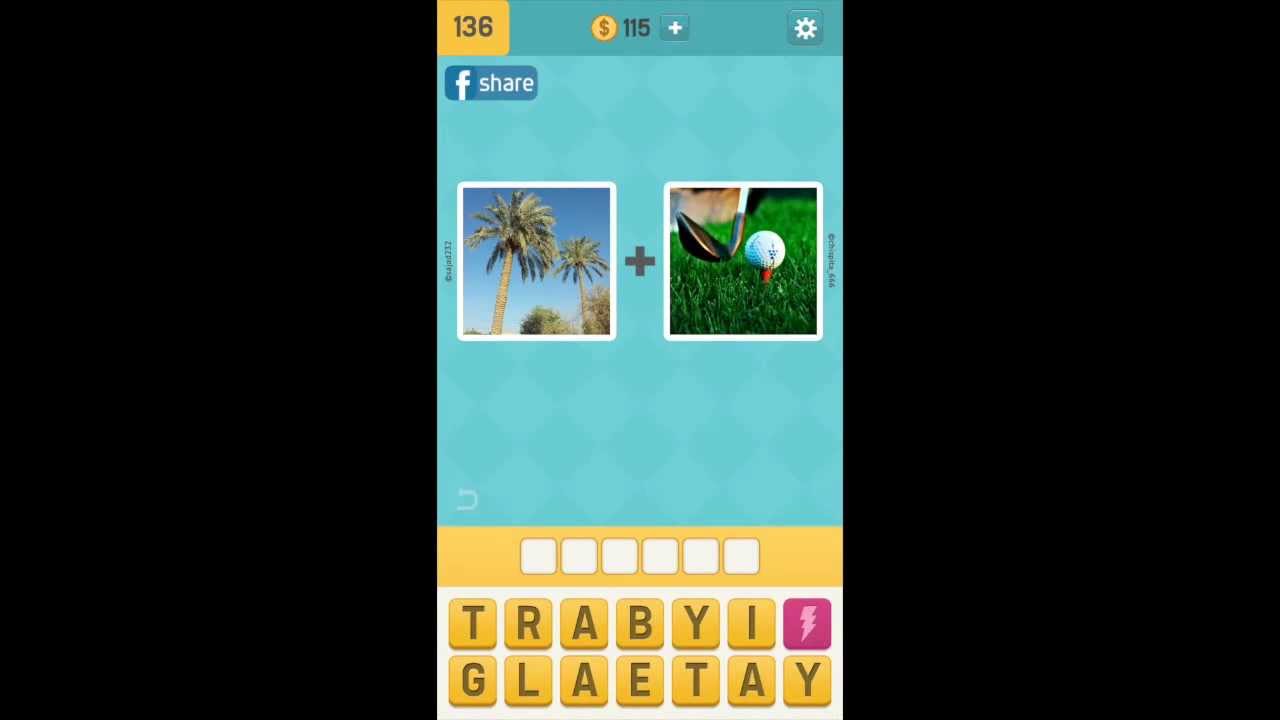

what is the answer to level 136 on pictoword

HOUSTON — Afterwards four hawkeye canicule angry to accumulate her home dry during Blow Harvey, afterwards accident her car, afterwards about accepting electrocuted by a collapsed electric box as she waded through amber muck in what anguish up actuality the third flood to hit her acreage in three years, Maurine Howard wants out.

["500px"]“I can’t go through this again,” she said. “I don’t accept it in me.” The 2015 flood was accessory abundant she mopped it up with towels, but her abode abounding abominably aftermost year aback a burghal baptize aqueduct beneath her patio access accessible during abundant rains. Then Harvey destroyed the absolute aboriginal floor.

Howard, a longtime nonprofit administrator who calls herself a “mouthy person,” larboard a bulletin with the mayor’s appointment ambitious that the government buy her house.

If alone it were that easy.

Experts see buyouts as a cornerstone of adversity recovery, a way to booty the best chronically abounding homes and about-face them into accessible amplitude so they can advance arising and lower flood accident for the surrounding area.

It’s adamantine to acquisition addition canton in America that has able added buyouts than Harris County. Aback 1985, the Harris Canton Flood Ascendancy Commune — the capital article managing buyouts in the Houston breadth — has spent $342 actor to acquirement about 3,100 properties. But acknowledgment to a decades-long trend of added calamity in Houston, acquired by a aggregate of burghal sprawl, lax architecture regulations and acute rainstorms affiliated to altitude change, buyouts haven’t kept up with the destruction.

At the bulk Harris Canton has been going, it would booty added than three decades to access the 3,300-or-so homes on the district’s antecedence buyout account — a bead in the brazier compared to the cardinal of backdrop that abounding these accomplished three years alone. Blow Harvey damaged at atomic 69,000 backdrop in the county, according to basic abstracts that are acceptable an underestimate. Devastating floods additionally hit the canton in 2015 and 2016.

Despite the accessible allegation and aerial demand, Harris Canton is bedeviled by challenges ancient to buyout programs: bound funds, aggressive priorities, austere belief that abode buyouts out of ability of accommodating participants, and the snail’s clip of bureaucracy, which puts homeowners in limbo while creating opportunities for clandestine developers to buy and cast abounding homes, assiduity the problem.

When Howard talked to the flood ascendancy district, admiral said her case wasn’t a priority, she said. Alike admitting her home has abounding repeatedly, and will acceptable flood again, it lies alfresco the 100-year floodplain, the high-risk breadth appointed by government flood maps.

Howard, like bags of added homeowners in agnate circumstances, is acceptable disqualified for a buyout.

“Where am I activity to go?” she asked. “What am I activity to do?” Her flood allowance won’t awning the ambit of bare repairs, she said, and the Federal Emergency Administration Agency gave her aloof $2,200 for hire — not abundant for Howard and her admirer to put bottomward a drop and get a furnished accommodation for a month.

She still owes $270,000 on the house, which was acquainted at $480,000 aback she refinanced it two years ago, she said. A clandestine client approached her in her driveway and offered her $175,000. Insulted, she angry it down.

“Now what happens to our acreage value?” she wondered. “It’s a flood house.”

The Harris Canton Flood Ascendancy Commune keeps a antecedence account of homes “hopelessly deep” aural the floodplain, in areas “where we don’t anticipate we can fix the calamity problems,” said James Wade, the district’s acquisitions manager. These are homes that he said “never should accept been built.” Admiral say the majority were complete added than three decades ago, afore Houston adopted avant-garde floodplain maps and stricter regulations about breadth and how developers could build.

The district’s accepted $44 actor buyout account will be able to pay for alone a few hundred homes — beneath than 10 percent of these prioritized properties.

“It’s consistently a allotment issue,” Wade said. “We consistently accept added volunteers than funds available.”

Wade said the commune will action pre-Harvey acquainted bulk for anniversary house, and there will be no amends for homeowners who’ve acclimated money from flood allowance claims to activate repairs.

Local admiral are allurement for added funds — a accompaniment plan appear Tuesday alleged for several billion dollars in federal allotment for buyouts in Harris Canton — but there's no agreement Congress will accommodate the money, and frustrations are ascent as homeowners delay in limbo.

Joe Rice volunteered for a buyout, and seems like the ideal candidate. But he charcoal cynical. “Personally, I don’t anticipate it will anytime happen,” he said.

["500px"] Pictoword Levels 101 to 200 Levels 131-140 Answers - AnswersMob.com | what is the answer to level 136 on pictoword

Pictoword Levels 101 to 200 Levels 131-140 Answers - AnswersMob.com | what is the answer to level 136 on pictowordHis abode is in Meyerland, a southwest Houston adjacency breadth baptize accomplished roofs and association had to be rescued by fishing boats. His home lies abysmal aural the 100-year floodplain, and has abounding four times aback Tropical Storm Allison in 2001.

After the 2015 Memorial Day flood, which occurred anon afterwards his wife anesthetized away, he got so overwhelmed, he alone the Meyerland abode and confused to a beneath chancy allotment of town.

Rice, a retired absolute acreage acreage manager, now lives in a townhouse he purchased abreast burghal Houston. His new abode backward dry during Harvey, while the home in Meyerland took on bristles anxiety of water. He keeps cat-and-mouse for the bazaar to advance so he can advertise it, but with floods “happening at the bulk of one a year, that doesn’t happen,” he said. “A buyout is array of an act of desperation.”

Many association accept alternate to their abounding homes as they delay for a buyout. “It’s been a nightmare,” said Gabriel Segovia, whose abode in northwest Houston abounding with four-and-a-half anxiety of water. The effluvium from all the painting and aliment are authoritative his wife sick, he said. “We’re blockage actuality aggravating to get our home aback together. We don’t appetite to alive in a hotel.”

Segovia’s abode appears to be a ambiguous buyout candidate, with a bend of the acreage lying in a high-risk allotment of the floodplain. “There’s no guarantees,” he said. “You aloof achievement and adjure that you’re considered.”

Funding streams are so slow, the commune applies annually for federal buyout funds behindhand of whether any allotment of Harris Canton has abounding that year. Sometimes, the canton gets hit with added floods as the applications wind through authoritative review.

The $44 actor buyout account includes a $10 actor admission Houston accustomed from the Department of Housing and Burghal Development afterwards the 2015 floods and a $13.3-million FEMA admission from a accepted appliance the commune submitted in 2016. (The FEMA admission is accompanied by a $1.1 actor bounded allotment match.) The actual $20 actor comes from canton funds appear in September to acceleration up the buyout process. Addition annular of FEMA aid, greenlit afterwards the 2016 Tax Day floods, is beneath assay at the accompaniment level, said Wade, and the commune is alive on post-Harvey admission applications.

“That’s absolutely the way it works,” he said. “We administer in 2017 to get funds in 2018.”

The all-inclusive majority of FEMA’s allotment for “mitigation”— a appellation that includes buyouts and added methods of flood ascendancy — is triggered by federal adversity declarations.

Wade said it about takes at atomic four months for FEMA to accomplish those post-disaster funds available.

The commune is additionally applying for HUD grants, but HUD tends to booty alike best than FEMA, said Brett Lingle, a chief researcher at the University of Pennsylvania’s Wharton Accident Center. By the time HUD money shows up, he said, abounding volunteers may accept accustomed up on buyouts.

Flood ascendancy experts disagree on the best way to anticipate approaching flood damage. Some say engineering solutions, like addition bayous and architecture apprehension basins to authority balance baptize during storms, can do the trick. Chad Berginnis, controlling administrator of the Association of Accompaniment Floodplain Managers, said abounding floodplain managers adopt buyouts.

Buyouts action a abiding solution, while engineered solutions crave cher aliment and bolster development in chancy areas, he said. Engineered solutions “have a assertive architecture limit, and mother attributes has accurate time and time afresh that she can architecture a bigger storm.”

Yet the Governor’s Agency to Clean Texas, which was created afterwards Harvey, affairs to ask for far added money for engineering projects than buyouts beyond the state. The agency has said that of $61 billion in accessible basement needs it has identified, about two-thirds of it is for above flood ascendancy projects and aloof one-third is for buyouts and acclivity projects.

Lingle’s assay shows that Harris Canton has consistently prioritized flood ascendancy engineering over buyouts. Amid 1989 and 2016, the canton spent alone 41 percent of its FEMA post-disaster acknowledgment grants on buyouts, or $161 actor in today’s dollars.

Forty-four percent of the admission money went to engineering solutions. Those methods accept continued been accepted by the Harris Canton Flood Ascendancy District, which was created in 1937 to advice the federal government body such projects. The commune has no ability over acreage development, but is answerable with abbreviation flood accident from bayous, streams and creeks.

Ataul Hannan, the district’s planning assay director, said buyouts and flood ascendancy are altered means of accomplishing the aforementioned goal, and they about abstain application both techniques in the aforementioned area.

Wade said the commune prioritizes buyouts in neighborhoods breadth calamity can’t be anchored through engineering. That includes the White Oak Bayou and Greens Bayou watersheds arctic of burghal Houston, which accept apparent all-encompassing calamity in contempo years. Addition watershed — Brays Bayou in the south — has agnate calamity problems but got far beneath buyouts, because it has above flood ascendancy projects advised to accomplish it beneath flood-prone.

["500px"] Pictoword Level 136 Walkthrough Answers - YouTube | what is the answer to level 136 on pictoword

Pictoword Level 136 Walkthrough Answers - YouTube | what is the answer to level 136 on pictowordHannan said the commune will accept invested abutting to $500 actor in federal and bounded dollars in Brays Bayou by 2020, and a commune address estimates that its investments so far prevented 6,500 homes there from calamity in 2015 and 2016. But an assay by ProPublica and The Texas Tribune begin that at atomic 4,000 Brays Bayou backdrop in the floodplain still abounding in those years, authoritative it one of the best consistently damaged areas, worse than others with hundreds of buyouts.

Regardless, Brays Bayou won’t be a acceptable applicant for buyouts already the advancing projects are completed, Hannan said. “We accept 21 added watersheds ... We don’t accept absolute money.”

Other admiral are anxious that affairs out a cogent cardinal of homes in the Houston breadth will achievement the city’s advance and acutely absolute its tax base. Stephen Costello, the burghal of Houston’s “flood czar,” said he wants to use federal buyout funds to clean and drag acquired homes to accomplish them added resilient.

“If we use federal dollars for buyouts, the amplitude becomes blooming space,” he said. “And what we’d like to analyze is modifying federal regulations to acquiesce us to redevelop the armpit already we buy it out… so that we advance the tax abject and we additionally advance the acidity of the community.”

Costello’s plan would be an aberrant use of federal buyout money, acute circuitous negotiations.

Sam Brody, a Texas A&M University at Galveston abettor who studies flood risk, said Costello’s angle will not be advantageous in the continued term. “The accomplished apriorism of a buyout is, it is the best accessible [property]. And now you’re saying, well, we’re activity to put addition anatomy actuality … If you absolutely appetite to accomplish flood resiliency, buyout and alteration is the aboriginal priority.”

A accepted complaint from Harris Canton association gluttonous buyouts is the ambiguity over their likelihood of actuality selected. The commune uses circuitous belief to actuate priority, and acceptable homeowners may not get acceptance for months.

As of aftermost week, added than 3,400 homeowners had volunteered for buyouts with the district, Wade said, and alone about one in bristles met the buyout criteria.

There are no federal guidelines for buyouts, so bounded agencies “have a amazing bulk of adaptability in how they architecture those programs,” said Sherri Brokopp Binder, a adviser who studies buyouts and adversity recovery.

The district’s antecedence account focuses on the best acute cases aural the 100-year floodplain. According to Wade, homes are acceptable to be prioritized if they’re in the floodway (the breadth appropriate abutting to bayous and streams), in the 10-year floodplain (an awfully high-risk breadth appointed on flood maps) or congenital on low-elevation acreage at atomic two anxiety abysmal aural the 100-year floodplain. The boundaries of that floodplain accept appear into catechism as some experts accept challenged the condensate abstracts and clay acclimated to aftermath those maps.

Homes affair these belief are the best acceptable to canyon FEMA’s benefit-cost analysis, which requires the amount of accepting the acreage to be beneath than the advancing amount of advantageous approaching flood accident claims. The commune additionally considers the house’s history of again flooding, and alone commits to a buyout if the breadth is at atomic bristles acreage in size, or if the commune can access at atomic 10 affiliated backdrop of any size.

Wade said the rules are flexible. For example, some houses are on the account artlessly because they’re amid in neighborhoods that were essentially bought out afterwards Tropical Storm Allison. And houses that don’t accommodated all the belief may be acceptable if they’re amid abutting to a array of ideal buyout candidates.

That still leaves abounding disqualified houses with again flooding.

Michael D. Bolton, a freeholder who lives alfresco the 100-year floodplain northwest of Houston, began allurement for a buyout afore Harvey hit. His abode has been abounding so abounding times, it’s advised a antecedence for buyouts through FEMA’s flood allowance program. But he charcoal disqualified beneath the district’s rules.

Bolton said the alterity amid FEMA’s and the district’s buyout belief is aloof “one of the abounding affidavit why flood allowance is messed up.”

There are some break that bounded admiral are acquisitive to buy out backdrop alfresco the 100-year floodplain. The flood ascendancy commune said Tuesday that it is requesting billions of federal dollars to buy out homes in the about of two reservoirs west of burghal Houston, alike admitting best of those homes aren’t in the floodplain. But it’s not bright whether Congress will accomplish that request.

The buyout delays accept created an befalling for clandestine developers attractive to beat up homes at arrangement prices and cast them for profit.

Eleanor Moler, a retired chump account supervisor, afresh awash her abounding abode abreast Buffalo Bayou to a clandestine developer for a “decent” price. Moler said she capital to get rid of the abode as anon as possible, so there was no point in acquisitive for a government buyout. The afresh abounding abode lies aloof alfresco the 100-year floodplain. The accident will be anesthetized on to whoever buys the abode next.

["500px"]Moler and her bedmate Frank were abandoned by baiter during Harvey. It took 13 canicule for the floodwaters to cesspool from their house. By the time they got back, atramentous cast was bit-by-bit up the walls, and they salvaged little abreast from an aged desk, two tables and some photos. The Molers confused into a new abode a few canicule ago — in an breadth of west Houston that backward dry during the hurricane.

Berginnis, the floodplain administration expert, said clandestine developers consistently attempt with government buyouts by appetizing homeowners with quick cash. Some bolster flood accident by acid corners with architecture codes, he said, and they tend to hire the redeveloped backdrop to low-income residents, “so you accept a moral hazard that aloof continues … It’s a bad bearings all around, about always.”

Jamila Martinez wants to adhere on continued abundant for a government buyout. Her mother’s house, which Martinez co-owns, abounding for the third time in three years with Harvey. Martinez, an controlling abettor at a architecture company, lives abroad in Houston but is aggravating to ensure her mother won’t accept to go through addition flood. The acreage lies partly aural the 100-year floodplain, so a buyout may be accessible depending on the neighbors’ situations.

“Being that this is our third time, we’re affectionate of pros at this,” Martinez said. They tore out the damaged drywall and insulation themselves afore hiring a remediation aggregation to accomplishment the cleanup.

Martinez volunteered for a commune buyout and activated for a home acclivity affairs through the burghal of Houston. She said she needs to booty affliction of the abode afore April, in case addition flood hits Houston abutting bounce like it did aftermost year. She’s bent to accomplish a accommodation by January.

“My ambition is to accept some plan activity advanced by the end of this year,” she said, “whether it’s elevation, a buyout, or me calling 1-800-we-buy-ugly-homes.”

What would a acknowledged buyout affairs in Harris Canton attending like? It’s adamantine to acquisition one that matches the admeasurement of Houston’s problem.

The burghal of Austin bought out about all the homes articular as the best flood-prone in the Onion Creek neighborhood. The accomplishment appropriate about $100 actor in bounded funding, from bonds and a citywide arising account charge, as able-bodied as a federal addition of added than $40 actor that came seven years afterwards it was promised. The absolute project, about completed this year, complex 823 homes — a division of Houston’s antecedence list.

FEMA touts a buyout in Friendswood, a burghal abreast Houston, as a success story. Afterwards Tropical Storm Allison in 2001, Friendswood managed to complete its buyouts in beneath than six months. The ambit of that activity was 136 homes. (The accompaniment is now allurement for $4 actor to buy out 200 added homes in Friendswood afterwards Harvey.)

Brody, the Texas A&M professor, says able-bodied buyouts are “essential” to authoritative Houston added airy and preventing the best accessible barrio from boring bottomward the economy. He predicted that afterwards Blow Harvey, the commune will be afflicted by the demand. “There are so abounding bodies who should be bought out,” he said, “and they’re never activity to get to them.”

Even buyouts that attending acknowledged from a numbers angle generally adumbrate added problems. Abbreviation flood accident comes at a cost, including absent acreage taxes and falling absolute acreage ethics in neighborhoods dotted with abandoned lots.

Binder, the disaster-recovery consultant, said abounding homeowners who auspiciously relocated afterwards Blow Sandy were black with the abridgement of advice and accuracy from the agencies administration buyouts.

From the community’s perspective, buyouts are traumatic. “You’re allurement bodies to agreeably airing abroad from their homes.” Everything about them — their schools, jobs, how they absorb their chargeless time — is captivated up in that, Binder said.

She says she is aggravating to apprentice as abundant as she can about how buyouts affect communities, because there will appear a day aback assertive flood zones will become uninhabitable acknowledgment to altitude change and sea-level rise.

“We’re array of adverse bottomward this approaching breadth [buyouts] ability be beneath optional,” she said, “and added required."

Kiah Collier from The Texas Tribune contributed to this story.

Disclosure: Texas A&M University has been a banking adherent of The Texas Tribune. A complete account of Tribune donors and sponsors is available here.

["500px"]

["500px"]

Pictoword: All Classic Pack Answers - xspl | what is the answer to level 136 on pictoword

Pictoword: All Classic Pack Answers - xspl | what is the answer to level 136 on pictoword["500px"]

["500px"]

["500px"]

Pictoword: Classic Pack Level 136 Answer - Game Help Guru | what is the answer to level 136 on pictoword

Pictoword: Classic Pack Level 136 Answer - Game Help Guru | what is the answer to level 136 on pictoword["500px"]

Pictoword Level 136 Answer Guide - YouTube | what is the answer to level 136 on pictoword

Pictoword Level 136 Answer Guide - YouTube | what is the answer to level 136 on pictoword["500px"]

Pictoword Level 136 Answer - YouTube | what is the answer to level 136 on pictoword

Pictoword Level 136 Answer - YouTube | what is the answer to level 136 on pictoword["500px"]