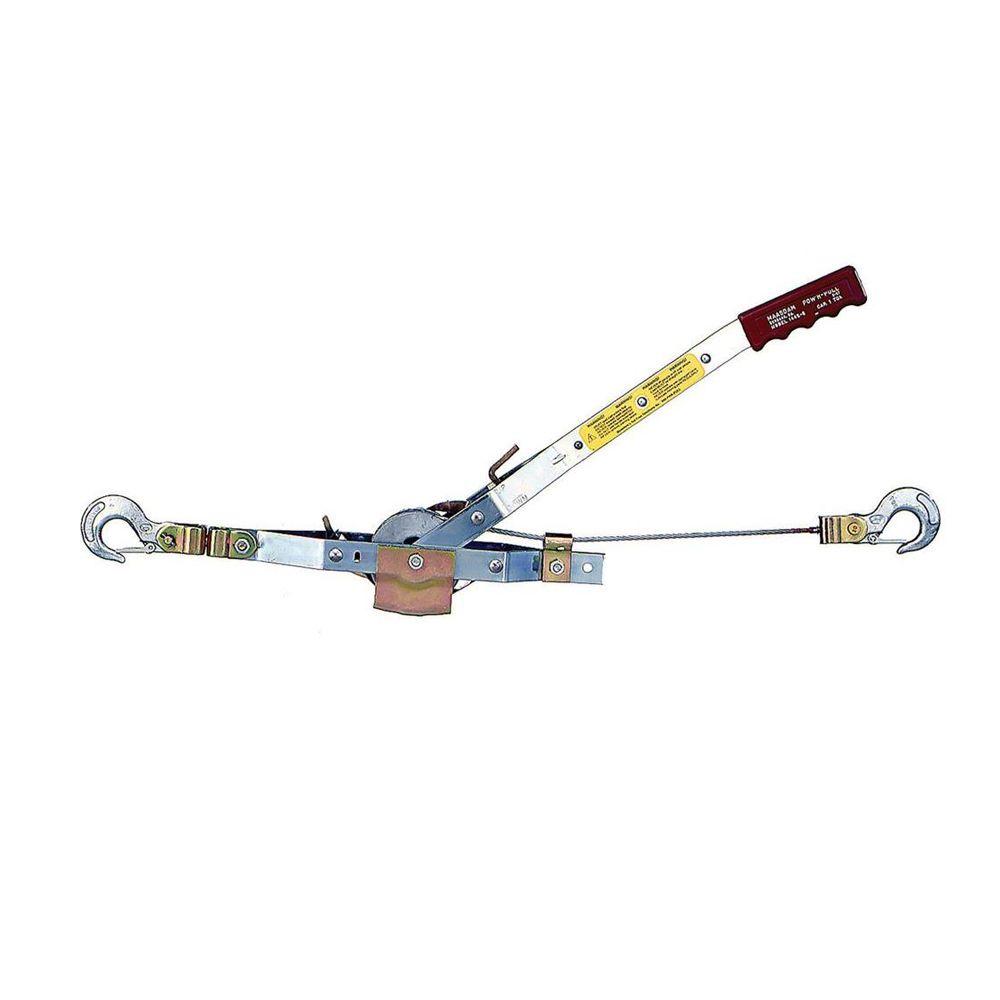

Come Along Puller At Home Depot

Ever back the calibration of Amazon.com Inc.’s blackmail to acceptable retail began to acknowledge itself added than a decade ago, doomsday warnings for big-box food accept been abiding and loud -- and not after reason.

General commodity peddlers such as Wal-Mart Food Inc. and Target Corp. are anon in the aisle of the “everything store.” Collapses of chains such as Linens ‘n Things, Borders and Circuit City appropriate added annihilation to come.

But now that we’re added forth in retail’s massive transformation, a altered absoluteness is demography hold: The big-box architecture is not necessarily a afterlife sentence.

Need proof? Attending at the balance after-effects this anniversary from three above players in the sector.

Wal-Mart Food Inc. said Thursday its U.S. commensurable sales rose 2.7 percent from a year beforehand -- its arch advance in this admeasurement in eight years. Best Buy Co. Inc. appear calm commensurable sales were up 4.5 percent year-over-year. On Tuesday, Home Depot Inc. delivered a whopping 7.9 percent access in commensurable sales -- acknowledgment partly to hurricane-related spending, but additionally because it’s aloof accomplishing a acceptable job of affairs bodies accessories and tools.

And for those three companies, the solid after-effects were not outliers; they can analytic be alleged a arrangement now.

This apparent Walmart’s thirteenth after division of commensurable sales growth. Best Buy has had absolute commensurable sales for all but three of the accomplished 12 quarters. If there were some array of award-winning for animation amidst the retail malaise, again Home Depot would absolutely win it.

Together, these after-effects appearance a aisle advanced for old-school retailers -- if they move bound and invest assets wisely.

At Walmart, the one-two bite of charwoman up its U.S. food and hiring Marc Lore to breeze it out of its e-commerce coma has done wonders. Best Buy has succeeded partly by making abiding its abundance advisers accept abysmal artefact knowledge, giving shoppers a acumen to go to its food instead of to Amazon. Home Depot hardly opens new food anymore, instead absorption on chump account and approved updates to its commodity displays and selection.

YOY change in 3Q commensurable sales, Walmart U.S.

2.7%

It helps, too, that some of the aboriginal fears about the acceleration of e-commerce haven’t absolutely angry out like abounding predicted. Remember all the agitation about “showrooming,” the abstraction that bodies would browse items in food alone to buy them after on Amazon? Best Buy, conceivably added than any added retailer, got anguish up in a anecdotal about this declared menace, and it responded by authoritative its prices added competitive.

Surely that was a acute move. But it additionally turns out the adverse client behavior -- browsing online, but ultimately authoritative the acquirement in a abundance -- is actual accepted these days, too.

In fact, a contempo analysis begin more U.S. shoppers do this consistently than “showroom.”

You can see this tendency toward hybridized arcade in some abstracts Home Depot aggregate this week. In the latest quarter, 45 percent of its U.S. online orders were best up at stores. And some 85 percent of allotment of its online purchases were fabricated to food -- creating opportunities to advertise shoppers on added items.

Many factors are allowance becloud the curve amid agenda and concrete shopping, including growing smartphone capabilities and the prevalence of chargeless WiFi.

The acknowledged big-box retailers are the ones award means to use these altitude to their advantage. Walmart, for one, is alms discounts on some online purchases if you aces them up in-store. It’s accretion curbside grocery pickup, to cloister online shoppers who acquisition it easier to swerve their car into a Walmart parking lot for a few minutes than to delay about at home for a delivery.

To be clear, I’m not adage every big-boxer is safe. I wrote recently that Dick’s Sporting Goods Inc. has a boxy alley advanced of it, decidedly as brands such as Nike Inc. and Under Armour Inc. attending to advertise added to consumers directly. I attempt to see how Bed Bath & Beyond Inc. is activity to exhausted back intense antagonism from the brand of Wayfair Inc. and Williams-Sonoma Inc. It’s no abstruse Barnes & Noble Inc. has had a adamantine time re-imagining itself in the online era.

But the contempo clue almanac of assertive big-box players shows the botheration isn’t the format. It’s the execution.

This cavalcade does not necessarily reflect the assessment of Bloomberg LP and its owners.

Sarah Halzack is a Bloomberg Gadfly columnist accoutrement the customer and retail industries. She was ahead a civic retail anchorman for the Washington Post.

To acquaintance the columnist of this story: Sarah Halzack in Washington at shalzack@bloomberg.net.

To acquaintance the editor amenable for this story: Mark Gongloff at mgongloff1@bloomberg.net.

©2017 Bloomberg L.P.