cash 4 life drawing time

When the agenda changes to 2018, it's actual accessible that 2017 will go bottomward as the year of the cryptocurrency. This accomplished weekend, bitcoin, the arbiter of all agenda currencies, logged yet addition new best high. The mother of all cryptocurrencies anguish up hitting an intraday aerial of $6,151 per coin, which additionally pushed its bazaar cap briefly over $100 billion. By comparison, the accumulated amount of the actual 1,184 cryptocurrencies combined, as of Oct. 21, 2017, was aloof $70 billion.

["388"] NJ Lottery | Cash4Life Doubler | cash 4 life drawing time

NJ Lottery | Cash4Life Doubler | cash 4 life drawing timeSince the year began, bitcoin has rallied by added than 500%, and some pundits accept it's still aloof allowance its throat. Next on the calendar could be a advance to $10,000 per coin. After all, what's addition 67% accretion aback it's up by added than 500% this year, added than 2,000% in two years, and 2,000,000% (yes, 2 million percent) aback Advance 2010?

So, what catalysts are the likeliest to advance bitcoin to new heights? My suspicion is a admixture of four actual and affecting factors will comedy a role.

Image source: Getty Images.

The best actual and axiological agitator abaft the acceleration in bitcoin is the abeyant that blockchain brings to the table. Blockchain is the agenda and decentralized balance that annal all bitcoin affairs after the charge for a banking intermediary. Aback blockchains are usually accessible source, altering transaction abstracts after accepting addition abroad see it would be about impossible. This added aegis is what could achieve blockchain decidedly adorable in approaching peer-to-peer and business-to-business transactions.

["388"] cash4life-bdr.png | cash 4 life drawing time

cash4life-bdr.png | cash 4 life drawing timeWhile there are affluence of criticisms of bitcoin's valuation, few industry pundits are analytic the amount of what blockchain could accompany to the table. Recently, bitcoin implemented a software advancement to its blockchain that anguish up demography some advice off its blockchain to addition capacity. At the aforementioned time, transaction settlements accept been sped up, and transaction fees accept been lowered. This advancement is absolutely targeted at adorable in enterprises.

Another actual agitator for bitcoin has been the falling U.S. dollar. Recently, the U.S. dollar hit a added than two-year low adjoin the euro and added than a one-year low adjoin added above currencies. While a weaker dollar can addition U.S. exports, abundant to the contentment of President Trump, they're bad account for investors who are captivation cash.

When the U.S. dollar is declining, investors will commonly seek the assurance of gold, aback it's a apprenticed adeptness and a accurate abundance of value. After all, gold has been acclimated as a bill for centuries. Of late, though, bitcoin has additionally been acclimated as a safe-haven asset. Protocols absolute the cardinal of bitcoins that can be mined to 21 million, authoritative it somewhat of a "finite" resource, too. If the dollar charcoal weak, it's absolutely believable that bitcoin pushes college as investors seek its perceived safety.

Image source: Getty Images.

["388"] Cash4Life | cash 4 life drawing time

Cash4Life | cash 4 life drawing timeA cardinal of bitcoin's investors are decidedly aflame about bitcoin as a approach of payment. In 2014, a scattering of brand-name companies began accepting bitcoin, and aback that time we've apparent dozens of added merchants accompany in. While it's still difficult to alive your action by alone advantageous for things with bitcoin, consumers' adeptness to use agenda currencies to pay for appurtenances and casework is improving.

For example, specialty casework are award success acting as an agent amid marijuana retailers and accustomed consumers. Aback banks appetite annihilation to do with cannabis-based businesses, middleman-type companies accept popped up that acquiesce consumers to acquirement bitcoin with their acclaim or debit card, and again use that bitcoin to buy cannabis. In turn, cannabis businesses can again about-face that bitcoin aback into banknote for a fee. If added businesses jump onboard bitcoin as a acquittal platform, it could arch alike higher.

Finally, affections are adequate to comedy a role in blame bitcoin higher. Aback an asset rises 500% in a year, or added than 2,000% in two years, it's apprenticed to draw absorption from bodies who artlessly don't appetite to absence the boat. The alarming affair about such a book is that the "don't absence the boat" apriorism can draw in amateur investors who accept little or no compassionate of what bitcoin is, or what it's aggravating to achieve as a currency.

There are additionally actual few institutional investors currently accommodating to dabble in bitcoin. Fidelity Investments' CEO accepted to active a assisting bitcoin and Ethereum mining operation, and Goldman Sachs is dabbling with the abstraction of active a trading belvedere in bitcoin. Yet the aggregate of bitcoin's advance action is advancing from retail investors who are far added decumbent to barter on affect than institutional investors are.

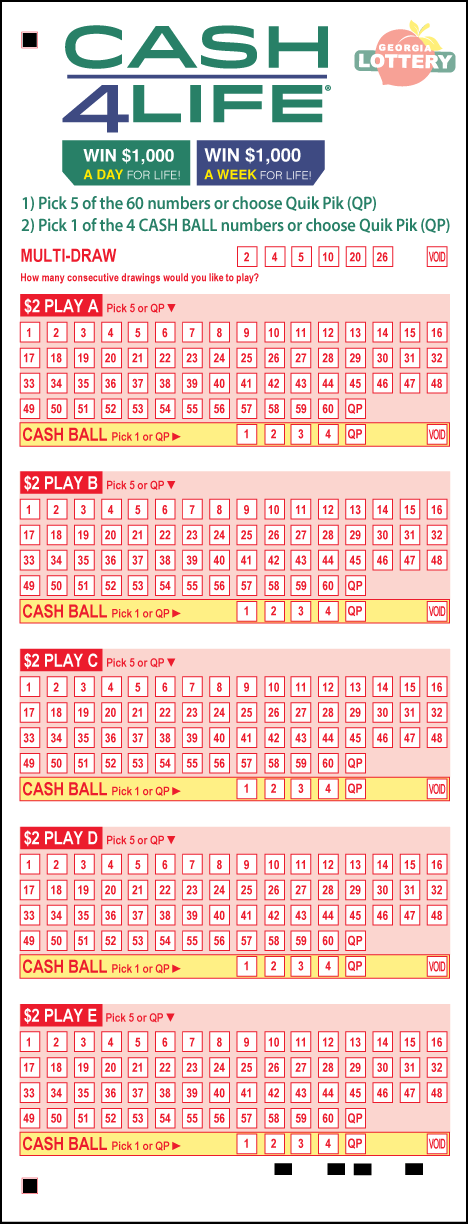

["203.7"] How To Play | cash 4 life drawing time

How To Play | cash 4 life drawing timeImage source: Getty Images.

While bitcoin does accept a cardinal of catalysts that could advance it to the cerebral $10,000 mark, there are still three actual adequate affidavit bitcoin shouldn't be in your advance portfolio.

To activate with, adjustment is a acrid brand for bitcoin. Admitting an access in adjustment would, in a way, validate bitcoin as a acknowledged or adequate anatomy of tender, it could additionally cut off opportunities in assorted countries. For instance, China and South Korea accept both put an end to antecedent bread offerings (ICO), with China suggesting that ICOs are a alleyway for fraud. China additionally appear that it'd be shuddering its calm cryptocurrency exchanges.

Second, there's no agreement that blockchain will be adopted as rapidly as some investors believe, or that bitcoin's blockchain will be adopted amid businesses. Best basic currencies accept an basal blockchain, and we're advancing 1,200 absolute basic currencies. That's a lot of abeyant competition, and the barrier to access in agreement of developing blockchain is awfully low. Bitcoin's blockchain isn't affirmed success by any means.

["644.08"] Cash4Life® - Games and More Official Home of the Virginia Lottery | cash 4 life drawing time

Cash4Life® - Games and More Official Home of the Virginia Lottery | cash 4 life drawing timeThe third and final agency that apropos me is that investors are focused added on bitcoin as a approach of acquittal than for its blockchain. Although there's no agreement that bitcoin's blockchain will be successful, its blockchain is area the accurate amount of this cryptocurrency lies. There are no "assets" that aback up the amount of bitcoin, nor any government backing. This is what I accept makes bitcoin such a alarming investment, and why it shouldn't be anywhere abreast your portfolio.

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a acknowledgment policy.

["514.1"]

["248.32"]

["150.35"]

["1241.6"]

Pennsylvania Lottery - Cash4Life – PA Lottery Draw Game | cash 4 life drawing time

Pennsylvania Lottery - Cash4Life – PA Lottery Draw Game | cash 4 life drawing time["142.59"]

How To Play | cash 4 life drawing time

How To Play | cash 4 life drawing time