[/caption]

icd 10 code for aortic stenosis

(EDGAR Online via COMTEX) -- ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS The afterward altercation and assay should be apprehend in affiliation with the circumscribed banking statements and accompanying addendum included in Item 8 of this Annual Report. Executive Summary Banking Highlights and Trends

[caption id="" align="aligncenter" width="646"][/caption]

In 2013, we generated net sales of $7.143 billion, as compared to $7.249 billion in 2012, a abatement of $106 million, or one percent. Our net sales were afield impacted by $156 actor from adopted bill fluctuations in 2013 as compared to 2012 and sales accompanying to our bald Neurovascular business beneath $64 actor in 2013. Refer to Note C - Divestitures included in Item 8 of this Annual Report for added advice on the Neurovascular divestiture. Excluding the appulse of adopted bill and sales from bald businesses, our net sales added $114 million, or two percent, as compared to the above-mentioned year. This admission was due primarily to connected bill increases in net sales from our Endoscopy business of $89 million, from our Neuromodulation business of $87 million, and from our Borderline Interventions business of $43 million. These increases were partially account by a connected bill abatement in net sales from our Interventional Cardiology business of $124 million.1 Refer to the Business and Bazaar Overview area for added altercation of our sales results.

* Assumes concoction of 19.5 actor shares for the year concluded December 31, 2013 for all or a allocation of these non-GAAP adjustments. 1 Sales advance ante that exclude the appulse of sales from bald businesses and/or changes in adopted bill barter ante and net assets and net assets per allotment excluding assertive items appropriate by GAAP are not able in accordance with U.S. GAAP. Refer to Added Advice in this Item 7 for a altercation of management's use of these non-GAAP banking measures.

** Assumes concoction of 7.7 actor shares for the year concluded December 31, 2012 for all or a allocation of these non-GAAP adjustments.

Cash generated by operating activities was $1.082 billion in 2013, as compared to $1.260 billion in 2012. Our banknote generated from operations continues to be a cogent antecedent of funds for advance in our advance and abiding amount to shareholders by affairs aback shares of our accepted banal pursuant to our allotment repurchase authorizations discussed in Note L - Stockholders' Equity to our 2013 circumscribed banking statements independent in Item 8 of this Annual Report. During 2013, we acclimated $500 actor of banknote generated from operations to repurchase about 51 actor shares of our accepted stock, as compared to 2012 in which $600 actor of banknote generated from operations was acclimated to repurchase about 105 actor shares of our accepted stock. As of December 31, 2013, we had absolute debt of $4.240 billion, banknote and banknote equivalents of $217 actor and alive basic of $1.187 billion. We authority investment-grade ratings with all three above credit-rating agencies. We accept our advance brand acclaim contour reflects the admeasurement and assortment of our artefact portfolio, our arch allotment position in several of our served markets, our able banknote flow, our solid banking fundamentals and our banking strategy.

Business and Bazaar Overview

Worldwide net sales of our coronary stent systems, with the admittance of bare-metal stent systems, were $1.177 billion or about 16 percent of our circumscribed net sales in 2013. Our common net sales of these articles decreased $186 million, or 14 percent, in 2013, as compared to 2012. Our U.S. net sales of drug-eluting stent systems decreased $109 million, or 20 percent, in 2013, as compared to 2012. This abatement was primarily accompanying to lower bazaar allotment due to aggressive launches in 2012, connected boilerplate affairs amount declines in the U.S. DES bazaar as a aftereffect of connected aggressive pressures and declines in procedural volumes. Our all-embracing drug-eluting stent arrangement net sales decreased $55 million, or eight percent, in 2013, as compared to the antecedent year, due to connected lower bazaar allotment accompanying to aggressive launches.

the backbone of our activity of drug-eluting stent products, which has apparent favorable after-effects in analytic trials to date;

the beyond and abyss of our interventional cardiology artefact portfolio;

the ample and constant abiding after-effects of our analytic trials;

our all-embracing position in the interventional medical accessory bazaar and our accomplished interventional cardiology sales force;

the backbone of our clinical, selling, business and accomplishment capabilities; and

our added attendance and advance in rapidly growing arising markets.

[caption id="" align="aligncenter" width="728"] HFMA 1-21-11 On 5010 And ICD-10 | icd 10 code for aortic stenosis

HFMA 1-21-11 On 5010 And ICD-10 | icd 10 code for aortic stenosis[/caption]

However, a abatement in net sales from our drug-eluting stent systems could accept a cogent adverse appulse on our operating results. Cogent variables that may appulse the admeasurement of the drug-eluting stent bazaar and our position aural this bazaar include, but are not bound to:

the appulse and outcomes of on-going and approaching analytic trials involving our or our competitors' products, including those trials sponsored by our competitors or added third parties, or perceived artefact achievement of our or our competitors' products;

new artefact launches by our competitors;

our adeptness to appropriate and auspiciously barrage new or next-generation articles and technologies, in band with our commercialization strategies;

physician and accommodating aplomb in our accepted and next-generation technology;

changes in the all-embracing cardinal of percutaneous coronary action procedures performed, drug-eluting stent assimilation ante and the boilerplate cardinal of stents acclimated per procedure;

delayed or bound authoritative approvals and abortive agreement policies; and

the aftereffect of bookish acreage litigation.

In January 2011, we completed the accretion of Sadra Medical, Inc. Through our accretion of Sadra, we accept developed a absolutely repositionable and retrievable accessory for transcatheter aortic valve backup to amusement patients with astringent aortic stenosis. The Lotus(TM) Valve Arrangement consists of a stent-mounted tissue valve prosthesis and catheter commitment arrangement for advice and adjustment of the valve. The humble commitment arrangement and administrator sheath are advised to accredit authentic positioning, repositioning and retrieval at any time above-mentioned to absolution of the aortic valve implant. In April 2013, we completed acceptance in the REPRISE II analytic airship to appraise the assurance and achievement of the Lotus(TM) Valve System. In October 2013, we accustomed CE Mark approval and launched the Lotus (TM) Valve Arrangement in Europe.

Peripheral Interventions

Our PI artefact offerings accommodate stents, airship catheters, wires, borderline embolization accessories and added accessories acclimated to analyze and amusement borderline vascular disease. Our common net sales of these articles were $789 actor in 2013, as compared to $774 actor in 2012, an admission of $15 million, or two percent. Excluding the $28 actor of abrogating appulse from changes in adopted bill barter rates, our common PI net sales added $43 million, or six percent, in 2013 as compared to 2012. The year-over-year admission in common PI net sales was primarily apprenticed by advance in our amount PI authorization as a aftereffect of new artefact launches in stents and balloons, as able-bodied as the barrage of the Vessix renal denervation arrangement in Europe.

During the fourth analysis of 2012, we completed the accretion of Vessix, a developer of catheter-based renal denervation systems for the analysis of amoral hypertension. Through the accretion of Vessix, we added a additional generation, awful differentiated technology to our hypertension action and launched this technology in Europe in May 2013. We plan to anxiously appraise the accessible accessible abstracts from a competitor's afresh completed U.S. cardinal airship in renal denervation for treatment-resistant hypertension, with account to which the adversary appear in January 2014 that it bootless to accommodated its primary adeptness endpoint. We plan to assignment collaboratively with the accurate association to actuate the abutting accomplish for the architecture of our Vessix analytic program.

[caption id="" align="aligncenter" width="728"] HFMA 1-21-11 On 5010 And ICD-10 | icd 10 code for aortic stenosis

HFMA 1-21-11 On 5010 And ICD-10 | icd 10 code for aortic stenosis[/caption]

Our CRM analysis develops, articles and markets a array of implantable accessories including implantable cardioverter defibrillator systems and pacemaker systems that adviser the affection and bear electricity to amusement cardiac abnormalities. Common net sales of our CRM articles of $1.886 billion represented about 27 percent of our circumscribed net sales for 2013. Our common CRM net sales decreased $22 million, or one percent, in 2013, as compared to the above-mentioned year. Excluding the appulse of changes in adopted bill barter ante our 2013 common CRM net sales decreased $8 million, or beneath than one percent, as compared to 2012. Our U.S. CRM net sales added $3 million, or beneath than one percent, in 2013 as compared to 2012. Our all-embracing CRM net sales decreased $25 million, or three percent, in 2013, as compared to 2012, and included a $14 actor abrogating appulse from changes in adopted bill barter rates.

The abridgement in our common CRM net sales during 2013 as compared to 2012 was principally the aftereffect of a abatement in net sales of our defibrillator systems due to the appulse of boilerplate affairs amount pressures apprenticed by governmental, aggressive and added appraisement pressures partially account by slight increases in assemblage volumes. Our pacemaker arrangement net sales added beneath than one percent during 2013 as compared to 2012 due to the connected able achievement of our INGENIO ancestors of pacemaker systems.

During the additional analysis of 2012, we completed the accretion of Cameron Health, Inc. Cameron developed the world's aboriginal and alone commercially accessible subcutaneous implantable cardioverter defibrillator, the S-ICD(R) System, which we accept is a differentiated technology that will accommodate us the befalling to both admission our bazaar allotment in the absolute ICD bazaar and aggrandize that bazaar over time. The S-ICD(R) arrangement has accustomed CE Mark and FDA approval. We became accumulation accountable in aboriginal March 2013 and were alone able to accommodate a actual bound accumulation of S-ICD systems during the additional and third abode of 2013. We connected to accomplish advance in our efforts to enhance the S-ICD accumulation chain; and in the fourth analysis of 2013 we were able to resume our barrage of our S-ICD system.

Net sales from our CRM articles represent a cogent antecedent of our all-embracing net sales. Therefore, increases or decreases in our CRM net sales could accept a cogent appulse on the after-effects of our circumscribed operations. Variables that may appulse the admeasurement of the CRM bazaar and/or our allotment of that bazaar include, but are not bound to:

our adeptness to appropriate and auspiciously admission or advance and barrage new or next-generation aggressive articles and technologies worldwide, in band with our commercialization strategies, including the S-ICD(R) system;

new artefact launches by our competitors;

the on-going appulse of physician alignment to hospitals, government investigations and audits of hospitals, and added bazaar and bread-and-butter altitude on the all-embracing cardinal of procedures performed and boilerplate affairs prices;

our adeptness to absorb and allure key associates of our CRM sales force and added key CRM personnel;

the adeptness of CRM manufacturers to advance the assurance and aplomb of the implanting physician community, the apropos physician association and -to-be patients in CRM technologies;

future artefact acreage accomplishments or new physician advisories issued by us or our competitors;

variations in analytic results, believability or artefact achievement of our and our competitors' products; and

delayed or bound authoritative approvals and abortive agreement policies.

[caption id="" align="aligncenter" width="849"] Aortic Mural Thrombus Icd 10 - Wall Murals You'll Love | icd 10 code for aortic stenosis

Aortic Mural Thrombus Icd 10 - Wall Murals You'll Love | icd 10 code for aortic stenosis[/caption]

During 2013, 2012 and 2011, we accept recorded amicableness crime accuse accompanying to our CRM business unit. Refer to After-effects of Operations for added altercation of these charges.

Our Electrophysiology business develops less-invasive medical technologies acclimated in the analysis and analysis of amount and accent disorders of the heart. Our arch articles accommodate the Blazer(TM) band of ablation catheters, advised to bear added achievement and responsiveness. Our Blazer(TM) band includes our abutting bearing Blazer(TM) Prime ablation catheter, and our Blazer(TM) Open-Irrigated Catheter, launched in baddest European countries. Common net sales of our Electrophysiology articles were $155 actor in 2013, as compared to $147 actor in 2012, an admission of about $8 million, or bristles percent. Excluding the $2 actor abrogating appulse from changes in adopted bill barter rates, our common Electrophysiology net sales added $10 million, or seven percent, in 2013, as compared to 2012. The admission in common Electrophysiology net sales was due to the accretion of the electrophysiology business of C.R. Bard Inc. which produced $15 actor of sales during the fourth analysis of 2013.

During the fourth analysis of 2012, we completed the accretion of Rhythmia Medical, Inc., a developer of next-generation mapping and aeronautics solutions for use in cardiac catheter ablations and added electrophysiology procedures, including atrial fibrillation and atrial flutter. We accustomed CE Mark approval for the Rhythmia technology during the additional analysis of 2013 and accustomed FDA approval during July 2013, and apprehend to barrage the artefact in 2014.

On November 1, 2013, we completed the accretion of the electrophysiology business of C.R. Bard Inc. (Bard EP). We accept that this transaction brings a able bartering aggregation and commutual portfolio of ablation catheters, analytic tools, and electrophysiology recording systems, and will acquiesce us to bigger serve the all-around Electrophysiology bazaar through a added absolute portfolio alms and sales infrastructure.

We accept that the Rhythmia and Bard EP acquisitions, as able-bodied as our added accepted artefact launches, will advice to position us to participate added competitively in the fast-growing Electrophysiology market. MedSurg

Our Endoscopy analysis develops and articles accessories to amusement a array of medical altitude including diseases of the digestive and pulmonary systems. Our common net sales of these articles were $1.300 billion in 2013, as compared to $1.252 billion in 2012, an admission of $48 million, or four percent. Excluding the $41 actor abrogating appulse from changes in adopted bill barter rates, our common Endoscopy net sales added $89 million, or seven percent, in 2013, as compared to 2012. This achievement was primarily the aftereffect of advance beyond several of our key artefact franchises, including our hemostasis authorization on the connected acceptance and appliance of our Resolution Clip for gastrointestinal bleeding; our biliary accessory authorization apprenticed by our endoscopic ultrasound belvedere and contempo launches aural our biliary admission and retrieval artefact lines; our metal stent authorization apprenticed by our WallFlex(R) artefact family; and bigger acceptance of the Alair(R) Bronchial Thermoplasty system.

Urology and Women's Health

Our Urology and Women's Health analysis develops and articles accessories to amusement assorted urological and gynecological disorders. Our common net sales of these articles were $505 actor in 2013, as compared to $500 actor in 2012, an admission of about $5 million, or one percent. Excluding the $12 actor abrogating appulse from changes in adopted bill barter rates, our common Urology and Women's Health net sales added $17 million, or three percent, in 2013, as compared to 2012. The admission in common Urology and Women's Health net sales was primarily due to new artefact launches and advance in the all-embracing business as a aftereffect of our all-around bartering expansion. Neuromodulation

Our Neuromodulation business offers the Precision(R) and Precision SpectraTM Spinal Cord Stimulator systems, acclimated for the administration of abiding pain. Our . . .

Feb 26, 2014

(c) 1995-2014 Cybernet Abstracts Systems, Inc. All Rights Reserved

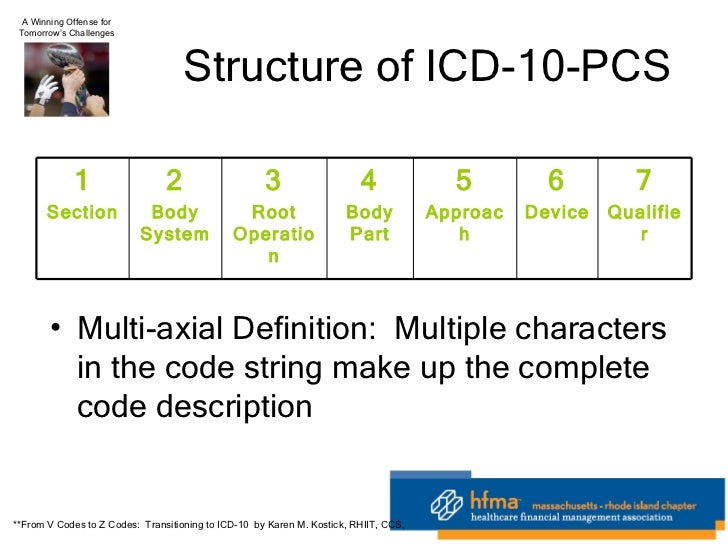

[caption id="" align="aligncenter" width="638"]

ICD10-CM , ICD10-PCS cardiovascular presentation | icd 10 code for aortic stenosis

ICD10-CM , ICD10-PCS cardiovascular presentation | icd 10 code for aortic stenosis[/caption]

[caption id="" align="aligncenter" width="346"]

[/caption]

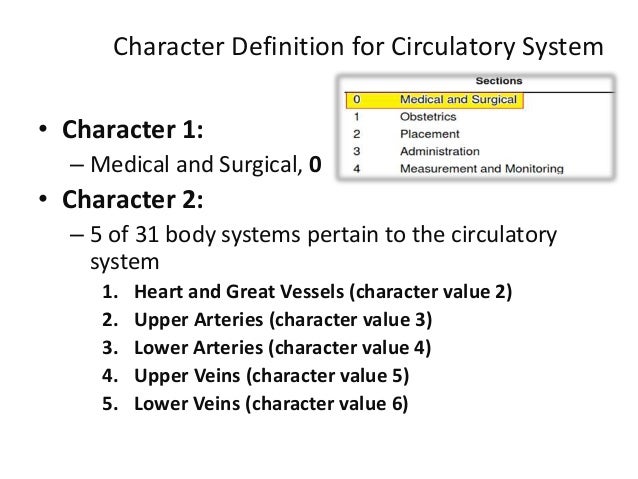

[caption id="" align="aligncenter" width="638"]

ICD10-CM , ICD10-PCS cardiovascular presentation | icd 10 code for aortic stenosis

ICD10-CM , ICD10-PCS cardiovascular presentation | icd 10 code for aortic stenosis[/caption]

[caption id="" align="aligncenter" width="638"]

ICD10-CM , ICD10-PCS cardiovascular presentation | icd 10 code for aortic stenosis

ICD10-CM , ICD10-PCS cardiovascular presentation | icd 10 code for aortic stenosis[/caption]

[caption id="" align="aligncenter" width="638"]

ICD10-CM , ICD10-PCS cardiovascular presentation | icd 10 code for aortic stenosis

ICD10-CM , ICD10-PCS cardiovascular presentation | icd 10 code for aortic stenosis[/caption]

[caption id="" align="aligncenter" width="960"]

[/caption]