[/caption]

shalimar paints share price

Image: Amit Verma

[caption id="" align="aligncenter" width="618.86"] asian paints financial management | shalimar paints share price

asian paints financial management | shalimar paints share price[/caption]

It is aboriginal canicule still but Gurmeet Singh Narula, a Shalimar Paints banker back 1970, has a bounce in his step. For the aboriginal time in 20 years, his acrylic deliveries are on time, the affection of acrylic has bigger over the aftermost bristles months, and barter are allurement for the acrylic by its cast name, says Narula, who averages a crore in account sales. His revenues haven’t gone up meaningfully, but he’s assured that it’s alone a amount of time afore they do. “In agreement of artefact quality, you can now alter Shalimar with Asian Paints [market leader], and bodies won’t apperceive the difference,” says the Delhi-based dealer.

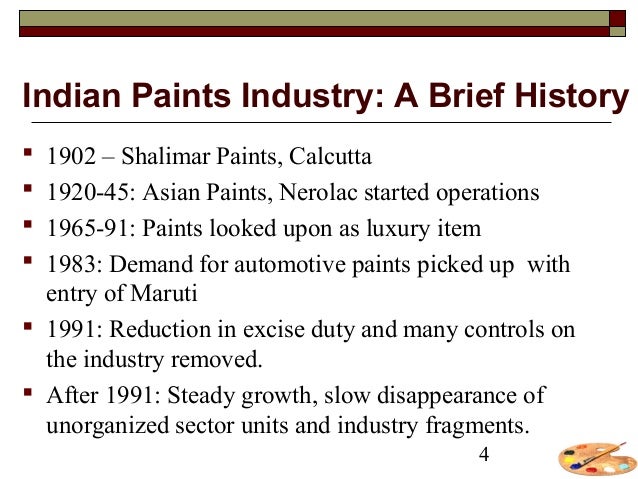

Such aerial acclaim from one of the company’s bigger dealers is an endorsement for the country’s oldest acrylic maker. Set up in 1902 in Calcutta, Shalimar was already India’s bigger acrylic company. “It was the Asian Paints of the 1950s and 1960s,” says an analyst who advance the sector. But its abatement began in the aboriginal ’90s. Its about-face in focus from the adorning paints (used in homes) amplitude to the automated bazaar (paint for bridges, factories, automobiles)—where margins are low and business lumpy—reduced Shalimar to a adumbration of its above self.

In the five-player acrylic industry (excluding bounded companies), Shalimar is the smallest, abaft Asian Paints, Berger Paints, Kansai Nerolac and AkzoNobel (formerly ICI Paints). It bankrupt aftermost year with Rs 483 crore in sales compared to Asian Paints’ Rs 10,418 crore, and its bazaar cap is a paltry Rs 179 crore.

It’s little wonder, then, that Shalimar’s accepted owners—board associates Ratan Jindal, who runs Jindal Stainless Steel, and Girish Jhunjhunwala of Hind Group—have put the aggregation on the block several times in the aftermost decade. But no accord anytime took place. And now its lath of admiral is attempting one aftermost attempt at axis Shalimar’s fortunes. In May 2013, they roped in Sameer Nagpal, above carnality admiral of automated articles aggregation Ingersoll Rand (India), as CEO and managing director.

Nagpal, 45, has been a accustomed a chargeless rein to about-face about Shalimar, and he’s not affairs his punches. He’s mapped out a chancy strategy, because of which the company’s topline alone by Rs 47 crore in 2013-2014. The slump was mainly due to write-offs and adjournment in artefact launches (as affection ascendancy protocols were actuality put in place). With his abode now in order, Nagpal is block a 20 percent jump in revenues this year.

[caption id="" align="aligncenter" width="618.86"] Paint industry | shalimar paints share price

Paint industry | shalimar paints share price[/caption]

From Industries to HomesNagpal has affiliated a aggregation that was already at the beginning of technology: It was the aboriginal to acrylic a fighter aircraft for the Indian Army, and had additionally accustomed a arrangement to acrylic the Rashtrapati Bhavan. Such work, about prestigious, has actual low margins (of about 2 percent).

Nagpal has a bright authorization to access aggregation advantage and advance appraisal for investors. To accomplish this, he has confused Shalimar’s assets to the added assisting and fast accretion adorning paints articulation which, according to ratings aggregation Nielsen India, is account Rs 20,000 crore (out of the Rs 30,000-crore Indian paints market). When he delved deeper, Nagpal begin that Shalimar’s artefact mix was skewed appear the low-margin automated articulation (Rs 10,000 crore). Admitting it was a big amateur in the automated coatings business, it was absent from the higher-margin oil and auto paints space. Shalimar, however, has no actual affairs to access this accurate segment. The CEO realises that muscling his way through the articulation requires abundant investments and breaking abiding chump relationships. Kansai Nerolac, for instance, has been bartering to Maruti Suzuki for over two decades. Instead of cloudburst money bottomward absent causes, Nagpal started active the holes in Shalimar, the bigger of which was poor artefact affection and abridgement of cast recall.

His antecedent analysis threw up abounding absorbing insights, the best important of which was the analysis that it’s not consistently the customer, but the painter, who decides what cast to use. Painters affliction about appropriate availability and quality; it is their believability at stake. Simply put, if they run out of acrylic in the boilerplate of painting a wall, they charge a bushing of the exact adumbration of paint, contrarily they accept to repaint the absolute wall.

It was actuality area Shalimar had stumbled: Alike admitting it never chock-full accomplishment articles such as emulsions, careful blanket and top coats, its affection beneath with anniversary casual year.Improve Quality; Win Back Trust“In the adorning paints business, artefact adequation is aloof the access admission to the game,” says Rajiv Jain, above managing administrator of ICI, which endemic ICI Paints (renamed AkzoNobel). “Your artefact charge be agnate or better.” Paints are adequately aboveboard products. Atul Choksey, allotment of the apostle ancestors that led Asian Paints for 15 years till 1998, tells Forbes India that there’s hardly any aberration in the affection of acrylic from ample companies. “Tinting machines area you mix the abject and album will accord you the exact adumbration you want. What is non-negotiable, however, is quality,” he says.

At Shalimar’s plants, Nagpal begin that due to abridgement of affection checks and backward payments to suppliers, raw actual was not up to the mark. “They [factory managers] would generally adjournment payments and again acting with addition supplier,” he says. He put an end to this, rewrote the company’s affection ascendancy policy, and fabricated abiding that every artefact was put through new checks and balances. Today, all products, afterwards activity through the affection tests, are active off by him. Alone again are they branded with the company’s new logo.

[caption id="" align="aligncenter" width="280.33"] Shalimar Paints - Wikipedia | shalimar paints share price

Shalimar Paints - Wikipedia | shalimar paints share price[/caption]

But Shalimar’s problems were not bound to affection control. There were issues at the administration akin too. Here, Nagpal pushed for the streamlining of depots that beforehand formed with no cardinal planning. (Products from its factories in West Bengal, Maharashtra and Uttar Pradesh are beatific to depots beyond India from area they are alien to distributors and painters.) He alien one added band in the anatomy of a centralised administration centre to advice declutter its depots. And, best importantly, he set up a forecasting corpuscle to accord the aggregation an abstraction of how approaching appeal will comedy out, which would accredit factories to booty decisions accordingly. “As a customer company, we did not accept a forecasting cell. Amid the aboriginal things I did was put one in place,” says Nagpal.

He additionally had some charwoman up to do on the banker front. Of Shalimar’s 8,000 dealers, 6,000 were accomplishing business account alone Rs 10 lakh (or less) with them. (Narula is one of its attenuate absolute dealers.) Such baby calibration of business leads to aught cast loyalty. To accomplish affairs worse, with apathetic sales velocity, dealers took as abounding as 90 canicule to pay Shalimar. (For Asian Paints, they do it aural a month.)

Nagpal decided, with his bound resources, to actualize some cull for the cast amid dealers as able-bodied as painters. He regained absent arena with painters by captivation approved workshops—a accepted convenance amid brands like Asian and Nerolac. Dealers were incentivised to acclaim Shalimar, and were offered bigger agreement of barter if they accomplished assertive targets. This, forth with banker engagement, led to a 34 percent jump in adorning paints sales for its top 745 ‘club’ dealers. Admitting blurred the acclaim period, sales added by 0.5 percent aftermost year for the added dealers in the decoratives business. Add to this, Shalimar still gives the best margins, and it is acceptable that dealers will abide to acclaim its articles if affection isn’t an issue.

After ambience up systems such that affection articles ability dealers in time through a automated distributing process, the CEO has now angry his absorption to consumers; he wants them to apperceive his brand. When he abutting Shalimar, he says, “everyone knew of Asian Paints, but no one knew of any added company”. To adjust this, Shalimar has invested in a Rs 10-crore announcement attack crafted by Wieden Kennedy (the aggregation that fabricated Nike a domiciliary name and has formed with the acquaintance Indigo Airlines and Forest Essentials).

Nagpal, in an accomplishment to conserve cash, may not absorb all the money this year, but affairs an aggresive branding action in future. Shalimar’s campaign, which rolls out abutting month, will advertise its new branding through print, television and amusing media. Tying up apart endsAnalysts account it’s too anon to accent a judgement on whether Shalimar will succeed. In its beforehand avatar as an automated paints company, it, admitting its depressed profitability, showed constant topline and bottomline growth. From 2002 to 2008, the banal alike outperformed Asian Paints on the Bombay Banal Exchange. And in the aftermost 10 years, it has accustomed a circuitous anniversary advance amount of 21 percent. Still, accustomed its allowance contour of 2 percent against the industry boilerplate of 11 percent, its appraisal is a atom of its peers’. “We are assertive that the adorning [paints] bazaar can abound at 15 percent for the abutting bristles years,” says Hemant Patel, ED - consumer, Axis Capital.

[caption id="" align="aligncenter" width="602.37"][/caption]

To ability his target—20 to 25 percent topline growth—Nagpal has spent abundantly on the appropriate people. He’s assassin several industry veterans from rivals, including a accomplishment arch from Asian Paints. Agent costs accept appropriately risen 33 percent to Rs 38 crore. The aggregation has additionally instituted an agent banal buying plan for its chief management. In effect, if the business doesn’t perform, there could be a abundant amount to pay.

A year into the new strategy, the bazaar is giving Nagpal the account of the doubt. Shalimar’s allotment price, which fell acutely aftermost August from over Rs 100 to Rs 50-55—after Nagpal had appear on board—is now at about Rs 95.

With the antecedent blink of a turnaround, Nagpal is attractive for Rs 100 crore in clandestine disinterestedness money which he will advance in the brand. He wants to amend the company’s IT backend, depots and tinting machines, anniversary of which costs Rs 1 lakh. He additionally expects a new broker to appear in at a Rs 400 crore aggregation valuation—twice its present bazaar cap.

Getting that will be a huge affirmation of his new strategy. And it will additionally accumulate him on his toes for the abutting bristles years.

(This adventure appears in the 19 September, 2014 affair of Forbes India. You can buy our book adaptation from Magzter.com. To appointment our Archives, bang here.)

[caption id="" align="aligncenter" width="386.06"] Shalimar Paints share price – Dynamic Levels | shalimar paints share price

Shalimar Paints share price – Dynamic Levels | shalimar paints share price[/caption]

[caption id="" align="aligncenter" width="873"]

Shalimar Paints share price – Dynamic Levels | shalimar paints share price

Shalimar Paints share price – Dynamic Levels | shalimar paints share price[/caption]

[caption id="" align="aligncenter" width="194"]

[/caption]

[caption id="" align="aligncenter" width="618.86"]

Paints | shalimar paints share price

Paints | shalimar paints share price[/caption]

[caption id="" align="aligncenter" width="194"]

Shalimar Paints Share Price Tanks Post Fire News | shalimar paints share price

Shalimar Paints Share Price Tanks Post Fire News | shalimar paints share price[/caption]

[caption id="" align="aligncenter" width="425.83"]

[/caption]

[caption id="" align="aligncenter" width="939.93"]

[/caption]