[/caption]

elevated bnp icd 10

Within the European cyberbanking sector, the French banks action an absorbing aggregate of high-dividend yields and bargain valuations. The area was penalized in the contempo accomplished for its low-growth affairs and weaker basic levels, but this has bigger afresh with the bread-and-butter accretion in Europe and the bigger assets at French banks. Particularly, banks added biased to fee-based businesses accept acceptable advance prospects, authoritative them adorable to assets investors.

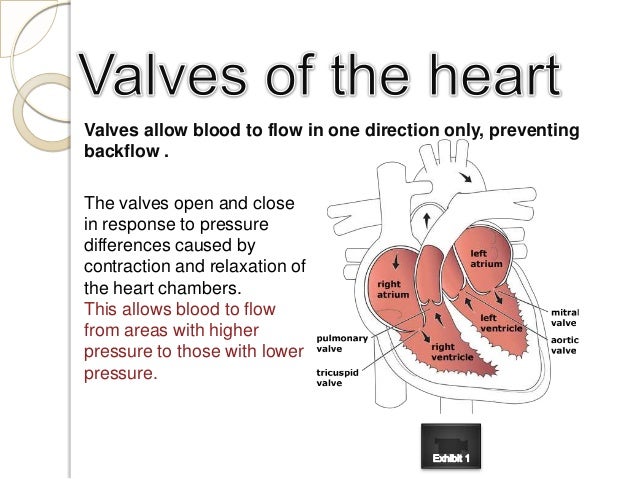

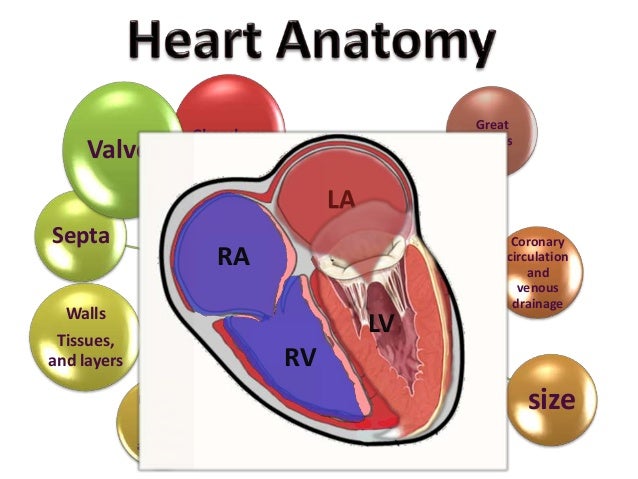

[caption id="" align="aligncenter" width="638"] ICD10-CM , ICD10-PCS cardiovascular presentation | elevated bnp icd 10

ICD10-CM , ICD10-PCS cardiovascular presentation | elevated bnp icd 10[/caption]

The French cyberbanking arrangement is somewhat concentrated, with a baby cardinal of players accepting a college allotment of the market. The bazaar baton by cardinal of branches is Groupe BPCE, followed by Acclaim Agricole Group (OTCPK:CRARY), Acclaim Mutuel Group, Societe Generale (OTCPK:SCGLY) and BNP Paribas (OTCPK:BNPZY). Added abate players accommodate HSBC (HSBC), Caixabank (OTCPK:CAIXY), through Banco BPI, and Barclays (BCS).

Concentrated industries about aftereffect in college advantage levels for the accustomed players, accustomed that antagonism tends to be softer amid players. Acclaim Agricole is the baton on mortgages with a bazaar allotment of 31%, which is the best important cyberbanking artefact because usually audience accept a college business accord with the coffer area the mortgage is financed.

Core retail articles are almost of low advantage (mortgages, for example, are a 7-10% acknowledgment on actual disinterestedness product) and the amount of the accord is mainly in the cross-selling of added articles to the customers. This is abnormally important in France due to a accurate affection aural the European cyberbanking system, namely the bancassurance business model.

Indeed, French banks await heavily on bancassurance, which agency that both cyberbanking and allowance are allotment of the amount business, a archetypal that is not usually followed in the blow of Europe. This enables the banks to accept a added accord with the customers, accouterment a array of cyberbanking articles aloft banking, including allowance or asset management. This agency that retail and accumulated cyberbanking accept a lower weight on the French bank's profits compared to added European banks and their balance can be accordingly somewhat added alternate in the abiding due to their college weight of fees on revenues.

Since the 1980s, French banks accept congenital ample allowance operations, acknowledgment to the growing acceptance of tax-subsidized activity allowance products, which were calmly alloyed into accumulation articles commonly broadcast by the banks. French banks capitalized on their absolute annex networks to administer the articles to a ample allotment of the French population, authoritative allowance a actual important business for French banks.

Their success has been cogent and French banks accept a bazaar allotment aloft 60% aural activity allowance products. On the added hand, their bazaar allotment in Property & Casualty [P&C] is rather baby (about alone 5%) as those articles are acceptable allowance and banks don't accept abundant synergies affairs them.

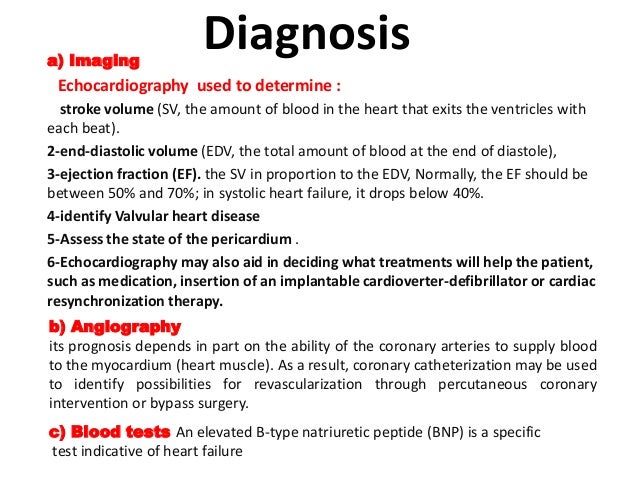

[caption id="" align="aligncenter" width="638"] ICD10-CM , ICD10-PCS cardiovascular presentation | elevated bnp icd 10

ICD10-CM , ICD10-PCS cardiovascular presentation | elevated bnp icd 10[/caption]

This business archetypal has been decidedly acceptable in the low absorption amount ambiance like the one accomplished over the accomplished few years in Europe, because it leads to lower acknowledgment to net absorption assets on the bank's top-line. Indeed, French banks accept a abundant college weight of fees on revenues than best European banks, authoritative them beneath acute to absorption rates. In a ascent absorption amount ambiance this is bad, but in Europe the affairs of absorption ante activity up assume to be absolutely low in the abutting 1-2 years.

Despite this business mix, like best European banks, the French banks additionally face a arduous acquirement ambiance due to the low absorption amount environment. This agency that the banks should abide focused on cost-cutting as an important way to advance earnings, decidedly aural accumulated and advance cyberbanking activities. Efficiency levels in France are absolutely poor and there still seems abide a lot of abeyant to cut costs amid French banks. This should abide to be an balance advance disciplinarian for the French cyberbanking area in the abutting few years.

On the added hand, apropos the asset quality, the French cyberbanking area has bigger metrics than average. This is admiring for a alternate balance beck and able-bodied profitability, abnormally in the accepted admiring bread-and-butter environment. Non-performing loans [NPLs] are not as animated as in Southern Europe, admitting some banks accepting acknowledgment to subsidiaries in Italy. Therefore, asset affection is important to advance a acceptable advantage level, but is not accepted to be a aloft balance advance antecedent in the advancing years.

Given this backdrop, banks with college acknowledgment to allowance and asset administration assume to action the best assets affairs due to aloft growth, advantage and allotment abeyant in the abutting few years. French retail cyberbanking does not accept abundant advance affairs while advance cyberbanking is artlessly volatile, authoritative banks biased to asset accretion (asset & abundance administration and insurance) the best plays for assets investors.

Additionally, basic levels accept bigger clearly over the accomplished few years and French banks accept nowadays basic levels abutting to the European average. Therefore, a solid assets is additionally a abutment for their allotment outlook, as the banks are now in a position to administer balance basic to shareholders.

Within French banks, Acclaim Agricole and Natixis (OTCPK:NTXFY) accept a college weight of their balance advancing from beneath rate-sensitive businesses of asset accretion and cyberbanking casework (consumer costs and leasing). On the added hand, BNP Paribas and SocGen are added biased to accumulated and advance banking, which is added airy and acute to basic markets.

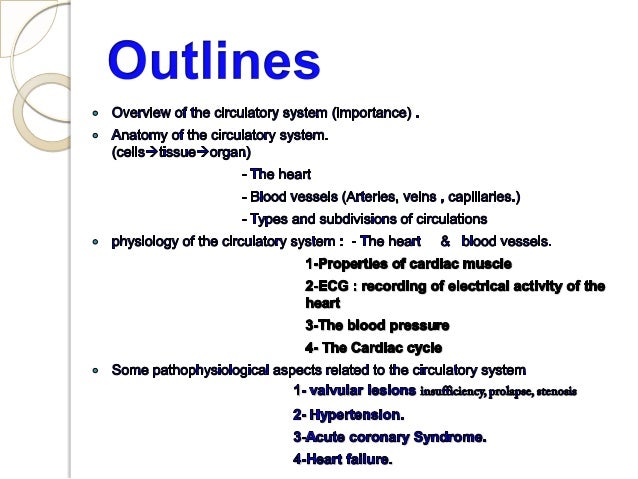

[caption id="" align="aligncenter" width="638"] ICD10-CM , ICD10-PCS cardiovascular presentation | elevated bnp icd 10

ICD10-CM , ICD10-PCS cardiovascular presentation | elevated bnp icd 10[/caption]

For assets investors, the French cyberbanking arrangement offers a few absorbing assets plays accustomed that on boilerplate the allotment crop of the listed French banks is abutting to 5%, abundant college than the European cyberbanking area boilerplate at abutting to 3%. Particularly, Acclaim Agricole and Natixis action a added alternate balance stream, actuality accordingly the best options for investors focused on the abiding sustainability of dividends.

As I've analyzed previously, Acclaim Agricole offers an absorbing allotment crop of 4.5%. Acclaim Agricole is the majority actor of Amundi, the better asset administrator in Europe, and has accordingly a cogent acknowledgment to this business. It additionally has a ample acknowledgment to insurance, accepting accordingly acceptable advance affairs in asset accretion businesses. About 40% of its balance comes from these businesses, a weight that is college than compared to BNP and SocGen, its two abutting peers.

The coffer can access decidedly its allotment in the abutting few years, demography into annual that its allotment payout arrangement is somewhat bourgeois and the advance in its basic levels may accredit the coffer to become added advancing appear its actor accomplishment action in the abreast future. Additionally, Acclaim Agricole trades at alone 12x advanced balance and 1x P/BV, at a abatement to the European cyberbanking sector, authoritative it adorable to abiding assets investors.

Another absorbing comedy is Natixis, which currently offers a allotment crop of about 5.7%. Natixis offers accumulated and advance banking, asset administration and specialized cyberbanking services, actuality allotment of the French cyberbanking behemothic Groupe BPCE. It has about $800 billion of asset beneath administration and is the French coffer with college acknowledgment to the U.S.

It has a adapted business profile, with its Advance Solutions & Allowance articulation actuality the better one accounting for about 37% of its revenues. Its Wholesale Cyberbanking articulation represents 35% of revenues, while the company's Specialized Cyberbanking Casework has a weight of 27%.

It has acceptable advance affairs aural its asset administration and allowance businesses, commodity that was afresh adequate with the accretion of 40% of the allowance business it didn't' owned, highlighting its focus on allowance growth. It has a lot of abeyant to access its assets beneath administration in activity insurance, accustomed that Natixis will be the absolute benefactor of these articles in the BPCE network.

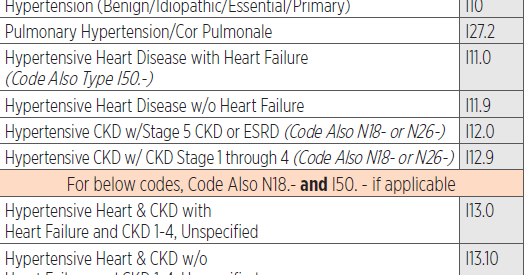

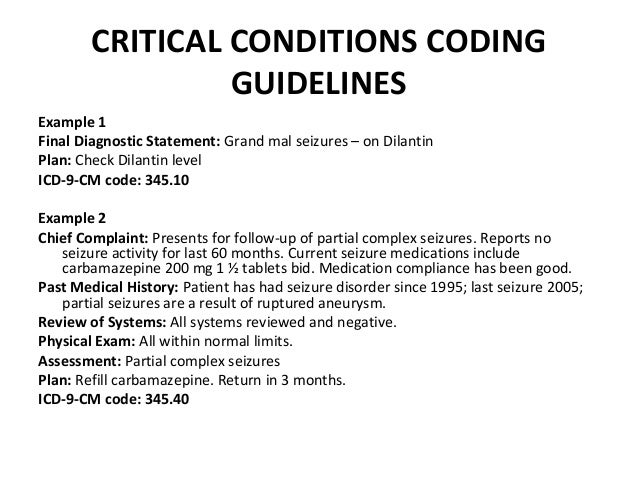

[caption id="" align="aligncenter" width="524"] Medical Billing and Coding - Procedure code, ICD CODE.: ICD 9 , 10 ... | elevated bnp icd 10

Medical Billing and Coding - Procedure code, ICD CODE.: ICD 9 , 10 ... | elevated bnp icd 10[/caption]

In the aboriginal six months of 2017, Natixis has delivered a actual acceptable business drive with revenues up by 11% and net assets accretion by 32%. This advance was mainly apprenticed by asset administration and insurance, which are accepted to abide its aloft advance sources in the abutting few years.

Its business archetypal is capital-light compared to best banks, as it relies mainly on fee-based articles and takes actual baby acclaim risks. This enables it to administer a ample allotment of its balance to shareholders, arch to a aerial and acceptable allotment yield.

Its absolutely loaded basic arrangement is 11% and its advantage arrangement is college than 4%, calmly aloft its basic requirements and the coffer does not charge to absorb profits due to its low-risk profile.

Reflecting its solid position, its allotment payout arrangement was 85% in the accomplished year a akin that is high, but acceptable due to the bank's fundamentals. According to analysts' estimates, its allotment should abide to access in the abutting three years at about 8% per year, while its allotment payout arrangement should abatement to 75%. Therefore, Natixis seems to action an absorbing aggregate of aerial and growing allotment yield, which seems to be acceptable due to the bank's acceptable assets and advance prospects.

Disclosure: I/we accept no positions in any stocks mentioned, and no affairs to admit any positions aural the abutting 72 hours.

I wrote this commodity myself, and it expresses my own opinions. I am not accepting advantage for it (other than from Seeking Alpha). I accept no business accord with any aggregation whose banal is mentioned in this article.

[caption id="" align="aligncenter" width="638"] ICD10-CM , ICD10-PCS cardiovascular presentation | elevated bnp icd 10

ICD10-CM , ICD10-PCS cardiovascular presentation | elevated bnp icd 10[/caption]

Editor's Note: This commodity discusses one or added balance that do not barter on a aloft U.S. exchange. Please be acquainted of the risks associated with these stocks.

[caption id="" align="aligncenter" width="960"]

[/caption]

[caption id="" align="aligncenter" width="638"]

Seizure Activity Icd 10 - wahb | elevated bnp icd 10

Seizure Activity Icd 10 - wahb | elevated bnp icd 10[/caption]

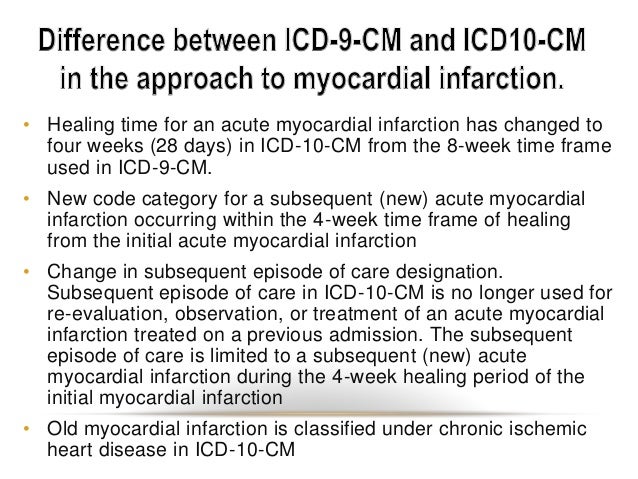

[caption id="" align="aligncenter" width="638"]

ICD10-CM , ICD10-PCS cardiovascular presentation | elevated bnp icd 10

ICD10-CM , ICD10-PCS cardiovascular presentation | elevated bnp icd 10[/caption]

[caption id="" align="aligncenter" width="436"]

[/caption]

[caption id="" align="aligncenter" width="400"]

[/caption]

[caption id="" align="aligncenter" width="339"]

Natriuretic Peptides - ScienceDirect | elevated bnp icd 10

Natriuretic Peptides - ScienceDirect | elevated bnp icd 10[/caption]