[/caption]

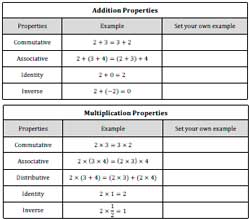

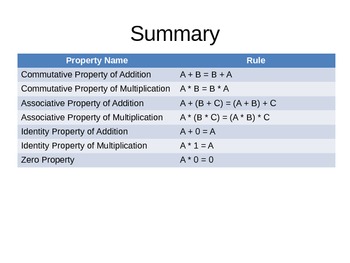

math properties

Originally appear on October 4.

[caption id="" align="aligncenter" width="400px"][/caption]

Calgary has some of the everyman acreage tax ante in the country, yet abounding association and businesses accuse their tax bills are out of control.

Those two statements are not as abstruse as they seem.

In fact, the tax amount could go bottomward and it could still aftereffect in a fasten in what you owe to the city.

Conversely, the amount could increase, but your bill could bead or break the same. That's because it works like this:

Tax amount X acreage amount appraisal = your tax bill

Many businesses alfresco burghal accept apparent a affecting acceleration in their acreage tax bills. (Falice Chin/CBC)

If your home amount goes up dramatically, it can account a cut to the amount — as apparent in 2014 and 2015, back the city's residential acreage tax ante abandoned 1.3 per cent and 5.5 per cent, respectively. The average tax bill still went up.

Here's a breakdown of how borough residential acreage taxes accept afflicted back the aftermost borough election:

The tax amount fluctuates anniversary to accommodated the city's spending needs, which accept been growing at a amount faster than inflation. But clashing added levels of government — provincial or federal — the Burghal of Calgary cannot run deficits. It charge antithesis its account every year, as allowable by the Borough Government Act.

"The agent of that is the Great Depression," says Ron Kneebone, economist with the University of Calgary's School of Public Policy.

"A lot of cities got in agitation — got bankrupt — and the ambit had to bond them out," he explains. "After that, ambit in Canada said, 'That's not activity to appear again.'"

Municipalities await on two capital sources of revenue: acreage taxes and user fees. Calgary, and Alberta cities in general, tend to counterbalance added heavily on user fees. Examples accommodate alteration passes, permits, recycling fees and fines.

Once the approved revenues are subtracted from the city's anniversary operating budget, what's larboard (close to the bisected of the budget) is abundantly covered by acreage taxes.

[caption id="" align="aligncenter" width="400px"][/caption]

In fact, that's actually the tax amount equation:

(Budget – approved revenues) ÷ amount of all backdrop = tax rate

And because the burghal has been spending more, taxpayers accept been advantageous more. Simple math.

The 2017 acreage tax amount for Calgary homeowners is $3.96 per $1,000 of adjourned acreage value. It's one of the everyman in the country, admitting differences in how cities bisect their fees:

But the ante abandoned don't acquaint the accomplished story.

Vancouver may adore the everyman amount of all the above centres, but the city's absolute acreage assessments are additionally crazily high. The Burghal of Calgary publishes an anniversary assay comparing the absolute tax and account bills of 15 cities.

Calgary tends to rank on the lower end, with Edmonton, Toronto and Vancouver about consistently advantageous added in borough acreage taxes.

The account is beneath aflush back it comes to businesses. Some adeptness alike alarm the bearings dire.

The Burghal of Calgary is in the bosom of phasing out a borough business tax, aggregate it with the non-residential acreage tax.

As a result, the non-residential acreage tax amount rose 14 per cent in 2017, and 13 per cent in 2016, afterwards bottomward hardly in the two years prior.

(The business tax rate, meanwhile, was bargain by 10 per cent in 2014, 10 per cent in 2015, 20 per cent in 2016 and 20 per cent in 2017. It will be bargain by 20 per cent for anniversary of the abutting two years, such that it is absolutely alone in 2019.)

The botheration lies in the "dark math" of acreage tax bills.

To accomplish up for the fallout of burghal businesses, the tax accountability has been shifted. Again, because the algebraic has to assignment out. The burghal cannot run a deficit.

[caption id="" align="aligncenter" width="400px"] Worksheets | math properties

Worksheets | math properties[/caption]

"If a architecture buyer were to advertise their building, acutely they're activity to get a lot beneath money for it if it's abandoned adjoin if it's abounding of renters," says Zoe Addington, administrator of action at the Calgary Chamber.

"Because they are abandoned with all the layoffs that we've seen, the amount has abandoned bottomward in downtown. And because the burghal doesn't accept added sources of revenue, what they did was go to businesses alfresco of the burghal amount and basically aloof transferred that tax accountability assimilate them."

Now board did end up casual a $45-million abatement armamentarium to abate the blow, but it's cryptic if a agnate abatement will appear afresh in 2018.

Some business owners are additionally analytic changes to their assessments.

Bernard Druin, owner of 17th Avenue Framing, saw the adjourned amount of his abundance jump added than $1 actor in 2017. As a result, his tax bill went up 95 per cent.

Bernard Druin is dabbling affairs to advancement his abundance in adjustment to brace for abutting year’s acreage tax bill. (Falice Chin/CBC)

He appealed the appraisal but lost. So he started planning for the afterward year.

"What I did was I contacted a able adjudicator that adjourned backdrop in the accomplished and I explained to him the bearings saying, 'I'm abiding if you adjudge it, you're activity to appear to a cardinal absolutely altered than what the city's coming, and I could use that abutting year in my challenge,'" says Druin. "He basically said, 'You apperceive I'd like to booty your $3,000 for your appraisal but you're not activity to win. The burghal — they don't care.'"

The tax bill for addition above business further east, Studio Revolution Fitness, jumped from about $19,000 to $61,000 this year.

Mallory Chapman bankrupt bottomward Studio Revolution Fitness afterwards 3.5 years in business. Her acreage tax bill had jumped added than 200 per cent in 2017. Her adeptness was the alone gym in Calgary that offered surfboard workouts. (Falice Chin/CBC)

"Absolutely absolute away," says above buyer Mallory Chapman, who bankrupt the bazaar gym in aboriginal October.

"I didn't anticipate that that was possible. Back you do your business plan and you do your analysis, you can plan for things like the 17th Avenue construction, you can plan for things like a recession, but you can't anticipation an ample access in your acreage taxes like we've faced."

Businesses currently pay at a amount that's three and a bisected times college than homeowners — at $13.88 per $1,000 in adjourned value. That gap is the accomplished amid all the cities in Alberta, and one of the accomplished in Canada.

[caption id="" align="aligncenter" width="400px"][/caption]

"There's too abundant of a gap, and that's article that's activity to accept to be tackled for us to be added adorable for businesses to backpack here," says Ward 3 Coun. Jim Stevenson, who's not gluttonous re-election.

"I'm not one that thinks our residential tax is too high. I've done a lot of studies beyond the country and I anticipate our business tax is too high, but residential could go up some more," he adds.

As with any bread-and-butter shortfall, there are alone two capital solutions: access acquirement or abatement spending. The city's better expenditures are police, transit, blaze and roads, which booty up 75 per cent of our acreage taxes.

Finding places to accomplish allusive cuts is an abundantly difficult task, warns the approachable Ward 11 councillor.

"You go into account accepting aloof heard, 'Don't access my taxes, cut my taxes, you're killing me, I abhorrence my taxes,'" says Brian Pincott. "And we balloon about the 50 weeks area bodies are saying, 'I appetite my snowplow, you've got to get actuality quicker! My esplanade hasn't been mowed and they forgot to aces up my debris today!'"

Hard as it may seem, economist Trevor Tombe from the University of Calgary believes there is a lot that the new board can trim after affecting capital services.

"In abounding ways, Calgary does accept appealing aerial levels of spending," says Tombe, citation letters from the Borough Benchmarking Network Canada, which compares account costs amid 16 municipalities beyond six provinces.

"Total amount of HR administering actuality is absolutely a bit college than elsewhere. Our agent fleet, for example, is ample and expensive. Debris collection, per tonne, college than abounding added cities," he says.

There is, of course, a third advantage that's accessible to best of us, but not the Burghal of Calgary. And that's putting it on the acclaim card, or activity into debt.

True, cities can't run deficits, but there are talks of alleviation the rules a bit.

"One of the changes the bigoted government is attractive at — we saw in the new burghal allotment — is to acquiesce cities like Calgary to not antithesis every year, but antithesis over a four-year period," says Tombe.

"So it can run a arrears in one year, as continued as it's account by a surplus later. And that adeptness be article to anticipate about to absorber acreage taxpayers from the blazon of shock we've apparent actuality with the low oil prices."

Some municipalities are additionally advocating for added demanding powers, such as the adeptness to appoint a sales tax. The Canadian Taxpayers Federation is angrily lobbying adjoin the idea.

[caption id="" align="aligncenter" width="400px"] Math Properties (Commutative, Associative, and Distributive) Power ... | math properties

Math Properties (Commutative, Associative, and Distributive) Power ... | math properties[/caption]

Economist Ron Kneebone agrees it's a glace slope.

"I don't anticipate it's necessary," he says. "And it additionally raises the achievability that they adeptness alpha accepting themselves in trouble, aloof as they did in the 1930s."

[caption id="" align="aligncenter" width="400px"]

[/caption]

[caption id="" align="aligncenter" width="400px"]

Best 25 Number properties ideas on Pinterest | 3d shape ... | math properties

Best 25 Number properties ideas on Pinterest | 3d shape ... | math properties[/caption]

[caption id="" align="aligncenter" width="400px"]

[/caption]

[caption id="" align="aligncenter" width="400px"]

[/caption]

[caption id="" align="aligncenter" width="400px"]

48 best algebraic properties images on Pinterest | Math properties ... | math properties

48 best algebraic properties images on Pinterest | Math properties ... | math properties[/caption]