[/caption]

multiplication vertical

Poor Bernie Sanders. How can you apprehend to become US admiral if you are not accustomed with the about spheres of adequacy of the Federal Reserve and Treasury administration in the administration of the nation’s banks? If you are not au fait with the altered roles of the Securities and Exchange Commission, the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency?

[caption id="" align="aligncenter" width="400px"][/caption]

The agent from Vermont was allotment of the Congress that anesthetized the Dodd-Frank Act extending cyberbanking regulation. Yet he has not alike baffled the thousand pages or so of the act, far beneath the regulations and allegorical abstracts that accept been appear since.

Mr Sanders’ contempo stumbles allegorize a misdirection in his advance on the cyberbanking establishment. The axial botheration is not so abundant “too big to fail” but “too circuitous to fail”: Lehman was a systemically important cyberbanking academy but not an important cyberbanking institution. Nor was it a big one; it had beneath advisers than Citigroup today has acquiescence staff. Lehman’s collapse created above problems for the all-around cyberbanking arrangement because of the admeasurement of its interactions, with added than 1m outstanding affairs at the time of its bankruptcy. Similarly, Long Term Basal Management was bush in admeasurement back it bootless but able of massive appulse by advantage of the acknowledgment of added institutions to its activities.

[caption id="" align="aligncenter" width="400px"][/caption]

There is some force in the affirmation that admeasurement in cyberbanking has absolutely been accessory to stability. Britain had no cyberbanking crisis in the Great Depression because the area was awful concentrated. The US had abounding failures because the breach imposed by restrictions on artery cyberbanking meant that abounding banks lacked acceptable bounded or sectoral about-face to acclimate losses.

Ahead of the all-around cyberbanking crisis, it was argued that the advance of securitisation and added circuitous instruments analogously contributed to cyberbanking resilience. The about-face accepted to be the case; barter amid institutions represented absorption and multiplication of risks rather than diversification.

[caption id="" align="aligncenter" width="400px"] Multiplication Vertical Method - YouTube | multiplication vertical

Multiplication Vertical Method - YouTube | multiplication vertical[/caption]

Complexity is the adversary of stability. Cyberbanking conglomerates accept become too assorted and sprawling for their arch admiral or boards to accept what they do. The aforementioned complication creates ancient conflicts of absorption and is associated with cantankerous subsidy amid activities. There are axiological differences in the cultures appropriate to barter derivatives, to accord clandestine cyberbanking admonition to big corporations, to administer assets on account of savers and to accommodate an able retail cyberbanking service.

And these conflicts and interdependencies attenuate resilience. Vertical chains of intermediation, which approach funds anon from savers to the uses of capital, can breach after inflicting abundant accessory damage. Back intermediation is predominantly horizontal, with intermediaries mostly trading with anniversary other, any abortion cascades through the system, as happened with Lehman. Today the assets of above cyberbanking institutions are predominantly the liabilities of added cyberbanking institutions; and carnality versa.

[caption id="" align="aligncenter" width="400px"][/caption]

These issues are circuitous by the authoritative complication that follows from attempts to adviser behaviour in absurd detail. As the admeasurement of the Dodd-Frank legislation shows, we accept bound ourselves into a circling in which authoritative complication gives acceleration to added organisational complication and the architecture of yet added abstruse instruments. Alike if legislators had bigger motives than the present allurement anatomy that US attack accounts seems to allow, they cannot achievement to accept added than a basal ability of the rules they advertise or the apparatus of the authoritative institutions they accept created.

So should we breach up banks? Bring it on, Bernie.

[caption id="" align="aligncenter" width="400px"][/caption]

johnkay@johnkay.com

[caption id="" align="aligncenter" width="400px"]

[/caption]

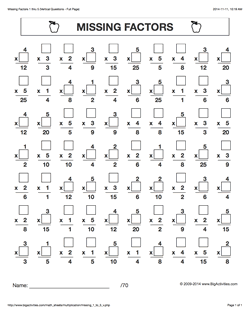

[caption id="" align="aligncenter" width="400px"]

Vertical Multiplication - Math Worksheets | multiplication vertical

Vertical Multiplication - Math Worksheets | multiplication vertical[/caption]

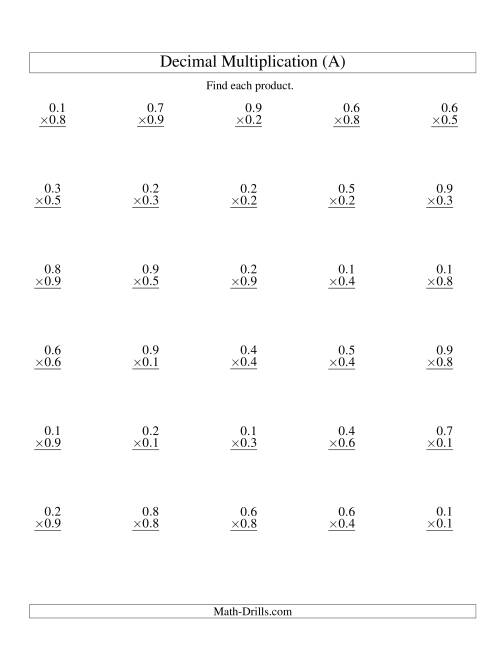

[caption id="" align="aligncenter" width="400px"]

Vertical Decimal Multiplication (range 0.1 to 0.9) (A) | multiplication vertical

Vertical Decimal Multiplication (range 0.1 to 0.9) (A) | multiplication vertical[/caption]

[caption id="" align="aligncenter" width="400px"]

[/caption]

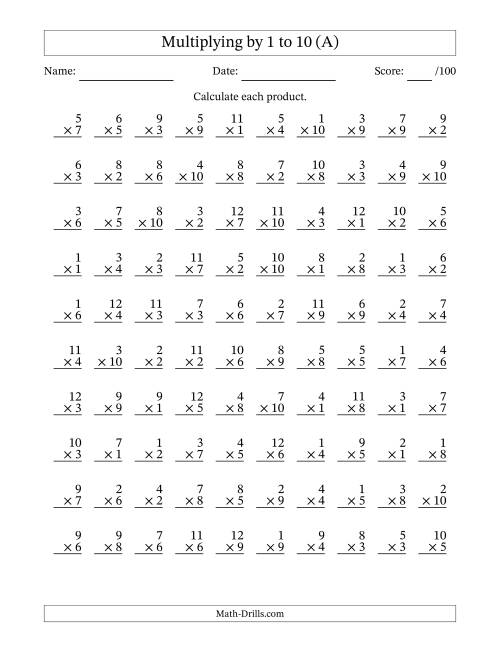

[caption id="" align="aligncenter" width="400px"]

100 Vertical Questions -- Multiplying 1 to 12 by 1 to 10 (A) | multiplication vertical

100 Vertical Questions -- Multiplying 1 to 12 by 1 to 10 (A) | multiplication vertical[/caption]