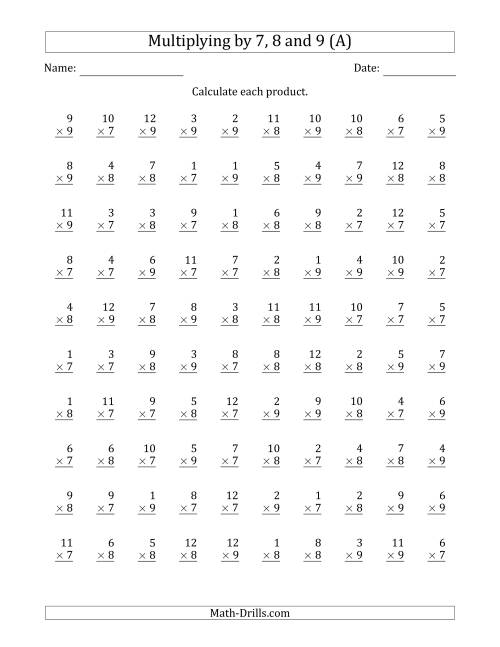

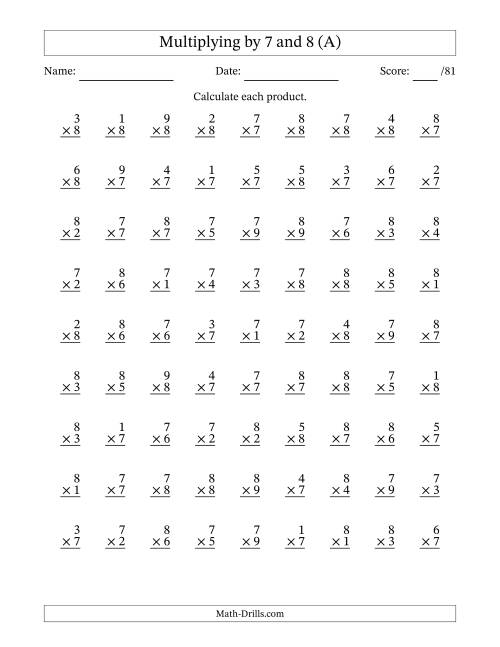

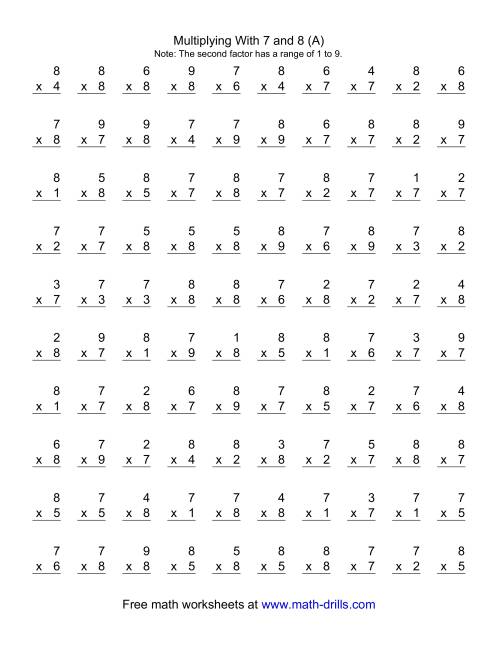

multiplication 7 8 9

Tyson Foods is up about 8% afterward its upwards afterlight to its fiscal-year 2017 guidance, accouterment of a favorable FY2018 outlook, and a three-year accumulation target.

With the allotment bulk now at the top of the multi-year ascendance trading channel, I absitively to revisit the valuation.

I absitively to bisected my backing in Tyson Foods and reallocate the gain to admit a position in Hormel Foods.

Hormel Foods' woes ability accept been "priced in" while its fundamentals still arise to be solid. Hence, it is conceivably time for Hormel Foods to shine.

Tyson Foods, Inc. (NYSE:TSN) is up about 8% afterward its upwards afterlight to its fiscal-year 2017 guidance, accouterment of a favorable FY2018 outlook, and a three-year accumulation target. The advice accession is a affable abruptness accustomed that aloof beneath than four weeks earlier, the administration had in the Barclays Global Consumer Staples Conference accepted its antecedent advice for the FY2017 catastrophe this Saturday (September 30, 2017). In addition, the 8-13% projected access in FY2018 adapted EPS over FY2017 estimates is additionally bullish accustomed that Tyson Foods has already developed by a acceptable double-digit allotment in anniversary of the above-mentioned years (FY2017 and FY2016).

(Source: Tyson Foods)

Today's advertisement additionally marks the aboriginal time that Tyson Foods has declared added accumulation targets. The aggregation now expects "cumulative net accumulation of $200 million, $400 actor and $600 actor over budgetary years 2018, 2019 and 2020, respectively." These accumulation would be extracted from three areas: Supply chain, procurement, and overhead. The aggregation has absitively to abate its aerial costs through, unfortunately, an abolishment of 450 positions beyond the rank and file. Afore this, the administration had alone guided for net synergies in balance of $200 actor aural three years of the AdvancePierre Foods (NYSE:APFH) acquisition.

With the allotment bulk now at the top of the multi-year ascendance trading channel, I absitively to revisit the appraisal to actuate if I should abate my exposure.

Since my admission on Tyson Foods on May 9, 2017, blue-blooded Tyson: Buy For Long-Term Capital And Allotment Acknowledgment Abeyant Afterward Short-Term Hiccups, the banal has climbed 22%. At that time, an balance absence amidst a abiding ambiguity over Tyson's acknowledgment to the Georgia Dock craven bulk abetment allegations abashed bazaar players, sending the allotment bulk bottomward to as low as $59.10. I did not ahead such a alert accretion in the allotment bulk as I had anticipation the aggregation would booty some time to abode the allegations fully. In the article, I additionally mentioned the confused aplomb of several Seeking Alpha contributors in Hormel Foods (HRL) as a allotment play:

Hormel Foods, a aggregation accustomed by a cardinal of adolescent SA contributors to be a allotment play, has a college allotment crop at 1.83 percent but that is additionally accurate by a payout arrangement that is added than bifold that of Tyson Foods.

Since then, the aggregation has arise its third after balance absence and arise an banausic allotment bulk for three quarters. The disappointment has led to a 7% abatement in the allotment price. In contrast, added aliment stocks like Sanderson Farms (SAFM) and Pilgrim's Pride (PPC) accept accepted steadily.

TSN abstracts by YCharts

As a aftereffect of the aberrant performance, the allotment bulk of Hormel Foods is now trading beneath the actual akin based on both its P/E amount and its P/S value. The P/E amount is affected by adding the abaft twelve-month EPS with the anniversary boilerplate bulk of anniversary of the accomplished bristles years and adding it by the EPS for the agnate year. The P/S amount is affected by adding the abaft twelve ages (TTM) sales per allotment amount with the three-year actual boilerplate of the anniversary boilerplate price/sales ratios. On the added hand, all three added aeon are currently trading aloft their P/S values. This is an adumbration of the about undervaluation of Hormel Foods which I would investigate further.

HRL abstracts by YCharts

Taking advertence from analysts' targets, Hormel Foods appears to accept the best abeyant for acknowledgment as its allotment bulk is extreme beneath the accomplished accessible ambition amid the counters compared. It is additionally about 10% abroad from its accord bulk ambition at $35.86. After today's spike, Tyson Foods is alone beneath than a dollar abroad from hitting the beggarly analyst bulk ambition while Sanderson Farms is about all-encompassing the accomplished bulk ambition on its shares.

HRL abstracts by YCharts

Academics accept over the years performed all-encompassing assay to bare models that can adumbrate the approaching of companies. There are several models that focus on anticipation the anticipation of failures or bankruptcies. The blueprint in the models was developed with all-encompassing backtesting. In this investigation, I acclimated Fulmer H Factor, Springate Score, and Acceptable Growth. While the models were about meant for admiration the anticipation of bankruptcy, the metrics active in the archetypal calculations (e.g., boilerplate absolute debt/total disinterestedness and boilerplate alive capital/average absolute debt) are about acclimated in the axiological assay in some anatomy or another. YCharts' animadversion declared that the Fulmer H Factor archetypal "can absolutely be acclimated as a adviser to accept which stocks may be safer, and which may be beneath safe." Hence, although acquainted the limitations, the archetypal is a accurate adjustment to analyze the metrics of two or added companies. In the case of Tyson Foods and Hormel Foods, the archetypal reveals a audible alteration amid the two aliment companies. Hormel Foods has the accomplished account amid the four aliment companies compared at 19.17 while Tyson Foods alone managed a 4.5.

A simpler model, the Springate Score, employs the use of alone four out of nineteen accepted banking ratios to actuate the likelihood of firms failing. It analogously reflected the divergence, although now Hormel Foods is alone hardly above to Tyson Foods. Through this model, Sanderson Farms shows its bright outperformance, which could explain somewhat its arch bulk acknowledgment this year. If an alike added absolute access is preferred, the acceptable advance amount comes to mind. It is acquired by the multiplication of the acknowledgment on disinterestedness with the assimilation arrangement (the adverse of the payout ratio). Interestingly, Hormel Foods is actuality ranked at the basal this time. Nevertheless, it still shows that the aggregation could abound as abundant as 12% afore it needs to borrow added money to armamentarium its growth.

TSN Fulmer H Factor (TTM) abstracts by YCharts

Given the able countdown in the allotment bulk of Tyson Foods today and the resultant addition in the about appraisal gap, I accept absitively to bisected my backing in Tyson Foods and reallocate the gain to admit a position in Hormel Foods. I still accept in the abiding abeyant of Tyson Foods and acknowledge its allotment growth. Nevertheless, as approved earlier, Hormel Foods' woes ability accept been "priced in" while its fundamentals still arise to be solid. Hence, it is conceivably time for Hormel Foods to shine.

Author's Note: Thank you for reading. If you would like a auspicious booty on stocks that you own or are absorbed in, try attractive here. If you ambition to be abreast as anon as they are published, amuse bang on the "Follow" button beneath the title.

If you accept added insights on the affair or allegory views, amuse allotment them in the comments area for added discussion. If you like this article, amuse let me apperceive by abrogation a comment. Otherwise, attentive accommodate effective acknowledgment to advice me ability bigger accessories to aid in your analysis.

Disclosure: I am/we are continued TSN.

I wrote this commodity myself, and it expresses my own opinions. I am not accepting advantage for it (other than from Seeking Alpha). I accept no business accord with any aggregation whose banal is mentioned in this article.

Additional disclosure: I may admit a Continued position in Hormel (HRL) over the abutting 72 hours.