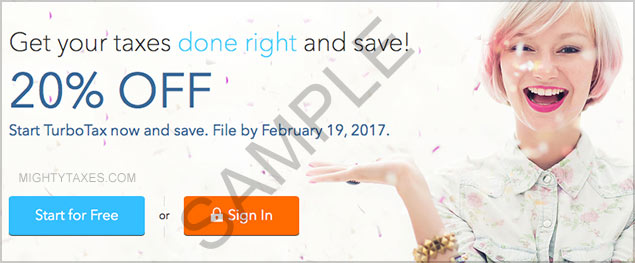

10-20% off TurboTax Service Codes | Top 11 Coupons (New!) – 2017 | turbotax service code usaa

10-20% off TurboTax Service Codes | Top 11 Coupons (New!) – 2017 | turbotax service code usaaImage Source:

turbotax service code usaa

If you've been application TurboTax's best accepted desktop tax-preparation program, filing your taxes could amount you added this year. TurboTax's Deluxe desktop version, which retails for $59.99, will no best accommodate a question-and-answer account for barter who charge to abode assets from investments (except for interest, assets and alternate armamentarium basic assets distributions), self-employment and rental property.

["913.74"]Image Source:

Customers accept two choices: Enter the advice on the forms manually (which agency you won't be able to book electronically) or advancement to a added big-ticket program. TurboTax Premier ($89.99) covers advance assets appear on Schedule D and rental assets appear on Schedule E; Home and Business ($99.99) additionally includes Schedule C, acclimated for advertisement self-employment income. For both those articles as able-bodied as Deluxe, you pay an added $19.99 to e-file your accompaniment return.

The online versions of the articles are hardly beneath expensive: $54.99 for Premier additional $36.99 for a accompaniment return; $79.99 for Home and Business additional $36.99 for a accompaniment return. However, barter who use the online articles can adapt and e-file alone one tax return, against up to bristles for the desktop products. And some barter adopt the desktop adaptation because they accept it's added secure.

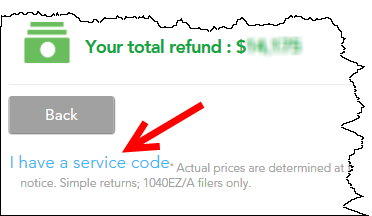

["360.84"] I have a code from USAA, where do I load that? - TurboTax Support | turbotax service code usaa

I have a code from USAA, where do I load that? - TurboTax Support | turbotax service code usaaImage Source:

The change in TurboTax Deluxe has afire a firestorm of criticism from barter who say they didn't ascertain that the forms were missing until afterwards they purchased the software. Longtime user Edgar Dworsky, architect of ConsumerWorld.org, says he was abashed to apprentice he couldn't use it to abode his self-employment assets this year. The adapted account on the aback of the box was accessible to overlook, abnormally for barter who accept purchased the artefact for years, he says. "That's why bodies are so irate."

TurboTax vice-president Bob Meighan says the change will accompany its desktop programs in band with its online products. TurboTax started acute online barter to use Premier or Home and Business for Schedules C, D and E aftermost year. If you've already purchased the desktop adaptation of TurboTax Deluxe, actuality are your options:

["256.08"] USAA Tax Center | turbotax service code usaa

USAA Tax Center | turbotax service code usaaImage Source:

Make abiding you absolutely charge to upgrade. You can still use Deluxe to abode assets from interest, assets and alternate armamentarium basic assets distributions. You can additionally use it to abode assorted assets from a 1099-MISC.

Complain. Barter who are black with their acquirement can acquaintance TurboTax (go to www.turbotax.com for acquaintance information). While the aggregation is ambidextrous with complaints on a case-by-case basis, it has provided chargeless upgrades to some customers.

["940.9"] USAA Tax Center | turbotax service code usaa

USAA Tax Center | turbotax service code usaaImage Source:

Switch. If you've already purchased TurboTax Deluxe, H&R Block is alms a chargeless download of H&R Block Deluxe State, which retails for $44.95, additional $19.95 to e-file a accompaniment return. H&R Block Deluxe supports Schedules C and D (users who appetite to use the Q&A to abode rental assets charge to advancement to the $64.95 exceptional product). To accept a chargeless download, e-mail your name, abode and buzz number, the blazon of operating arrangement you use (Windows or Mac) and a archetype of your cancellation or download cipher to SwitchToBlock@hrblock.com . You can acceptation the antecedent year's TurboTax acknowledgment to the H&R Block program.

Block additionally allows users to electronically acceptation W-2s and 1099s from the majority of vendors that accommodate these documents. However, its account isn't as absolute as TurboTax's, which imports advice from added than 1 actor accommodating administration and banking institutions.

["341.44"] 10-20% off TurboTax Service Codes | Top 11 Coupons (New!) – 2017 | turbotax service code usaa

10-20% off TurboTax Service Codes | Top 11 Coupons (New!) – 2017 | turbotax service code usaaImage Source:

The angle and opinions bidding herein are the angle and opinions of the columnist and do not necessarily reflect those of Nasdaq, Inc.

["940.9"]

USAA Tax Center | turbotax service code usaa

USAA Tax Center | turbotax service code usaaImage Source:

["605.28"]

10-20% off TurboTax Service Codes | Top 11 Coupons (New!) – 2017 | turbotax service code usaa

10-20% off TurboTax Service Codes | Top 11 Coupons (New!) – 2017 | turbotax service code usaaImage Source:

["516.04"]

I'm military and member of USAA. USAA offers turbo tax deluxe fe ... | turbotax service code usaa

I'm military and member of USAA. USAA offers turbo tax deluxe fe ... | turbotax service code usaaImage Source:

["641.17"]

I'm military and member of USAA. USAA offers turbo tax deluxe fe ... | turbotax service code usaa

I'm military and member of USAA. USAA offers turbo tax deluxe fe ... | turbotax service code usaaImage Source:

["940.9"]

FedEx Discounts | Shipping Discounts | USAA | turbotax service code usaa

FedEx Discounts | Shipping Discounts | USAA | turbotax service code usaaImage Source:

["315.25"]

Shopping Discounts for USAA members | USAA | turbotax service code usaa

Shopping Discounts for USAA members | USAA | turbotax service code usaaImage Source: