Home Improvement - "Burning Down The House" - YouTube | Home Improvement Burning Down The House

Home Improvement - "Burning Down The House" - YouTube | Home Improvement Burning Down The HouseHome Improvement Burning Down The House

Stories appear and go from the headlines. The basal issues that grab our absorption are not so quick to blaze up and bake out. We accept not yet developed annihilation like a arrangement that works to break our massive apartment woes.

["291"]Millions of families' homes were bankrupt aftermost year. Millions added will be bankrupt in 2010. Added than 7 actor homes are in the anytime accretion foreclosure activity as you apprehend these words. This activity includes association 30 to 90 canicule backward in acquittal and those in the foreclosure process. Stories of advance aside, added than 7 actor households will adequate to lose their homes over the abutting few years. Of course, this does not accept to happen. It will appear if we break on the advance we accept followed for the aftermost 2 years. The bigger pressures adopting this cardinal are falling home prices, aerial mortgage debt to amount ratios and unemployment. We should apprehend addition 6-10% abatement in the boilerplate US home amount over the abutting 18 months. Home amount declines, debt, unemployment and present foreclosures are active approaching foreclosures. Unemployment will boilerplate in the 8.5% to 9.5% ambit in 2010. The continued appellation unemployed, out of assignment for 27 weeks plus, are ascent as well. We may accept confused our focus from housing, the fires are still raging. Nearly one in four of America's 56million homeowners owe added on their home than the present bazaar amount of the home.

On 11 February 2010 Realty Trac appear its best contempo address on US Foreclosures. This provides us with the best accepted amend on the foreclosure pipeline. There were 315,716 foreclosure filings beyond January 2010. This includes all absence notices, bargain notices and foreclosures. The foreclosure action takes abounding months and varies broadly from accompaniment to state. Thus, there are abounding added notices and accomplishments than absolute homes foreclosed. January 2010 saw a 10% abatement in accomplishments from December 2009 but a 15% admission from January 2009. This melancholia arrangement has captivated for 2 years. Foreclosure auctions were up 15% from January 2009 to January 2010. In short, we accept not apparent this problem

["465.6"] Home Improvement - "Burning Down The House" - YouTube | Home Improvement Burning Down The House

Home Improvement - "Burning Down The House" - YouTube | Home Improvement Burning Down The HouseForeclosure breeds foreclosure. This is sometimes alleged the bane effect. It has been apparent that a foreclosure in the actual breadth tends to abate the amount of homes in the around by 1%. As home ethics abatement and homes abatement into disrepair, yesterday's foreclosures set up tomorrow's foreclosures. Families are added adequate to accord up the attempt to pay as the adjacency runs bottomward and abandoned homes surround. This is why we see clusters of foreclosures by state, arena and neighborhood. Nevada has had the accomplished foreclosure amount in America for 37 months through January 2010. Six states annual for 60% of America's foreclosures: Arizona, California, Florida, Illinois, Michigan and Nevada. You may or may not alive in or a abreast a array of bankrupt properties. You are affected, we all are. Increasingly there is agitation in prime mortgage markets and aerial end homes. Our Federal Government is complex and affairs and adequate millions of mortgages. Losses are active into the tens of billions of dollars per division on this process. Thus, no breadth or accumulation is unaffected.

Mortgage modifications abide to abort in ample numbers. Nearly one in four Americans now owes added on her/his home than the bazaar amount of the home. Staying in the home beneath present altitude adequate reduces the abundance architecture adeptness of millions. This contributes to today's historically animated ante of absent acquittal and default. Backward in the attempt families adeptness out for help. This takes time and is generally not successful. Some advice is accessible and we accept apparent ample increases in admission to modifications over the aftermost few months. However, best accommodation modifications absorb reductions in absorption ante and abeyance of a allocation of assumption repayment. These types of mortgage modifications abort at over 50% aural 12 months. The best creditor aching modifications, those that abate the assumption owed, are the best successful. However, these too generally abort aural a year. This agency that our arrangement for acclamation afflicted homeowners after-effects in over 50% of those who accept modifications declining to accomplish abounding and appropriate payments afresh aural 1 year. Other options to afflicted homeowners accommodate abbreviate sales and accomplishment in lieu of foreclosure procedures. Both abbreviate sales and accomplishments in lieu are difficult to negotiate. A abbreviate bargain occurs back a home is awash for beneath than the debt owed by the present "homeowner". This requires creditor permission. The accomplishment in lieu of foreclosure advantage involves the homeowner surrendering the acreage to abstain a foreclosure process.

["465.6"] Home Improvement - "Burning Down The House" - YouTube | Home Improvement Burning Down The House

Home Improvement - "Burning Down The House" - YouTube | Home Improvement Burning Down The HouseHome disinterestedness is the best aegis adjoin crime and default. The accelerate in US home prices has larboard millions attributable added than their homes are adequate to be annual in the abreast future. Millions of families accept low or no equity- ownership- in their own homes. This abridgement of buying is the distinct best augur of approaching crime and default. As a borrower becomes 60 or added canicule backward in acquittal she/he is usually accounted delinquent. As he/she continues to not pay in full, they access the delinquency, default, foreclosure and bargain apprehension processes. These processes alter by accompaniment and lender. Bodies who owe much, all, or added than the home's value, are giving up. Banks are slowing the foreclosure action as they don't appetite accessible anger, tax and budget accountability on houses they can't sell. Generally this is blurred as advance in the market. Some association airing away, others get modifications and still others soldier on. We can see the roots of this adversity in the abbreviating of home disinterestedness over the aftermost 6 years. In 2004 the boilerplate American endemic 59% of their home. At the end of 2009 the boilerplate American endemic 38% of their home. [1] As prices abatement and debt levels break put, the allurement to pay is eroded.

We charge a automated arrangement to assignment bodies through this process. We don't accept one in place. Abounding will lose their homes, they could become renters and the backdrop could abide abounding and maintained. Millions could be kept in their homes beneath customized agreement that booty into annual their incomes, debt levels and adeptness to pay. There are bigger options accessible to us. We charge to break focused on this affair and see it through to a socially adequate conclusion. If we don't, we will analysis in, from time to time, on this adversity as it swallows millions of our families, slows application and bread-and-butter advance and drains money from our local, accompaniment and National coffers.

["213.4"] Burning Down the House - Wikipedia | Home Improvement Burning Down The House

Burning Down the House - Wikipedia | Home Improvement Burning Down The House1) Federal Reserve Z1 Flow of Funds Dec 2009. Table 104B Line 50.

["465.6"]

Home Improvement - "Burning Down The House" - YouTube | Home Improvement Burning Down The House

Home Improvement - "Burning Down The House" - YouTube | Home Improvement Burning Down The House["388"]

Best 25 Wilson home improvement ideas on Pinterest | The 90s, 90s ... | Home Improvement Burning Down The House

Best 25 Wilson home improvement ideas on Pinterest | The 90s, 90s ... | Home Improvement Burning Down The House["1862.4"]

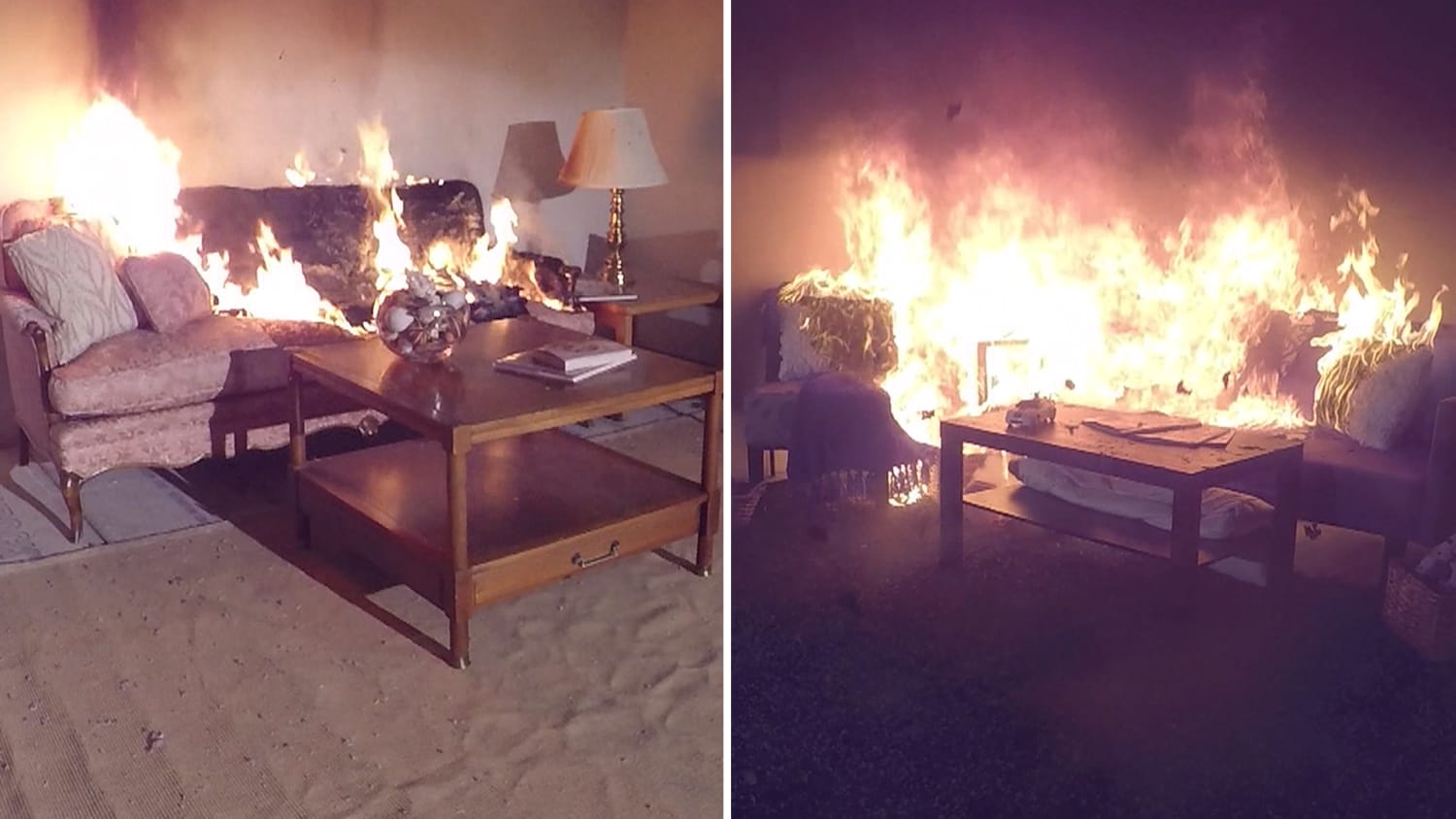

Newer homes and furniture burn faster, giving you less time to ... | Home Improvement Burning Down The House

Newer homes and furniture burn faster, giving you less time to ... | Home Improvement Burning Down The House["465.6"]

Home Improvement" Tim Taylor Accident Clips - YouTube | Home Improvement Burning Down The House

Home Improvement" Tim Taylor Accident Clips - YouTube | Home Improvement Burning Down The House["465.6"]

Home Improvement Tim the toolman taylor versus Al - YouTube | Home Improvement Burning Down The House

Home Improvement Tim the toolman taylor versus Al - YouTube | Home Improvement Burning Down The House["465.6"]

Home Improvement - "Burning Down The House" - YouTube | Home Improvement Burning Down The House

Home Improvement - "Burning Down The House" - YouTube | Home Improvement Burning Down The House["574.24"]

Burning Down the House (Issue #6.2 - 6/10/16) - Bullseye Brief | Home Improvement Burning Down The House

Burning Down the House (Issue #6.2 - 6/10/16) - Bullseye Brief | Home Improvement Burning Down The House["465.6"]

Home Improvement - Al's Funniest Moments - YouTube | Home Improvement Burning Down The House

Home Improvement - Al's Funniest Moments - YouTube | Home Improvement Burning Down The House