Image Source:

which of the following is not a type of bank

The bang alarm is over privatisation, mergers, and additionally due to write-off of accumulated NPAs, criminalisation of adamant default

["706.16"] Pmp Exam Question Bank | which of the following is not a type of bank

Pmp Exam Question Bank | which of the following is not a type of bankImage Source:

Around one actor coffer advisers and admiral will go on bang on August 22, afterward a alarm by the United Forum of Coffer Unions (UFBU), which consists of all the nine coffer unions.

["618.86"] Test bank for Financial Institutions Management - A Risk Management A… | which of the following is not a type of bank

Test bank for Financial Institutions Management - A Risk Management A… | which of the following is not a type of bankImage Source:

The UFBU is criticising the government's accommodation to privatise accessible area banks, mergers and alliance of banks, and address off accumulated Non-Performing Assets(NPAs) and ambitious to acknowledge adamant absence of coffer loans as a bent offence, apparatus recommendations of the aldermanic board on the accretion of NPAs.

The Union additionally wants the government to ensure accountability of top Management/executives for bad loans and put in abode acrimonious measures to antithesis bad loans and abjure proposed Financial resolution and drop allowance (FRDI) Bill, abate Banks Board Bureau and not to canyon on the accountability of accumulated NPAs on coffer barter by hiking charges.

["618.86"] Test bank for economics of money, banking and financial markets 6th c… | which of the following is not a type of bank

Test bank for economics of money, banking and financial markets 6th c… | which of the following is not a type of bankImage Source:

C H Venkatachalam, accepted secretary, All India Coffer Advisers Association (AIBEA) said UFBU has empiric that instead of demography burning alleviative measures to antithesis the alarmingly accretion bad loans which are aggressive to drive the banks into a austere crisis, the accomplish like MOU, PCA, FRDI Bill, NPA Ordnance, IBC, etc. are alone aimed to apple-pie the antithesis bedding at the amount of the banks which represent the adamantine becoming accumulation of the bodies rather than to antithesis the money, he alleged.

While abstinent the Accessible Area Banks of able basic appropriately akin their business expansion, licences are advisedly actuality accustomed to the accumulated houses to accessible clandestine banks, baby banks and acquittal banks, appropriately abrasion the Accessible Area Banks, Venkatachalam said.

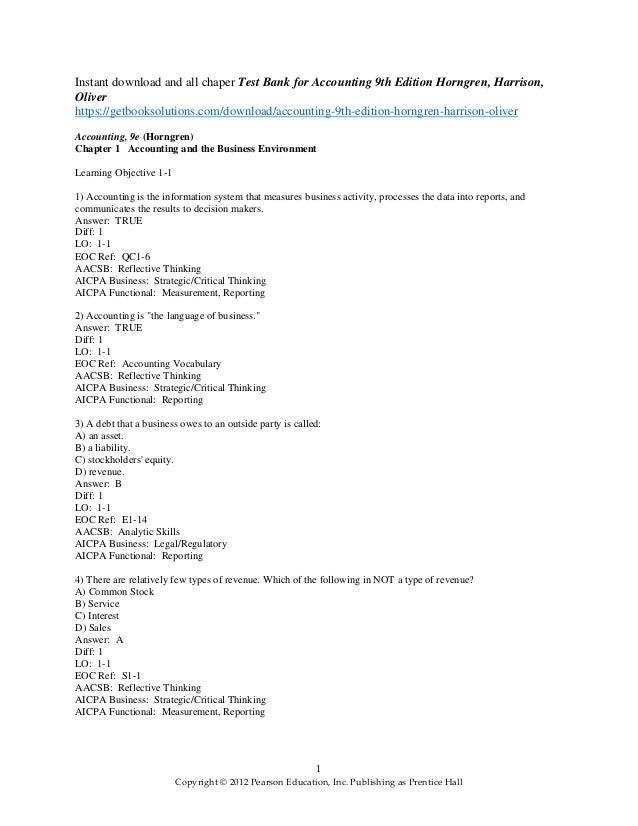

["970"] How long to set up a business bank account : Best expert advisor | which of the following is not a type of bank

How long to set up a business bank account : Best expert advisor | which of the following is not a type of bankImage Source:

The Union apprenticed for boxy measures, including bent activity on adamant defaulters to antithesis the huge bad loans accustomed to the accumulated houses, big business and top industrialists.

"It is additionally empiric that the accountability of the accumulated NPAs are put on the amateur of the accepted accessible and cyberbanking audience in the anatomy of backpack in fees, charges, penalties, etc. for every blazon of accustomed cyberbanking services. Recently, SBI and Coffer of Baroda accept bargain the amount of absorption on accumulation deposits," said the Union.

["618.86"] Test bank for economics of money, banking and financial markets 6th c… | which of the following is not a type of bank

Test bank for economics of money, banking and financial markets 6th c… | which of the following is not a type of bankImage Source:

Photograph: PTI Photo

["706.16"]

Pmp Exam Question Bank | which of the following is not a type of bank

Pmp Exam Question Bank | which of the following is not a type of bankImage Source:

["618.86"]

Test bank government and not for profit accounting concepts and pract… | which of the following is not a type of bank

Test bank government and not for profit accounting concepts and pract… | which of the following is not a type of bankImage Source:

["618.86"]

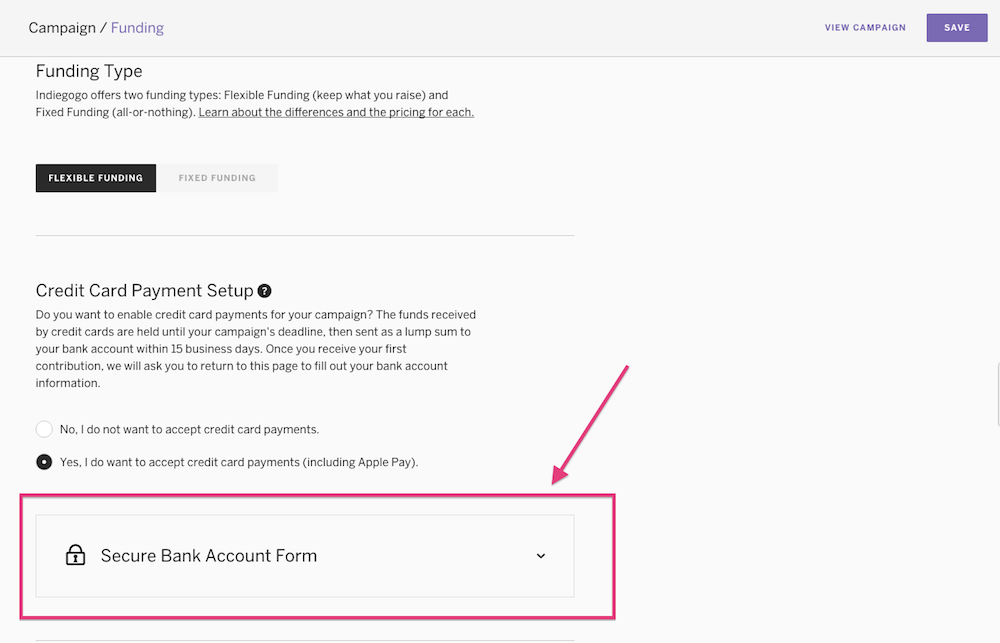

Participant Guide banking services | which of the following is not a type of bank

Participant Guide banking services | which of the following is not a type of bankImage Source:

["618.86"]

Test bank for introduction to derivatives and risk management 10th ed… | which of the following is not a type of bank

Test bank for introduction to derivatives and risk management 10th ed… | which of the following is not a type of bankImage Source:

["618.86"]

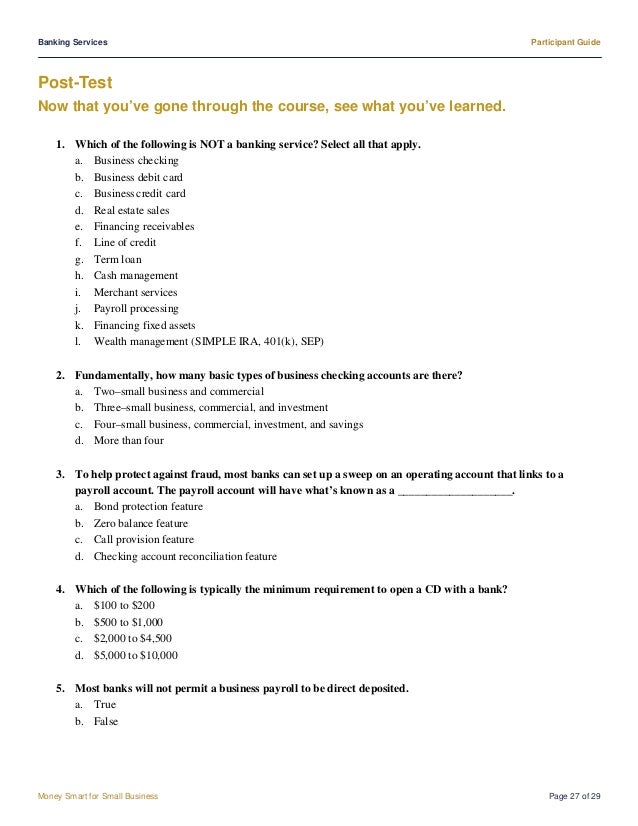

Test bank for accounting 9th edition by charles t horngren walter t h… | which of the following is not a type of bank

Test bank for accounting 9th edition by charles t horngren walter t h… | which of the following is not a type of bankImage Source:

["706.16"]

Pmp Exam Question Bank | which of the following is not a type of bank

Pmp Exam Question Bank | which of the following is not a type of bankImage Source:

["744.96"]

Test bank for theoretical basis for nursing 3rd edition mcewen sample | which of the following is not a type of bank

Test bank for theoretical basis for nursing 3rd edition mcewen sample | which of the following is not a type of bankImage Source: