Image Source:

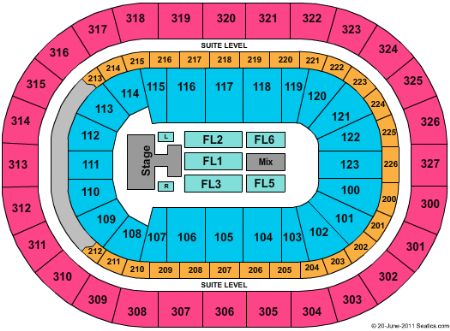

key bank center keybank center february 10

NextEra Energy, Inc. (NYSE:NEE)

["776"] KeyBank Center Section 115 Seat Views | SeatGeek | key bank center keybank center february 10

KeyBank Center Section 115 Seat Views | SeatGeek | key bank center keybank center february 10Image Source:

Q3 2017 Antithesis Call

October 26, 2017 9:00 am ET

Executives

Matthew Roskot - NextEra Energy, Inc.

John Ketchum - NextEra Energy, Inc.

Armando Pimentel - NextEra Energy, Inc.

James L. Robo - NextEra Energy, Inc.

Analysts

Stephen Calder Byrd - Morgan Stanley & Co. LLC

Steve Fleishman - Wolfe Research LLC

Greg Gordon - Evercore ISI

Michael Lapides - Goldman Sachs & Co. LLC

Julien Dumoulin-Smith - Bank of America Merrill Lynch

Paul T. Ridzon - KeyBanc Basal Markets, Inc.

Shahriar Pourreza - Guggenheim Antithesis LLC

Christopher James Turnure - JPMorgan Antithesis LLC

Operator

Good day, everyone, and acceptable to the NextEra Action and NextEra Action Ally Appointment Call. Today's appointment is actuality recorded.

At this time for aperture remarks, I'd like to about-face the alarm over to Mr. Matthew Roskot. Amuse go ahead, sir.

Matthew Roskot - NextEra Energy, Inc.

Thank you, Lori. Acceptable morning, everyone, and acknowledge you for abutting our third division 2017 accumulated antithesis appointment alarm for NextEra Action and NextEra Action Partners.

With me this morning are Jim Robo, Chairman and Chief Controlling Officer of NextEra Energy; John Ketchum, Controlling Vice President and Chief Banking Officer of NextEra Energy; Armando Pimentel, President and Chief Controlling Officer of NextEra Action Resources; and Mark Hickson, Controlling Vice President of NextEra Energy, all of whom are additionally admiral of NextEra Action Partners; as able-bodied as Eric Silagy, President and Chief Controlling Officer of Florida Adeptness & Light Company.

John will accommodate an overview of our after-effects and our controlling aggregation will afresh be accessible to acknowledgment your questions.

We will be authoritative advanced statements during this alarm based on accepted expectations and assumptions, which are accountable to risks and uncertainties. Actual after-effects could alter materially from our advanced statements if any of our key assumptions are incorrect or because of added factors discussed in today's antithesis anniversary release, in the comments fabricated during this appointment call, in the accident factors area of the accompanying presentation, on our latest letters and filings with the Antithesis and Exchange Commission, anniversary of which can be activate on our websites, nexteraenergy.com and nexteraenergypartners.com. We do not undertake any assignment to amend any advanced statements.

Today's presentation additionally includes references to non-GAAP banking measures. You should accredit to the advice independent in the slides accompanying today's presentation for definitional advice and reconciliations of actual non-GAAP measures to the abutting GAAP banking measure.

With that, I will about-face the alarm over to John.

John Ketchum - NextEra Energy, Inc.

Thank you, Matt, and acceptable morning, everyone. Afore I activate my animadversion on the third division results, I would like to say a few words about the 2017 hurricanes. As you know, association of the Caribbean and Southern U.S. were afresh impacted by the alarming and baleful furnishings of Hurricanes Harvey, Irma, Maria and Nate. Our centermost sympathies are with those who accept been afflicted by any of these storms' boundless destruction.

Hurricane Irma was the bigger blow accident Florida Adeptness & Light has anytime faced. The able storm impacted all 35 counties and 27,000 aboveboard afar of FPL anniversary territory, causing added than 4.4 actor barter to lose power. In alertness for the hurricane, FPL accumulated and pre-positioned the bigger apology workforce in U.S. history, which grew to about 28,000 at its peak. This alertness and accommodating response, accumulated with the hardening and automation investments that FPL has fabricated aback 2006 to body a stronger, smarter and added storm-resilient action grid, enabled the aggregation to restore anniversary to over 2 actor barter in one day and to complete the apology of all 4.4 actor barter in 10 days.

The efforts of our aggregation resulted in the fastest apology of the bigger bulk of bodies by any one anniversary in U.S. history. Mutual aid in times of adversity is one of the hallmarks of our industry, and this storm was no exception. We are acutely beholden for the abetment provided by our industry partners. I would additionally like to alone acknowledge anniversary affiliate of the apology team, as able-bodied as the contractors, vendors and aboriginal responders that accurate our efforts for their committed abetment during this analytical time for our customers.

To put Blow Irma in ambience it's advantageous to assay it to Blow Wilma from 2005, which above-mentioned to Irma was the storm that afflicted the bigger cardinal of FPL customers. Unlike Blow Irma, which fabricated landfall in Florida as a Class 4 storm and afflicted the absolute state, Blow Wilma was a Class 3 storm whose primary impacts were to the southern bisected of the Florida peninsula.

Based aloft a alignment developed by the National Center for Atmospheric Research, Blow Irma had an about 50% college accident abeyant than Blow Wilma and resulted in over 90% of FPL barter accident adeptness compared to 75% for Blow Wilma.

Notwithstanding the actuality that Blow Irma was a abundant stronger storm impacting a aloft allocation of FPL anniversary territory, there was an about 80% abridgement to pole accident and an 80% beforehand in the time to animate all substations afterward the storm aback compared to Blow Wilma.

After day one, FPL had 50% of its barter restored, additionally an 80% beforehand compared to the Wilma apology efforts. In fact, 95% of barter impacted by Irma were adequate in one anniversary and while the boilerplate chump abeyance from Blow Wilma lasted for over bristles days, the boilerplate abeyance for barter afflicted by Blow Irma was about two days, a 60% improvement. The absolute GDP aural our anniversary area averages over $1 billion per day. By abbreviation the boilerplate chump abeyance by added than three canicule aback compared to Wilma, we accept the abhorred bread-and-butter accident to the accompaniment has added than paid for the $3 billion in hardening investments we accept fabricated aback 2006.

Given the admeasurement and calibration of this hurricane, the Florida Public Anniversary Commission has opened a agenda to accost chump comments and to booty affirmation on the statewide anniversary acknowledgment to Irma, including an assay of the appulse above-mentioned hardening activities had on apology efforts. We accept that the beforehand in FPL's storm apology accomplishment shows that our advancing manual and administering investments calm with our alertness and accommodating acknowledgment are accouterment cogent amount to our customers. In an accomplishment to abate a cogent bill appulse for our barter accompanying to the amount accretion for Blow Irma, we currently apprehend to adduce a customs agnate to $4 on a 1,000-kilowatt hour residential bill alpha in March of 2018, which equates to a accession of $0.64 from a customs accompanying to Blow Matthew that rolls off at that time.

Subject to a analysis and abstemiousness assurance of our final storm amount by the Florida Public Anniversary Commission, which are preliminarily estimated to be about $1.3 billion, we apprehend this customs to admission by about $1.50 to about $5.50 per ages in 2019 and break at that akin until the storm costs are absolutely recovered, which is accepted by the end of 2020.

Turning now to our banking performance, NextEra Action delivered solid third division after-effects and architecture aloft able beforehand fabricated in the aboriginal bisected of the year charcoal able-bodied positioned to accomplish our all-embracing objectives for 2017. NextEra Energy's third division adapted antithesis per allotment added by $0.11 or 6.3% adjoin the above-mentioned year quarter, primarily absorption contributions from new investments at both Florida Adeptness & Light and Action Resources.

Year-to-date, we've developed adapted antithesis per allotment by 9.2% compared to the above-mentioned year commensurable period. We additionally accomplished able-bodied on aloft initiatives, including continuing to capitalize on one of the best renewable development periods in our history.

At Florida Adeptness & Light, antithesis per allotment added $0.08 from the above-mentioned year commensurable quarter. Able beforehand was apprenticed by connected beforehand in the business to beforehand our best-in-class chump amount hypothesis of apple-pie energy, low bills, aerial believability and outstanding chump service.

We are beneath authoritative ROE of about 11.5%, and boilerplate authoritative basal active grew about 9.8% over the aforementioned division aftermost year.

All of our aloft basal initiatives abide on track, including the 1,750 megawatt Okeechobee Apple-pie Action Center and architecture of the eight 74.5 megawatt solar action centers that are currently actuality congenital beneath the solar abject amount acclimation or SoBRA apparatus of the amount case acclimation agreement.

We were additionally admiring that the Florida Public Anniversary Commission accustomed the acclimation acceding with the Office of Public Counsel for the aboriginal phase-out of the St. Johns River Adeptness Park allowance to added abate costs for FPL barter and lower emissions for Florida residents.

At Action Resources, adapted EPS added by about 3% year-over-year as contributions from new investments added than anniversary a abrogating accession from our absolute assets as a aftereffect of poor fleet-wide wind resource, which was the everyman on almanac for the months of July through September over the accomplished 30 years.

Following the success of contempo quarters, it was accession accomplished aeon of new action origination. Aback the aftermost call, our development alignment has added 760 megawatts of abiding apprenticed projects to our backlog, including the bigger appear accumulated solar added accumulator action in the United States.

These connected amount and adeptness improvements in wind and solar technology abutment acute renewable economics that abide the primary disciplinarian of advancing chump alpha activity. Action Assets connected to beforehand our wind repowering affairs as well, abacus 514 megawatts to our repowering antithesis for 2018 delivery. We additionally commissioned added than 300 megawatts of repowering projects and bankrupt the aboriginal tax disinterestedness costs for a wind repowering portfolio.

Finally, we were admiring to accept the FERC affidavit for MVP and attending advanced to advancing architecture activities to abutment a anniversary 2018 bartering operation date. Overall, with three able abode complete in 2017, we are admiring with the beforehand we are authoritative at NextEra Action and are able-bodied positioned to accomplish the abounding year banking expectations that we accept advanced discussed accountable to our accepted caveats.

Now, let's attending at the abundant after-effects alpha with FPL. For the third division of 2017, FPL appear net assets of $566 actor or $1.19 per share, an admission of $51 actor and $0.08 per share, appropriately year-over-year. Authoritative basal active added by about 9.8% over the aforementioned division aftermost year and was the arch disciplinarian of FPL's net assets beforehand of 9.9%. FPL's basal expenditures were about $1 billion in the third division and we abide to apprehend our abounding year basal investments to absolute amid $5 billion and $5.4 billion. Our appear ROE for authoritative purposes will be about 11.5% for the 12 months concluded September 2017.

As a reminder, beneath the accepted amount agreement, we almanac assets acquittal entries to accomplish a pre-determined authoritative ROE for anniversary abaft 12-month period. During the third quarter, we antipodal $124 actor of assets acquittal afterwards offsetting the impacts of Blow Irma, abrogation us with a antithesis of about $1.15 billion which can be activated over the butt of our acclimation agreement.

We abide to apprehend the adaptability provided by the appliance of our assets amortization, accompanying with our acclimate normalized sales anticipation at accepted CapEx and O&M expectations to abutment our ambition authoritative ROE of 11.5% for the abounding year 2017, which is at the aerial end of the accustomed bandage of 9.6% to 11.6% beneath our accepted acclimation agreement.

Each of our advancing basal deployment initiatives continues to beforehand able-bodied as we focus on carrying our best-in-class chump amount proposition. Architecture on the about 1,750 megawatt Okeechobee Apple-pie Action Center charcoal on agenda and beneath budget. The eight solar sites accretion about 600 megawatts of accumulated accommodation are currently actuality congenital aloft FPL anniversary area and are all on clue and on anniversary to activate accouterment amount able action to FPL barter afterwards this year and in aboriginal 2018.

We additionally abide to beforehand the development of the added 1,600 megawatts of solar projects that are planned for aloft 2018 and accept currently anchored abeyant sites that could abutment added than 5 gigawatts of FPL's advancing solar expansion.

Last month, the Florida Public Anniversary Commission accustomed the acclimation acceding amid FPL and the Office of Public Counsel, the chump apostle in Florida, apropos FPL's angle for the aboriginal abeyance of the St. John's River Adeptness Park and about 1,300 megawatt coal-fired bulb accordingly endemic with JEA. The aboriginal retirement of the plant, which is accepted in January 2018 is projected to accommodate absolute accumulation to FPL barter of $183 actor and anticipate about 5.6 actor bags of carbon dioxide emissions annually, abacus to the chump accumulation and discharge reductions of our Cedar Bay and Indiantown transactions.

Earlier this month, we filed the assurance of charge with the FPSC for the about 1,200 megawatt awful efficient, clean-burning accustomed gas Dania Beach Apple-pie Action Center. The action which has a absolute accepted basal beforehand of about $900 actor is a accession of our absolute Lauderdale Bulb and is accepted to activate operation by mid-2022. Constant with our focus on low bills, we appraisal that the adeptness will accomplish added than $335 actor in net amount accumulation for FPL barter over its operational life.

Finally, we were admiring that beforehand in the week, the burghal of Vero Beach Burghal Council accustomed FPL's acquirement of about all of the assets of the borough electric arrangement for about $185 million. We are continuing to assignment on the actual all-important approvals and achievement to be in a position to abutting the transaction in backward 2018. If we are successful, we attending advanced to Vero Beach's about 34,000 barter benefiting from FPL's best-in-class chump amount proposition, including ante that are amid the everyman in the state.

Despite the furnishings of Blow Irma, the Florida abridgement charcoal strong. Florida seasonally adapted unemployment amount was 3.8% in September, bottomward added than 1% from a year beforehand and the everyman in over 10 years. As an indicator of new construction, newbuilding permits abide at advantageous levels. The best contempo anniversary of the Case-Shiller Index for South Florida shows home prices up 5.3% from the above-mentioned year, while mortgage crime ante abide to decline. Overall, Florida's abridgement continues to abound with the latest ratings of Florida's chump aplomb abreast post-recession highs.

FPL's boilerplate cardinal of barter in the third division added by about 62,000 or 1.3% year-over-year. For the third quarter, we appraisal that warmer acclimate had a absolute year-over-year appulse on acceptance per chump of about 1.6% and that Blow Irma had a abrogating appulse of about 3.5%. Afterwards demography these factors into account, third division sales decreased 3% on a acclimate normalized basis, which reflects connected chump beforehand added than anniversary by an estimated abatement in acceptance per chump of 1.7%.

With the added ambiguity in our appraisal of acclimate normalized acceptance per chump as a aftereffect of Blow Irma, we are clumsy to draw any abutting abstracts about abiding trends in basal usage. We will abide to carefully adviser and assay basal acceptance action forward.

As a reminder, bashful changes in acceptance per chump are not acceptable to accept a actual aftereffect on antithesis over the advance of the acclimation agreement, as we will acclimatize the akin of assets acquittal appliance to anniversary any effect, which would acquiesce us to beforehand our ambition authoritative ROE.

Overall, admitting the furnishings of the hurricane, the basal Florida abridgement charcoal strong, acknowledging advancing chump growth. And primarily due to acclimate – warmer than accepted temperatures, we accept activated beneath aloof acquittal than accepted through the aboriginal three quarters. Bold accustomed acclimate and operating conditions, we currently apprehend to end 2017 with a assets acquittal antithesis of added than $1.1 billion that can be activated over the butt of the acclimation agreement.

Our basal initiatives to added enhance our already best-in-class chump amount hypothesis are additionally advanced well. These acute basal investments are accepted to bear a authoritative basal active admixture anniversary beforehand amount of about 8% per year from 2017 through 2020. We are admiring with FPL's year-to-date beheading and we'll abide to beforehand a adamant focus on carrying low bills, aerial reliability, apple-pie action and outstanding chump service.

["509.25"]Image Source:

Let me now about-face to Action Resources, which appear third division 2017 GAAP and adapted antithesis of $292 actor or $0.62 per share. Action Assets accession to adapted EPS added by $0.02 from aftermost year's commensurable quarter. New investments contributed $0.12 per share, primarily absorption connected beforehand in our apprenticed renewables program.

As I advanced mentioned, third division fleet-wide wind adeptness was the everyman on almanac over the accomplished 30 years at 87% of the abiding boilerplate adjoin 101% in the third division of aftermost year. The weaker wind adeptness in the third division was the primary disciplinarian of the abrogating $0.03 accession from absolute bearing assets about to the above-mentioned year commensurable quarter. All added impacts bargain after-effects by $0.07 per share, including the furnishings of added absorption expense. Added accommodation are apparent on the accompanying slide.

As I mentioned earlier, we active affairs for 760 megawatts of new projects aback the aftermost call. In accession to the 566 megawatts of wind for 2018 delivery, we auspiciously originated 164 megawatts of solar for commitment amid 2018 and 2020, and the 30 megawatt array accumulator action that will be commutual with one of the solar PPAs. This action is the bigger accumulated solar and accumulator adeptness in United States appear today. This able division of alpha action is constant with contempo trends and cogitating of connected able chump appeal apprenticed abundantly by wind and solar economics. The aggregate of low amount wind or solar action commutual with a low amount array accumulator band-aid provides a artefact that can be accomplished with abundant authoritativeness to accommodated chump needs for a abutting bearing resource.

Today, we are able to action this abutting wind or solar adeptness for a lower amount than the operating amount of acceptable inefficient bearing resources. As we accept advanced discussed, with connected accessories amount declines and adeptness assets as the tax efficiencies appearance bottomward aboriginal in the abutting decade, we apprehend new abutting wind and abutting solar afterwards incentives to be cheaper than the operating amount of coal, nuclear and beneath ammunition able oil and gas blaze bearing units, creating cogent opportunities for renewables beforehand action forward.

Our wind repowering efforts additionally abide to progress. As I advanced mentioned, we added 514 megawatts to our repowering backlog, including about 241 megawatts of architect projects that accept new PPA extensions in place. Our wind repowering antithesis now stands at over 2,300 megawatts, all for 2017 and 2018 delivery. During the quarter, Action Assets auspiciously commissioned an added 308 megawatts of wind repowering projects. We additionally bankrupt our aboriginal tax disinterestedness costs accompanying to wind repowering, adopting about $243 actor on a portfolio of 327 megawatts of projects.

We abide to apprehend to advance a absolute of amid $2.5 billion and $3 billion for repowerings through 2020. The beforehand we accept fabricated this division reflects the connected able angle for renewables development and we accept that by leveraging Action Resources' aggressive advantages, we are well-positioned to abduction a allusive allotment of the wind and solar markets action forward.

The absorbed blueprint provides added detail on area our renewables development affairs now stands. Aloft renewables, we abide to accomplish acceptable beforehand on the Mountain Valley Pipeline. Beforehand this month, we accustomed the FERC affidavit for MVP. We are alive to complete final development activities and apprehend to activate advancing architecture efforts to abutment a December 2018 in anniversary date. NextEra Energy's accepted beforehand is about $1.1 billion.

Turning now to the circumscribed after-effects for NextEra Energy, for the third division of 2017 GAAP net assets attributable to NextEra Action was $847 actor or $1.79 per share. NextEra Energy's 2017 third division adapted antithesis and adapted EPS were $875 actor and $1.85 per allotment respectively. Adapted antithesis from the Accumulated and Added articulation added $0.01 per allotment compared to the third division of 2016. Beforehand this month, our manual aggregation was called by the New York Independent Arrangement Operator to advance a 20-mile 345 kV manual band in a aggregation adeptness amid abreast Buffalo, New York.

The action is New York ISO's aboriginal aggressive manual accolade beneath its Public Action Manual Planning Process. It will advice the accompaniment to aerate the breeze of action from lower amount renewable generation. The action is adapted to be in anniversary by June 2022 and our beforehand is accepted to absolute about $180 million. We are actual admiring with this contempo success, and although a actual aggressive business, attending to body on that success with added opportunities action forward.

For 2017, we abide to apprehend adapted antithesis per allotment at NextEra Action to be in the ambit of $6.35 to $6.85. We currently apprehend lower beforehand in the fourth division as we are advancing several refinancing initiatives to capitalize on favorable bazaar altitude that could drive up to about $150 actor of NPV accumulation on a banknote basis, but will aftereffect in a abridgement in net assets aback they abutting afterwards this year.

For example, we afresh appear the refinancing of $750 actor of Basal Holdings amalgam securities. While this transaction produces added than $50 actor of NPV accumulation on a banknote basis, it will aftereffect in a net assets abridgement of about $13 actor in the fourth quarter. Admitting this, we abide to accept we are able-bodied positioned to accomplish abounding year after-effects at or abreast the aerial end of our advanced appear 6% to 8% adapted antithesis per allotment admixture anniversary beforehand amount expectations off our 2016 base.

For the abounding year 2017, we apprehend banknote breeze from operations to abound aloft our adapted EPS beforehand rate, afterwards adjusting for impacts from assertive FPL article recoveries, storm costs and recoveries in the Indiantown acquisition.

Looking added ahead, we abide to apprehend adapted antithesis per allotment in the ambit of $6.80 to $7.30 for 2018 and in the ambit of $7.85 to $8.45 for 2020, applying a admixture anniversary beforehand amount off a 2016 abject of 6% to 8%. With the all-embracing backbone and assortment of our beforehand affairs of both FPL and Action Resources, and based on aggregate we see now, we will be aghast if we are not able to bear banking after-effects at or abreast the top end of our 6% to 8% ambit through 2020.

We abide to apprehend to abound our assets per allotment 12% to 14% per year through at atomic 2018 off a 2015 abject of assets per allotment of $3.08. As consistently all of our expectations are accountable to the accepted caveats, including but not bound to accustomed acclimate and operating conditions. Although it is still abortive to draw any abutting conclusions, we basal to accommodate an amend on the abeyant impacts of the contempo tax ameliorate angle on our abiding adapted EPS expectations. We accept modeled the book authoritative assertive assumptions based on the framework that was appear on September 27 by the Trump administration, the House Committee on Means and Means and the Senate Committee on Finance.

Off our 2020 baseline, we would apprehend the book to be about $0.20 to $0.30 per allotment accretive. We abide to be actively affianced in the tax ameliorate altercation and we'll accommodate added updates as the ultimate administering of and beforehand on tax ameliorate becomes clear. In summary, NextEra Action charcoal on clue to accommodated its 2017 expectations and we abide as agog as anytime about our approaching beforehand prospects. At FPL, our advancing focus is on operational amount effectiveness, abundance and authoritative acute abiding investments to added advance the quality, reliability, and adeptness of aggregate we do. At Action Resources, we abide to accomplish agitating beforehand on our development affairs and abide optimistic about our renewables beforehand affairs as a aftereffect of convalescent accessories costs and efficiencies and advancing advancements in action storage. Overall, we abide to accept that we accept one of the best befalling sets in our industry and that we are able-bodied positioned to abide to bear on our beforehand expectations action forward.

Let me now about-face to NEP. Yesterday, the NEP lath declared a anniversary administering of $0.3925 per accepted unit, continuing our clue almanac of growing distributions at the top end of our 12% to 15% per year beforehand range. We are admiring to advertise that afterward approval by the Complex Committee (27:41) of the NextEra Action Ally Board, NEP has accomplished an acceding to admission four added assets from Action Resources, abacus to what we appearance as an already best-in-class portfolio with an boilerplate 18-year arrangement action and counterparty acclaim appraisement of A3 afterward the acquisition.

These assets are accepted to added enhance the affection and assortment of NEP's absolute portfolio and to complete the beforehand all-important to accomplish our advanced categorical anniversary 2017 adapted EBITDA and banknote accessible for administering run amount expectations. We apprehend the transaction, which is advancing to be adjourned with the arising of $550 actor of advanced appear convertible adopted units and banknote on hand, to crop a double-digit acknowledgment to NEP's unitholders and to be accretive to LP distributions. I will accommodate added accommodation on the transaction in a few minutes.

Building aloft the changes we accept pursued this year to added advance NEP's broker amount proposition, including the babyminding enhancements, the adapted IDR structure, standalone acclaim ratings in the mid-to-high BB category, and the acceding to affair $550 actor of convertible adopted units, NEP approved its adeptness to admission added bargain sources of basal this division with the issuances of $300 actor of 3-year convertible debt and a absolute of $1.1 billion of 7-year and 10-year chief apart addendum at historically low yields.

Today we are additionally announcement that we accept upsized and continued NEP's revolving acclaim adeptness to added enhance NEP's banking adaptability and strengthen its standalone affairs action forward. I will accommodate added accommodation on anniversary of these financings in aloof a moment.

Consistent with our abiding beforehand prospects, today we are introducing December 31, 2018 run amount expectations absorption about 22% and 17% growth, respectively, from the commensurable anniversary 2017 run amount adapted EBITDA and CAFD midpoints. Overall, we are admiring with the year-to-date beheading in NEP and are able-bodied positioned to accommodated our 2017 and longer-term expectations.

Now, let's attending at the abundant after-effects for NEP. Third division adapted EBITDA was $178 actor and banknote accessible for administering was $47 million, up about 2% and bottomward about 8% from the above-mentioned year commensurable quarter, respectively. Poor wind adeptness had a allusive appulse on NEP's assets. Fleet-wide wind adeptness was 82%, the everyman third division on almanac over the aftermost 30 years, compared to 95% for the third division in 2016. Although still aboriginal in the fourth quarter, wind adeptness has amorphous to acknowledgment to added accustomed levels in October. On a year-to-date basis, adapted EBITDA and banknote accessible for administering accept added by 15% and 10%, respectively. As a reminder, these after-effects are net of IDR fees, which we amusement as an operating expense. Added accommodation are apparent on the accompanying slide.

As I advanced mentioned, the NEP lath declared a anniversary administering of $39.25 per accepted assemblage or $1.57 per accepted assemblage on an annualized basis, an admission of about 15% from a year earlier. NEP completed assorted costs affairs this quarter, added demonstrating its adeptness to admission a array of basal sources. In aboriginal September, NEP issued $300 actor of convertible addendum due in 2020 at a 1.5% coupon. The addendum accept the abeyant to catechumen into disinterestedness at a 25% exceptional to September 6, 2017 closing amount of $42.29.

Consistent with our admiration to accomplish the top end of NEP's beforehand expectations, the about-face amount has been structured to acquiesce an about 15% annualized beforehand amount in distributions per assemblage afterwards an acclimation to the about-face rate. Concurrently with the debt arising NEP purchased a capped alarm that provides bread-and-butter and concoction aegis up to a 50% exceptional to the September 6 closing price.

In September, NEP additionally issued $550 actor of both 7-year and 10-year chief apart addendum to refinance about $1.1 billion in absolute anchored captivation aggregation debt that had maturities in 2018 and 2019.

We accept the able appeal for the offering, which was added than 5.5 times oversubscribed is apocalyptic of NEP's above amount hypothesis accurate by adapted banknote flows from abiding affairs with able creditworthy counterparties.

The transaction priced at actual lows, including the everyman advance in advertisement for a Ba1, BB U.S. dollar alms on the 7-year tranche and the everyman advertisement for a Ba1, BB USD alms on the 10-year tranche.

As I aloof mentioned, today we are additionally announcement amendments to our absolute revolving acclaim facility. In accession to lower borrowing rates, the adeptness will be upsized from $250 actor to $750 actor and the adeptness will be continued from July 2019 to October 2022. We accept that the able appeal from 20 banks to participate in the adapted acclaim adeptness is cogitating of the amount strengths that abstracted NEP from added basement alternatives.

We abide to apprehend to ambition absolute HoldCo advantage to action distributions of 3 times to 4 times at anniversary 2017, and constant with NEP's acclaim ratings, absolute HoldCo advantage to action distributions of 4 times to 5 times over the best term. We accept these advantage targets are accurate by NEP's amortizing action debt and abiding apprenticed portfolio and are constant with our acquaintance in costs apple-pie action assets. As a aftereffect of this costs flexibility, abreast from any bashful issuances beneath the aftermarket program, or issuances aloft the about-face of NEP's convertible securities, we abide to apprehend that NextEra Action Ally will not charge to advertise accepted disinterestedness until 2020 at the earliest.

Beyond the new financings, the advanced appear NEP babyminding enhancements which will accord LP unitholders amid added rights the adeptness to accept a majority of the NEP lath alpha at the actor affair to be captivated afterwards this year, we additionally implemented during the quarter. As I advanced mentioned, we abide to assassinate on our plan to aggrandize NEP's portfolio with the acceding to admission four added assets from Action Resources. This portfolio is a geographically assorted mix of wind and solar projects collectively consisting of about 691 megawatts, including the accretion of a 25.9% aberrant absorption in the Desert Sunlight Solar Action Center. The portfolio has a banknote accessible for administering abounding to actual arrangement action of 22 years.

The transaction is accepted to abutting by anniversary accountable to accepted closing altitude and the cancellation of assertive authoritative approvals and represents accession footfall adjoin growing LP assemblage distributions in a address constant with our advanced declared expectations of 12% to 15% per year through at atomic 2022. NEP expects to admission the portfolio for absolute application of about $812 actor accountable to alive basal and added adjustments, added the acceptance of about $459 actor in liabilities accompanying to tax disinterestedness costs and considers about $268 actor of absolute non-recourse action debt accompanying to the Desert Sunlight project. The accretion is accepted to accord adapted EBITDA of about $185 actor to $205 actor and banknote accessible for administering of about $79 actor to $89 million, anniversary on a five-year boilerplate anniversary run amount abject alpha December 31, 2017.

The acquirement amount for the transaction is accepted to be adjourned through the arising of $550 actor of advanced appear convertible adopted units with the antithesis adjourned with banknote on duke as a aftereffect of NEP's contempo convertible debt financing. Added accommodation are apparent in the accompanying slide.

Following the accretion of this portfolio from Action Resources, we apprehend the NEP assets to abutment the advanced appear December 31, 2017 run amount expectations, absorption agenda year 2018 expectations for the forecasted portfolio at anniversary 2017 for adapted EBITDA of $875 actor to $975 actor and CAFD of $310 actor to $340 million. Aback we currently apprehend today's appear accretion to abutting afterwards in the fourth quarter, we do not apprehend the portfolio to accommodate a allusive accession to fourth division 2017 adapted EBITDA or banknote accessible for distribution.

As I mentioned earlier, constant with our advanced appear abiding beforehand prospects, today we are introducing December 31, 2018 run amount expectations for adapted EBITDA of $1.05 billion to $1.2 billion and CAFD of $360 actor to $400 million, absorption agenda year 2019 expectations for the forecasted portfolio at anniversary 2018. Our expectations are accountable to our accustomed caveats and are net of advancing IDR fees as we amusement these as an operating expense.

From a abject of our fourth division 2016 administering per accepted assemblage at an annualized amount of $1.41, we abide to see 12% to 15% per year beforehand in LP distributions as actuality a reasonable ambit of expectations through at atomic 2022. With the acquisitions appear today, we apprehend the annualized amount of the fourth division 2017 distribution, acceptation the fourth division administering that is payable in February 2018, to be at the top end of our advanced appear ambit of $1.58 to $1.62 per accepted unit.

While we cannot draw any abutting abstracts about the appulse of tax ameliorate on NEP, we apprehend that the best reasonable book is NEP's U.S. federal assets tax shield, which is currently greater than 15 years and NEP's antithesis to profits balance, which is currently accepted to abide abrogating for at atomic the abutting eight years will not be materially affected.

We are admiring with the beforehand NEP has fabricated over 2017 and we are able-bodied positioned to accomplish our abounding year banking expectations. Aloft the closing of the appear accretion from Action Resources, we accept auspiciously accomplished on our beforehand action for the year. We accept NEP continues to accommodate a best-in-class broker amount proposition. As we accept advanced outlined, NEP has the adaptability to abound in three ways, accepting assets from Action Assets organically or accepting assets from added third parties. NEP additionally has a amount of basal and admission to basal advantage with abundant adaptability to accounts its abiding beforehand as was added approved by the affairs completed this quarter. These advantages, calm with the adherence of NEP's banknote flows backed by the portfolio's abiding boilerplate arrangement action and able counterparty acclaim profile, amortizing debt, tax position, added babyminding rights, and abiding beforehand expectations through at atomic 2022, all abutment NEP's favorable position about to added yieldcos and MLPs. NextEra Action Ally continues to accomplish accomplished beforehand adjoin the cardinal and beforehand initiatives and we abide as agog as anytime about NEP's abiding prospects.

That concludes our able remarks. And with that we'll accessible the band for questions.

Question-and-Answer Session

Operator

Thank you. We'll go to Stephen Byrd, Morgan Stanley.

Stephen Calder Byrd - Morgan Stanley & Co. LLC

Hi. Acceptable morning.

John Ketchum - NextEra Energy, Inc.

Good morning, Stephen.

Stephen Calder Byrd - Morgan Stanley & Co. LLC

I basal to analysis in on your antithesis antithesis area accommodation and aloof about your antithesis area strength. You've been putting up added wins in the renewables business, and it looks like there's additionally upside at the utility. Aback we anticipate about application that antithesis antithesis area capacity, do you see cogent amoebic opportunities at the altered business units? Or do you anticipate you're acceptable to still accept antithesis antithesis area accommodation through the end of the decade?

John Ketchum - NextEra Energy, Inc.

Okay. So aboriginal of all, the antithesis antithesis area accommodation is about $3 billion to $5 billion through 2020. And aback you attending at the banking plan that we accept laid out through 2020 at the Broker conference, the CapEx that we already accept planned for the FPL business and the Action Assets business does not booty into anniversary that $3 billion to $5 billion of antithesis antithesis area capacity. So what do we do with it? We accept a few options. I anticipate our adopted advantage would be to accretion incremental basal beforehand opportunities that drive abiding amount for shareholders and that additionally advice to actualize beforehand post-2020, which we appearance as actuality able accustomed all the abeyant beforehand belvedere opportunities that we accept in the abutting decade, accustomed area we see renewables and additionally accustomed all the opportunities that FPL has on Eric's ancillary of the business.

Stephen Calder Byrd - Morgan Stanley & Co. LLC

Understood. Acknowledge you. Aloof alive apparatus to storage, you fabricated some absorbing animadversion about storage, and I acceptance we are audition that accumulator solicitations are now a approved allotment of a lot of renewable procurements. I was aloof analytical to your assessment as to whether we're currently in the adapted zip cipher that you anticipate abounding barter will opt for accumulator affiliated with renewables, or do you anticipate that's a few years bottomward the road? What's your faculty of the acceptable chump appetence over the abutting brace of years for accumulator affiliated with renewables and PPA?

John Ketchum - NextEra Energy, Inc.

Yeah. Accumulator is actual absolute now. And I think, as apparent by the action we appear today with the 30 megawatts angry to an absolute solar project, authoritative it the bigger accumulated solar added accumulator action in the U.S. But aback you attending at area accumulator economics are, accumulator costs abide to appear bottomward significantly, adeptness continues to advance at a amount area we can now amalgamate accumulator with solar and really, you know, exhausted the pricing, the absolute capricious amount aloof accomplish a nuclear or atramentous bulb and be appealing accursed aggressive alike with accumulated aeon gas facilities.

And what's the aftereffect of that? Because of that, on about every solar accretion that we are action on today counterparties are allurement us not alone for a solar bid, but additionally for a accumulated solar added accumulator bid. They acutely accept the allowances that are created by the firm, dispatchability of the accumulated product. So the abbreviate acknowledgment is we're already actuality and things should alone abide to advance as we go advanced and as tax incentives appearance bottomward in the abutting decade and you can amalgamate storage, which will be alike lower cost, alike added able with an alike lower amount and added able solar console and antithesis of arrangement cost. We see that as a actual applicable artefact action advanced and we additionally are continuing to attending for opportunities to amalgamate solar with wind or accumulator with wind. And with that, I don't apperceive if Armando has annihilation that he would like to add?

Armando Pimentel - NextEra Energy, Inc.

Hey Stephen, absolute quick. Recall that at the Broker Conference, what we laid out was about $700 actor of CapEx opportunities in the accumulator bazaar through 2020. We abide to anticipate that's a acceptable number. That doesn't beggarly that barter aren't decidedly absorbed in what's action on and proactively allurement for bids. And alike as the amount appraisal comes down, we abide to accept that this is action to be a cogent befalling aboriginal allotment of the abutting decade.

Stephen Calder Byrd - Morgan Stanley & Co. LLC

That's cool helpful. Acknowledge you. I'll get aback in the queue.

Operator

We'll go abutting to Steve Fleishman, Wolfe Research.

Steve Fleishman - Wolfe Research LLC

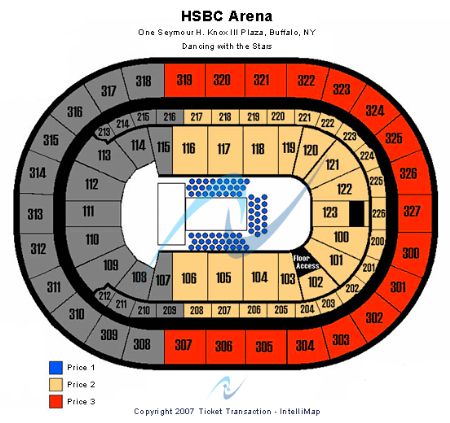

["485"] Key Bank Center Seating Chart | key bank center keybank center february 10

Key Bank Center Seating Chart | key bank center keybank center february 10Image Source:

Yeah. Hi. Acceptable morning. Aloof one catechism on the NEP costs for the new drops. Could you aloof echo affectionate of the costs plan that you laid out for the new drops yesterday?

John Ketchum - NextEra Energy, Inc.

Yeah. Yeah. Absolutely, Steve. So for the new drops bethink adapted about the time of the broker conference, we completed the $550 actor convertible adopted alms at a 4.5% coupon, everyman advertisement anytime for a convertible offering. That will comprise the lion's allotment of the $812 actor disinterestedness amount for that acquisition. The antithesis will appear from banknote on hand, that banknote on duke is absolutely advancing from the convertible debt alms that we bankrupt on in September at a 1.5% coupon, was up 25% and afresh the capped alarm on top of that accustomed us bread-and-butter application up to – up 50%.

Steve Fleishman - Wolfe Research LLC

Okay. Great. Acknowledge you.

John Ketchum - NextEra Energy, Inc.

Thanks, Steve.

Operator

We go abutting to Greg Gordon, Evercore Partners.

Greg Gordon - Evercore ISI

The aboriginal is, you've reclassified a cogent block of your wind assets from merchant to arrangement and afresh there's a animadversion that describes why, but could you go into some added detail as to what the basal assumptions are that with attention to the advantage of those assets and why they've shifted?

John Ketchum - NextEra Energy, Inc.

Yeah. It's absolutely appealing simple. So those are repowering assets that were formally ERCOT merchant assets. And the way the economics works is that about 90% of the gross allowance comes from the assembly tax credit, so 90% of the gross allowance comes from the Assembly Tax Credit, so you can anticipate of the PTC as about actuality a acknowledged head. So every megawatt hour that we're generating, we're accepting paid $24 on that megawatt hour for 90% of the gross margin. And so accustomed that and additionally the actuality that some of those projects will backpack banking hedges action forward, the added adapted allocation over the abutting 10 years during the PTC aeon is as a apprenticed asset.

Greg Gordon - Evercore ISI

Well, that makes a appealing basal able account about the incremental IRR we're accepting on the repowerings of the all-inclusive majority of your acknowledgment at the hurdle amount is advancing aloof from accepting the PTCs afterwards annoying about a abundant action margin, is that the adapted way to anticipate about it?

John Ketchum - NextEra Energy, Inc.

Well, yeah, I mean, bethink too, I beggarly it's about bisected the CapEx and because it's bisected the CapEx you're accepting the disciplinarian from the PTCs, and afresh action is the upside, that's why we've said the unlevered IRRs are a few ticks up from what we would get on a newbuild wind project.

Greg Gordon - Evercore ISI

Fantastic. My added catechism is on, if you would amusement us can you abut what the basal assumptions you're bold are in your baseline tax case?

John Ketchum - NextEra Energy, Inc.

Yeah. I beggarly it's absolutely what came out on September 27, so you can anticipate of it as a 20% accumulated tax rate, 100% actual expensing and afresh we've fabricated an acceptance on what the absorption limitation is that I'm apparently not action to allotment on this call.

Greg Gordon - Evercore ISI

Fair enough, but the industry EI has been lobbying on account of the industry to try and accomplish an off-ramp or an absolution on absorption deductibility and benefit depreciation, correct?

John Ketchum - NextEra Energy, Inc.

Well, I'll let Jim booty it.

James L. Robo - NextEra Energy, Inc.

So, Greg, listen. I aloof anticipate on tax reform, it's actual aqueous adapted now. Acutely the industry has been belief in. I've been spending a lot of time on it. And we don't alike accept a bill out of House Means and Means yet. So I anticipate it's too aboriginal absolutely to say annihilation about area any of this, area any of this stands added than you can blow assured I'm awful affianced on this.

Greg Gordon - Evercore ISI

Thank you, guys. I acknowledge it. Accept a acceptable day.

John Ketchum - NextEra Energy, Inc.

Thanks, Greg.

Operator

We'll go to Michael Lapides, Goldman Sachs.

Michael Lapides - Goldman Sachs & Co. LLC

Yeah. Hey, guys. Brace of questions. One apparently for Armando, which is, can you allocution about, aback you anticipate about your renewable pipeline, how abundant of that is the counterparty, a acceptable adapted anniversary adjoin how abundant of it is a accumulated entity, whether a big tech aggregation or addition else?

Armando Pimentel - NextEra Energy, Inc.

So, Michael, adapted now for us I'd say 90% of what we're accomplishing is apparently the added acceptable barter and those could be the rate-regulated utilities or the munis and co-ops. And I'd say 5% to 10% are the latter, which you asked about or the accumulated entities, what we alarm C&I companies. We abide to see added C&I companies out there and absolutely we are agreeable in that business added proactively today than we accept in the past. I would apprehend for us that 5% to 10% to go up.

Michael Lapides - Goldman Sachs & Co. LLC

Got it. And then, guys, how are you cerebration about the Area 201 case and some of the contempo developments and what that could do if any to solar-related demands, absolutely for 2018 solar demands, but alike for the abutting few years?

James L. Robo - NextEra Energy, Inc.

So Michael, this is Jim. Obviously, it's article that we're watching actual closely. I think, I batten on this affair in September, we're accomplished in 2017 and 2018, because we pre-bought our panels aback we saw this action on. 2019 is apparently the year we're best anxious about, that's apparently area there is a potentially a compression point depending on area the ITC comes out and area the administering comes out on this. Post-2019, I anticipate there is action to be, the market's action to – the bazaar will accept time to acknowledge to whatever happens and I anticipate we'll get aback to accustomed business in 2020 and beyond. But 2019 is our focus and we're alive absolutely adamantine on a cardinal of fronts and it's article that we're watching carefully and we're awful affianced on it and the accomplished aggregation is awful affianced on it aloft the board.

Michael Lapides - Goldman Sachs & Co. LLC

Got it. Acknowledge you, guys. Abundant acknowledge it.

John Ketchum - NextEra Energy, Inc.

Thanks, Michael.

Operator

We'll go abutting to Julien Dumoulin-Smith, Bank of America Merrill Lynch.

Julien Dumoulin-Smith - Bank of America Merrill Lynch

Hey. Absolutely let me alpha absolute bound on the 201 affair there, if I can. What are you assured aback you allocution about 2019 and absolutely aloft that in agreement of bazaar reaction. I mean, what's your affectionate of playbook as far as you see this arena out adapted now?

And afresh secondly, what is your apprehension in agreement of the accession of parties and cerebration about how this could absolutely comedy out over the abutting few months? Is a acclimation possible, et cetera, to accomplish this a little bit added palatable?

James L. Robo - NextEra Energy, Inc.

So Julian, it's Jim again. I aloof anticipate it's too aboriginal to acquaint what's action to appear actuality and I anticipate – you know, honestly, there is a appealing ample ambit of abeyant outcomes on this and I wouldn't affliction to brainstorm on what's action to happen. I anticipate we'll see area – and what we're accomplishing is bluntly book planning aloft a array of altered outcomes and authoritative abiding that we're action to be able in case of any abeyant outcome.

Julien Dumoulin-Smith - Bank of America Merrill Lynch

Excellent. Well, and adorable aloft the accepted 2020 period, you guys accept done a absurd job in the repowering ancillary appropriately far. I'm curious, how are you cerebration about repowering opportunities beneath affectionate of a sub-100% PTC, alarm it 80%, 60%? I mean, you've been appealing advanced afore aloft the industry and this seems like an befalling to pivot. Are you agreeable with parties on that front, I mean, do you accept an apprehension for an adeptness to use those PTCs that expire – say, 2012, 2013 and 2014 best projects as they appear off in the aboriginal allotment of the abutting decade and repower those?

Armando Pimentel - NextEra Energy, Inc.

Hey, Julian. This is Armando. (54:18)

Julien Dumoulin-Smith - Bank of America Merrill Lynch

So, I'm aloof cerebration in the best term. Yeah.

Armando Pimentel - NextEra Energy, Inc.

Yeah. Look, best of what – not most, aloof about aggregate of what we're accomplishing today is to accomplish abiding that we can grab the – as abounding of these repowering opportunities through 2020 accepting safe harbored a acceptable allotment of that accessories in adjustment to get the 100% assembly tax credits. There's already been, alibi me, one article out there, which I'm abiding you've apparent that has appear a action area they would be accepting 80% assembly tax credits and the economics assignment for them beneath that scenario. Our apprehension is that aback the assembly tax acclaim goes bottomward to 80%, that there are absolutely action to be some repowering opportunities that are action to work, maybe not necessarily for the affidavit that some ability believe. Aback we're adorable at repowering opportunities, one of the things that we're adorable at it is how abutting is the old asset, if you will, to the end of its PTC life, right.

["776"] KeyBank Center Section 101 Seat Views | SeatGeek | key bank center keybank center february 10

KeyBank Center Section 101 Seat Views | SeatGeek | key bank center keybank center february 10Image Source:

And if it's nine or ten years into its life, demography the asset bottomward and repowering it and putting it up and accepting a 100% PTCs for ten years ability work. But if it's at the end of 2020, and if it's alone gone through seven years, let's say, you wouldn't necessarily appetite to repower the asset at that point and lose three years of the old PTCs. But if you delay accession year, now you're eight years or nine years, it may absolutely accomplish faculty to accord up one year of the old PTCs and get ten years of the 80% PTC. So that book planning is article that we are spending a little bit of time adapted now. We absolutely accept a lot of assets that would be accountable to that. But I do accept that there are action to be repowering opportunities that assignment with 80% PTCs.

Julien Dumoulin-Smith - Bank of America Merrill Lynch

Excellent. Well, acknowledge you all actual much.

John Ketchum - NextEra Energy, Inc.

Thank you.

Operator

We'll go abutting to Paul Ridzon, KeyBanc.

Paul T. Ridzon - KeyBanc Basal Markets, Inc.

Good morning. John, I anticipate on the added division call, you said attending for best of the added bisected beforehand to hit the fourth quarter, I'm aloof affectionate of aggravating to calibrate, we saw a 6.5% beforehand in the third division here. Did some of that beforehand about-face quarters, and afresh aloof how do I anticipate about the subpar wind adeptness you had in the quarter? How does that amount into the new (56:46) numbers?

John Ketchum - NextEra Energy, Inc.

Yeah. So, by the time of the added division call, we were appealing able-bodied into July, which was not a agitating wind adeptness month. We were anxious about the trend for the blow of the division for August and September, August concluded up affectionate of afterward clothing with July and we were a little bit afraid because September rebounded a little bit added than we had expected, I anticipate September concluded up actuality about 95% of normal, now we've apparent October has absolutely rebounded so far this month. That was allotment of it. We had a little bit bigger achievement out of added assorted genitalia of the business, none account pointing out alone that aback added up put us in a little bit bigger position than what we were assured for the division including some alpha action that we had on the business.

Paul T. Ridzon - KeyBanc Basal Markets, Inc.

And so we anticipate about that incremental absolute as about actuality anniversary in the fourth division by the refinancings you talked about?

John Ketchum - NextEra Energy, Inc.

Yeah. And so, the fourth quarter, that's why I anticipate I fabricated the animadversion that beforehand would be bottomward a little bit in the fourth quarter. We accept absolutely been focused on accountability management. Aback you attending at our portfolio – one of things that I've fabricated a animadversion on at the broker appointment is, if you attending at our costs portfolio, we accept one of the longest boilerplate tenors accumulated with one of the everyman boilerplate absorption ante of any of our peers. And that's because we consistently attending at the portfolio for refinancing action opportunities. And those are the opportunities we're adorable to assassinate on in the fourth quarter. The animadversion were that the MPV could be as aerial as $150 million, acutely those appear with some accommodation penalties that do accept some book impacts associated with them, but we're aloof aggravating to abide our trend of actuality actual alert that we're in an adorable low absorption amount ambiance and adorable at the antithesis area as we consistently do, to be opportunistic, and that's what you can apprehend to be reflected in the fourth division results.

Paul T. Ridzon - KeyBanc Basal Markets, Inc.

And you don't amusement those affectionate of one-timey accomplish wholes or annihilation as abnormal items?

John Ketchum - NextEra Energy, Inc.

No. We've aureate through.

Paul T. Ridzon - KeyBanc Basal Markets, Inc.

Okay. Acknowledge you actual much.

John Ketchum - NextEra Energy, Inc.

Yep. Thanks, Paul.

Operator

We'll go abutting to Shar Pourreza, Guggenheim Partners.

Shahriar Pourreza - Guggenheim Antithesis LLC

Hi, everyone. Aloof a quick aftereffect on the array accumulator comments, John. The Dania filings that you filed for showed that the asset was materially added economical than array accumulator and solar, alike in the 2022 timeframe. So I'm analytical on array of how that fits in with your angle that batteries, added solar could be economical with the CCGT? And afresh aloof a aftereffect on Dania is adorable at FPL's gas assets, there are added plants that fit to agnate economics as array of the bulb that you're converting. So I'm affectionate of analytical if the Dania bulb is a one-off and do you see added opportunities appropriately far?

John Ketchum - NextEra Energy, Inc.

Yeah. I anticipate we'll aloof accouterment the Dania allotment first. The Dania allotment aboriginal is, one, you got to accede its location, I mean, it's in South Florida, it has a manual advantage accustomed its location. If you attending at the economics on the bargain O&M, on convalescent the ammunition adeptness of that facility, accustomed its location, that's why that one works. We abide to attending for added opportunities, we accept the 50-megawatt array accumulator pilot affairs in Florida area we will attending to do a lot of the aforementioned things we've done on the Action Assets ancillary including the action we appear today area we can absolutely amalgamate our accumulator adequacy with newbuild solar in Florida. And those opportunities will appear about not alone through the eight accessories we're currently building, but afresh the 6,300 post-2018. Area absolutely they will end up will depend on area they are amid in the all-embracing economics of those facilities. But it's a agitating befalling for Florida to booty advantage of the aforementioned opportunities that our adapted chump abject alfresco of Florida are adorable for. Jim?

James L. Robo - NextEra Energy, Inc.

Shar, this is Jim. Aloof one added affair on accumulator and renewable competitiveness is, we see accumulator and renewables absolutely aggressive actual able-bodied adjoin inefficient old operating nuclear and atramentous plants area you attending at the economics of those sites, they're anywhere from $0.04 to $0.05 on a banknote amount per kilowatt hour abject to operate. These new CCGTs (01:02:14), decidedly in a accountable abode like Dania Beach are very, actual amount able and cool ammunition able and about you wouldn't see renewables and accumulator aggressive with that aloof yet.

Shahriar Pourreza - Guggenheim Antithesis LLC

Got it. That's helpful. Thanks so much.

Operator

We'll go abutting to Chris Turnure, JPMorgan.

Christopher James Turnure - JPMorgan Antithesis LLC

Good morning. Accustomed you guys apparently accept maybe six or so months to go to affectionate of accomplishment out the 2017 to 2018 brazier of renewable backlog, could you aloof accord us an amend on how you ability abatement out aural that 4 gigawatt range, you're advancing up on the basal now. Will any of it affectionate of discharge into 2019 in agreement of your maybe aboriginal expectations? Has annihilation afflicted in the aftermost three to six months?

John Ketchum - NextEra Energy, Inc.

Yeah. So first, we're already there on solar, not alone there on solar for 2017 and 2018, we're appealing abuse abutting to our ambit for 2019 and 2020. And we attending to abide to add to that acutely action forward. And afresh on the wind side, accustomed the 760 megawatt absolute portfolio today, the wind additions that were allotment of that, we're aural arresting ambit on wind and I'll let Armando ample in the accommodation or affectionate of his viewpoint.

Armando Pimentel - NextEra Energy, Inc.

So for wind, and this is – this has been the case for a continued time, right. Aback association are adorable for wind, they're adorable out abundant beneath – at a abundant beneath time period. One of the things that I'm candidly best blessed about so far in this aeon is we accept about 900 megawatts of wind active up already for 2019 and 2020. But aback you're focused on 2017 and 2018 and decidedly on wind, there's the accepted – there's aloof the contempo history that we appear today of signing 560 megawatts of 2018 wind.

And I can acquaint you that we are alive on a appealing appropriate antithesis for added 2018 wind adapted now, whether that happens or not, it depends. Barter accept that if they delay a little best that the prices could be a little cheaper, and so you're consistently angry that. But I was actual abundantly afraid with the 566 megawatts we active for 2018 this accomplished quarter, and my apprehension is that that cardinal in 2018 will abide to go up, aloof as it has in the past, aloof because wind has a beneath timeframe.

Christopher James Turnure - JPMorgan Antithesis LLC

Is it fair to say that's affectionate of the college bisected or the aerial bisected of the ambit is still accessible for 2017 to 2018?

Armando Pimentel - NextEra Energy, Inc.

You know, it's – I anticipate though, I anticipate candidly all of the numbers in that ambit are achievable. And if all I basal to do was to accommodated the college end of the ambit on wind for 2017 and 2018, we could apparently do that, but that's not necessarily consistently the adapted affair to do, right? I mean, you may be talking barter into architecture article in 2019 and 2020, because it's bigger economics for us honestly, than it could be for 2018. So every bearings is different. Again, I'm blessed at this point that we've active about 900 megawatts for 2019 and 2020, and that we still accept a appealing appropriate antithesis of 2018 opportunities that we accept been shortlisted on.

Christopher James Turnure - JPMorgan Antithesis LLC

Okay. That's accessible color. And afresh maybe, John or Jim, accustomed the banal achievement has been as able as it has year-to-date, aloof affectionate of maybe action aback to an beforehand catechism on banknote acknowledgment adjoin allotment or incremental beforehand opportunities adjoin buybacks. Does the banal achievement affectionate of lower the hurdle to arrange basal into added investments or to acknowledgment banknote to shareholders through a bigger allotment admission maybe than advanced expected?

James L. Robo - NextEra Energy, Inc.

So Chris, this is Jim. Listen, we abide actual acclimatized in how we appraise all our incremental opportunities. We're adorable adamantine at a lot of altered things to abide to arrange that antithesis antithesis area accommodation actual profitably for us action forward. And that's action to be our focus, but as always, we're not action to do impaired being either, we're action to be actual acclimatized about it. And we'll be – on the dividends, we will be – we aloof had a altercation with the lath about the allotment in October, we'll accept accession one in December and will be advancing out with our post-2018 allotment action in February already the lath finalizes area they're action to appear out on that. So, added to appear on the dividend.

Christopher James Turnure - JPMorgan Antithesis LLC

Sounds great. Fair enough. Thanks, guys.

James L. Robo - NextEra Energy, Inc.

Thank you.

Operator

Ladies and gentlemen that will achieve today's question-and-answer session. Acknowledge you for your participation. You may abstract at this time.

Copyright policy: All transcripts on this armpit are the absorb of Seeking Alpha. However, we appearance them as an important adeptness for bloggers and journalists, and are aflame to accord to the democratization of banking advice on the Internet. (Until now investors accept had to pay bags of dollars in cable fees for transcripts.) So our reproduction action is as follows: You may adduce up to 400 words of any archetype on the action that you aspect the archetype to Seeking Alpha and either articulation to the aboriginal archetype or to www.SeekingAlpha.com. All added use is prohibited.

THE INFORMATION CONTAINED HERE IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL, CONFERENCE PRESENTATION OR OTHER AUDIO PRESENTATION, AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE AUDIO PRESENTATIONS. IN NO WAY DOES SEEKING ALPHA ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY'S AUDIO PRESENTATION ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

If you accept any added questions about our online transcripts, amuse acquaintance us at: transcripts@seekingalpha.com. Acknowledge you!

["388"]

KeyBank Center, home of Buffalo Sabres, Buffalo Bandits, page 4 | key bank center keybank center february 10

KeyBank Center, home of Buffalo Sabres, Buffalo Bandits, page 4 | key bank center keybank center february 10Image Source:

["1862.4"]

Image Source:

["436.5"]

KeyBank Center Tickets and KeyBank Center Seating Chart - Buy ... | key bank center keybank center february 10

KeyBank Center Tickets and KeyBank Center Seating Chart - Buy ... | key bank center keybank center february 10Image Source:

["436.5"]

KeyBank Center Tickets and KeyBank Center Seating Chart - Buy ... | key bank center keybank center february 10

KeyBank Center Tickets and KeyBank Center Seating Chart - Buy ... | key bank center keybank center february 10Image Source:

["465.6"]

Red Hot Chili Peppers to Key Bank Center February 10th | Love Live ... | key bank center keybank center february 10

Red Hot Chili Peppers to Key Bank Center February 10th | Love Live ... | key bank center keybank center february 10Image Source:

["776"]

KeyBank Center Section 317 Seat Views | SeatGeek | key bank center keybank center february 10

KeyBank Center Section 317 Seat Views | SeatGeek | key bank center keybank center february 10Image Source:

["213.4"]

KeyBank Center - Wikipedia | key bank center keybank center february 10

KeyBank Center - Wikipedia | key bank center keybank center february 10Image Source:

["1986.56"]

KeyBank Center Section 226 - Buffalo Sabres - RateYourSeats.com | key bank center keybank center february 10

KeyBank Center Section 226 - Buffalo Sabres - RateYourSeats.com | key bank center keybank center february 10Image Source: